Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

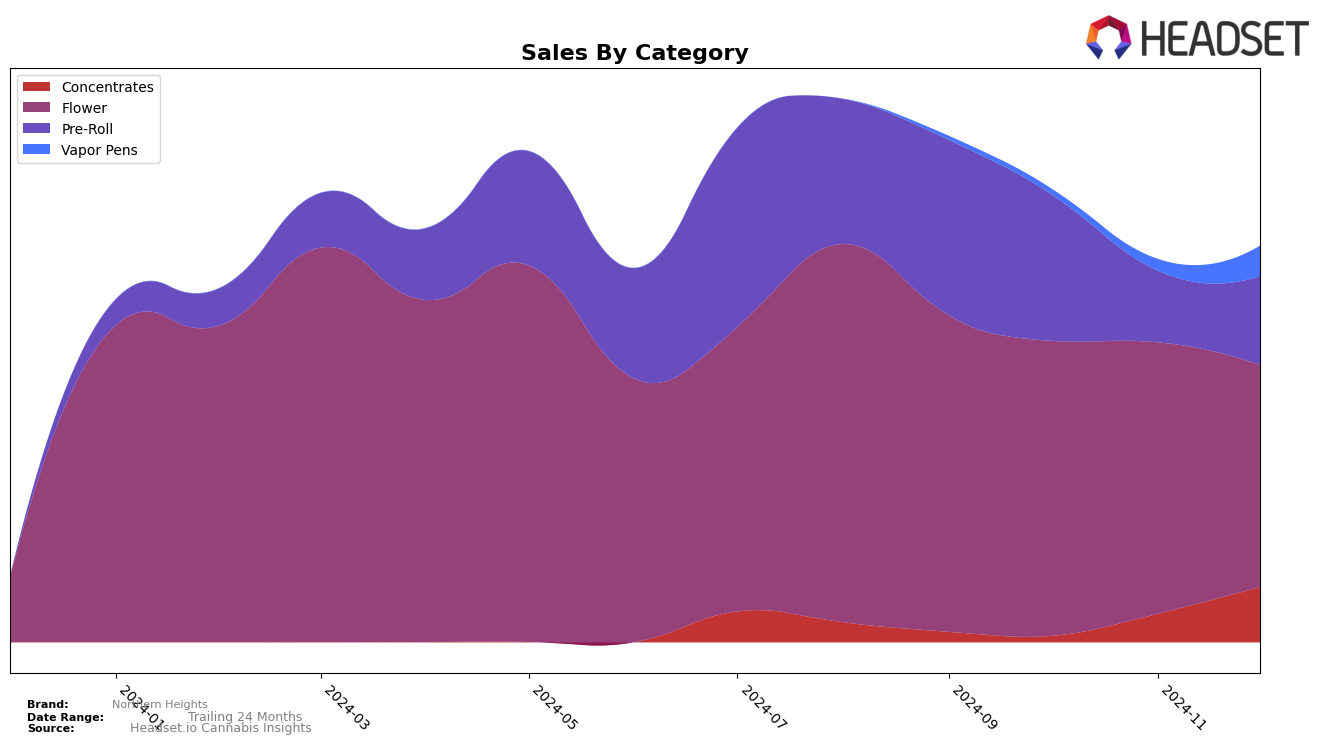

Northern Heights has shown a mixed performance across different categories in Illinois over the last few months. In the Concentrates category, the brand has made a notable upward movement, climbing from being outside the top 30 in October to securing the 28th position by December. This indicates a positive trajectory and suggests a growing consumer interest in their concentrates. In contrast, the Flower category has seen a steady decline, with Northern Heights dropping from 36th place in September to 40th in December, suggesting potential challenges in maintaining their market share in this highly competitive category.

The Pre-Roll category also reflects some fluctuations, with Northern Heights experiencing a decline from 20th place in September to 34th in November, before slightly recovering to 33rd in December. This volatility might indicate shifts in consumer preferences or increased competition within the category. Interestingly, Northern Heights was not ranked in the top 30 for Vapor Pens in September and October, but by November and December, they had moved to 71st and 64th place, respectively. Although still outside the top 30, this upward movement could signal the brand's efforts to establish a foothold in the Vapor Pens market, albeit at a slower pace compared to other categories.

Competitive Landscape

In the competitive landscape of the Illinois flower category, Northern Heights has experienced notable fluctuations in its rank and sales over the last few months of 2024. While maintaining a consistent rank of 36th in September and October, Northern Heights saw a slight decline to 38th in November and further to 40th in December. This downward trend in rank is mirrored by a decrease in sales, suggesting potential challenges in maintaining market share. In contrast, Fig Farms has shown resilience, starting at 35th in September, peaking at 28th in October, and then stabilizing around 35th and 36th in the following months. Meanwhile, Triple Seven has demonstrated a more stable performance, hovering around the 37th to 40th ranks, with relatively steady sales figures. The competitive dynamics indicate that while Northern Heights is facing pressure, particularly from brands like Fig Farms, there is an opportunity to strategize and reclaim its position by addressing the factors contributing to its declining sales and rank.

Notable Products

In December 2024, Gogurtz (3.5g) maintained its position as the top-performing product for Northern Heights, despite a decrease in sales to 1032 units. Bomb Sauce (3.5g) reclaimed its second-place rank after being unranked in previous months, with notable sales of 874 units. Strawberry Gary (3.5g) emerged as a new contender, securing the third spot with sales of 800 units. Super Boof (3.5g) experienced a drop to fourth place from its second-place rank in November, reflecting a decrease in sales to 781 units. Gogurtz Pre-Roll 2-Pack (1g) slipped to fifth place, continuing its decline from September, with sales figures of 777 units.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.