Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

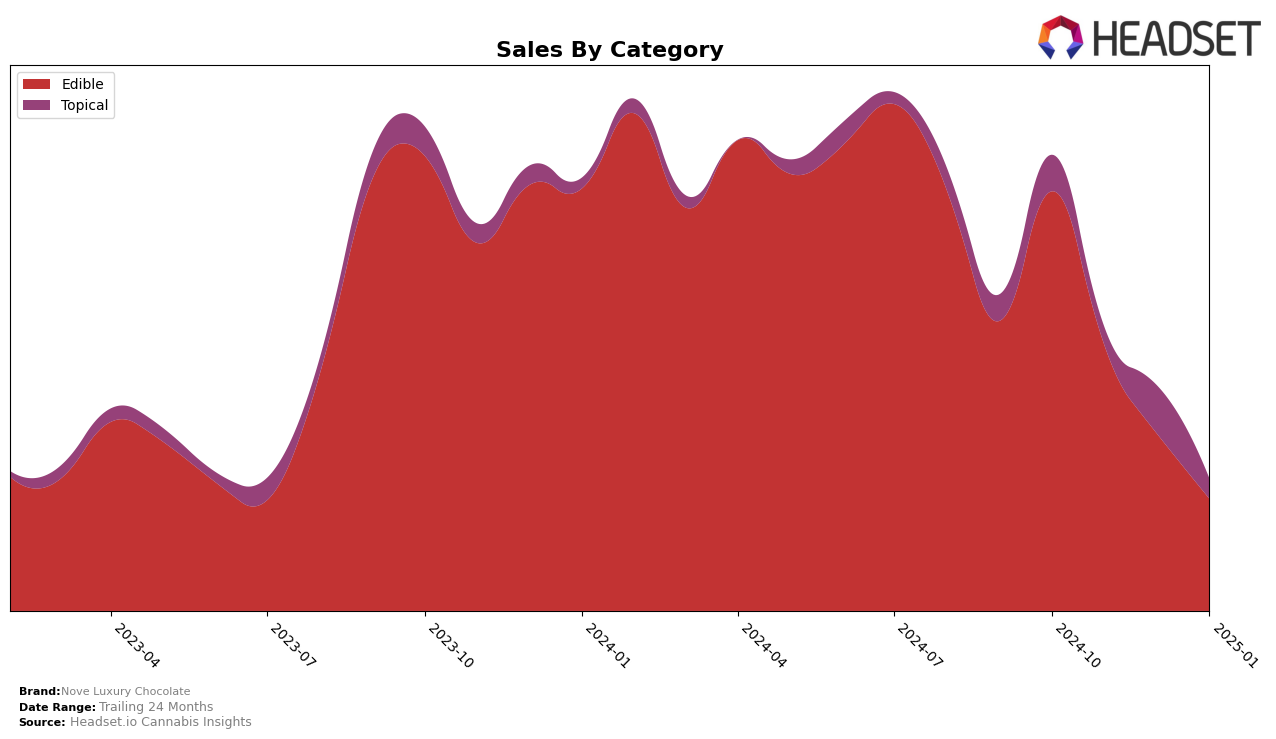

Nove Luxury Chocolate has shown varied performance across different categories and states, with notable shifts in rankings. In the Edible category in Colorado, the brand experienced a downward trend, slipping from the 17th position in October 2024 to falling out of the top 30 by January 2025. This decline in ranking coincides with a decrease in sales, suggesting a potential challenge in maintaining market share within this category. Conversely, in the Topical category within the same state, Nove Luxury Chocolate maintained a relatively stable presence, ranking 9th in October 2024 and 10th in December 2024, although it did not appear in the top 30 for November and January, indicating some fluctuation in consumer interest or market dynamics.

While the Edible category in Colorado showed a decline in both rank and sales, the Topical category presented a more stable yet inconsistent performance. The absence from the top 30 rankings in certain months could be a reflection of strategic shifts or seasonal variations impacting consumer preferences. The brand's ability to maintain a top 10 position in the Topical category during two of the months analyzed suggests a niche strength that could be leveraged for future growth. However, the overall decline in sales across categories may require strategic adjustments to regain traction in the competitive market landscape.

Competitive Landscape

In the Colorado edibles market, Nove Luxury Chocolate has experienced notable fluctuations in its ranking and sales over the past few months. Starting from a strong position at rank 17 in October 2024, Nove's rank declined to 31 by January 2025. This downward trend in rank is mirrored by a significant drop in sales, from a high of 106,758 in October to 30,888 by January. In comparison, Devour also saw a decline, falling from rank 21 to 30, with sales dropping from 77,752 to 31,468. Meanwhile, Dutch Girl improved its rank from 32 to 29, with sales increasing from 38,602 to 42,270, indicating a positive trajectory. Sweet Mary Jane and ROBHOTS remained outside the top 20, with relatively stable or declining sales figures. These dynamics suggest that while Nove Luxury Chocolate faces competitive pressure, particularly from brands like Dutch Girl, there is potential for strategic adjustments to regain its earlier market position.

Notable Products

In January 2025, the Sea Salt Caramel Milk Chocolate (100mg) from Nove Luxury Chocolate maintained its position as the top-performing product, continuing its streak as the number one ranked item for four consecutive months with sales of 657 units. The Honey Peanut Butter Milk Chocolate Bar (100mg) also held steady at the second spot, demonstrating consistent performance across the months leading to January. Notably, the Cafe Cappuccino Milk Chocolate (100mg) climbed to the third rank, showing an improvement from its previous fourth place in November 2024. Meanwhile, the CBD/THC 1:1 Rose Bath Salts (100mg CBD, 100mg THC) dropped to fourth place after being third in December. The Lavender Bath Salts (100mg) entered the rankings at fifth place, marking its debut in the top five for January 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.