Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

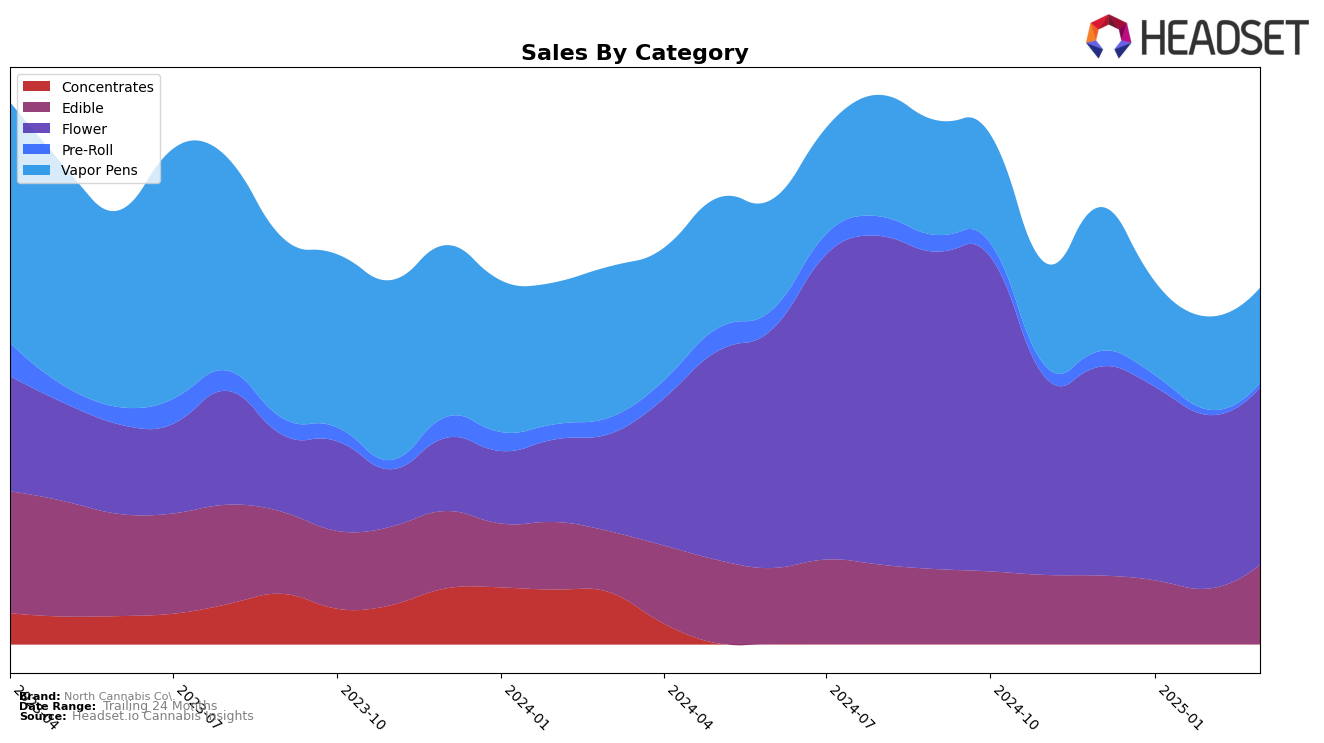

North Cannabis Co. has shown notable fluctuations in its performance across different categories in Michigan. In the Edible category, the brand experienced a dip in ranking from December 2024 to February 2025, falling out of the top 30, but made a comeback in March 2025, securing the 28th position. This rebound suggests a positive movement, potentially driven by increased consumer interest or successful marketing strategies. On the other hand, the Flower category has seen a consistent decline in rankings, finishing at 48th place in March 2025, indicating challenges in maintaining a competitive edge in this segment. The Vapor Pens category presents a slightly different story, with the brand's ranking stabilizing around the 29th and 30th positions after an initial drop, highlighting a steadier performance in this area.

Despite the challenges in some categories, North Cannabis Co.'s sales figures reveal interesting trends. For instance, the Edible category witnessed a significant sales increase in March 2025, contrasting with the previous months' downward trend. This surge could be indicative of successful product launches or seasonal demand shifts. Conversely, the Flower category's sales remained relatively stable in March after a decline, suggesting efforts to stabilize this segment. Meanwhile, the Vapor Pens category saw a slight sales increase in March 2025, aligning with its stable ranking, which could point to a loyal consumer base or effective product positioning. These dynamics underscore the importance of strategic focus on specific categories to bolster overall brand performance in the competitive Michigan market.

Competitive Landscape

In the competitive landscape of the Michigan flower category, North Cannabis Co. has experienced a fluctuating rank, starting at 41st in December 2024 and dropping to 48th by March 2025. This decline in rank is noteworthy, especially when compared to competitors like Cloud Cover (C3), which improved its position significantly from 81st to 50th over the same period. Meanwhile, Crude Boys demonstrated a more volatile trajectory, ultimately surpassing North Cannabis Co. by achieving 45th rank in March 2025. Despite these shifts, North Cannabis Co. maintained a relatively stable sales performance, with only a slight dip from January to February 2025, before a modest recovery in March. This suggests that while North Cannabis Co. faces stiff competition, particularly from brands like Uplyfted Cannabis Co., which consistently ranked higher, there remains a solid base of consumer loyalty that could be leveraged with strategic marketing and product innovation.

Notable Products

In March 2025, the top-performing product for North Cannabis Co. was the Wild Raspberry Vegan Gluten-Free Gummies 10-Pack (200mg) in the Edible category, maintaining its number one ranking from January and February. The Strawberry Rhubarb Gummies 10-Pack (200mg) climbed to the second position with notable sales of 6,978 units, a significant increase from its fifth position in January. The Sour Michigan Cherry Vegan Gluten-Free Gummies 10-Pack (200mg) debuted at the third spot, showing strong entry performance. Kitchen Sink (3.5g) in the Flower category was ranked fourth, having improved from an unranked position in February. The Sour Green Apple Gummies (200mg) also made a notable entrance into the top five, securing the fifth position for the month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.