Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

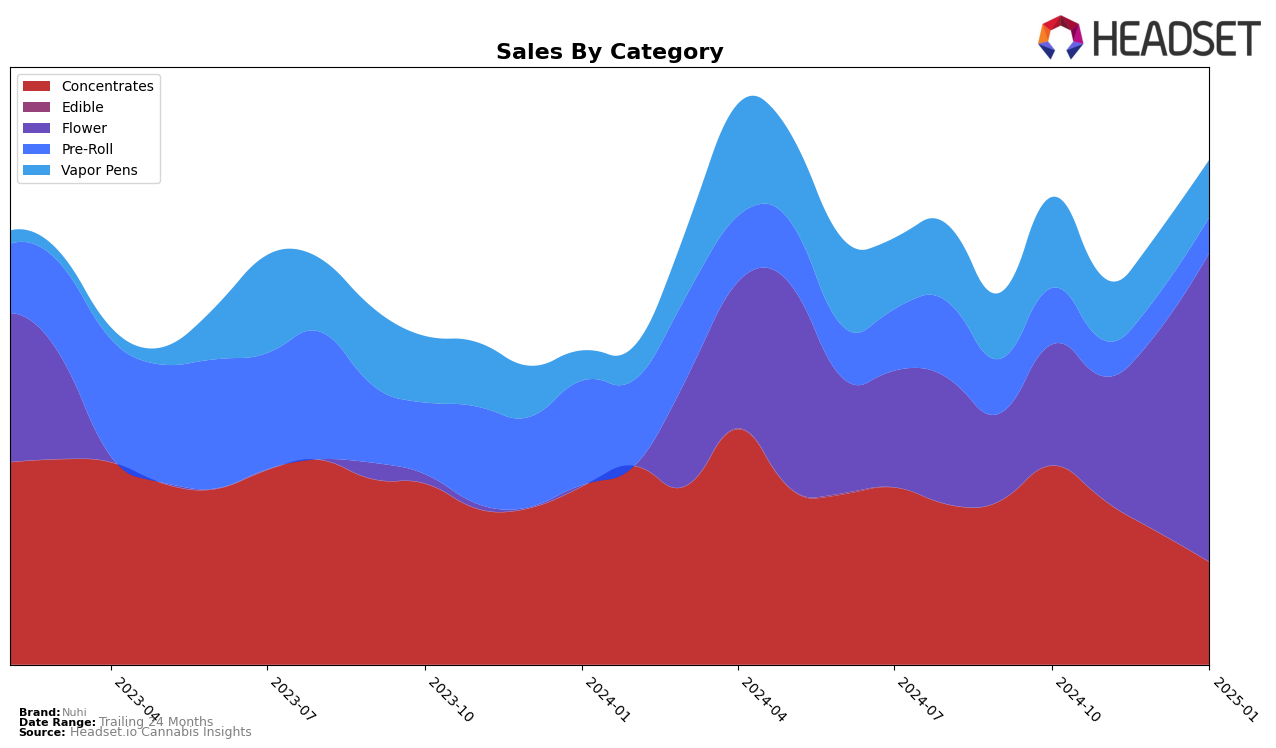

Nuhi's performance in Colorado demonstrates notable fluctuations across different product categories over the recent months. In the Concentrates category, Nuhi has experienced a gradual decline in rankings, moving from 18th in October 2024 to 23rd by January 2025. This downward trend is mirrored by a significant drop in sales, which suggests potential challenges in maintaining market share in this category. Conversely, in the Flower category, Nuhi has shown a remarkable improvement, climbing from a rank of 56th in October to 27th in January. This upward movement is supported by a substantial increase in sales, indicating a strengthening position in the Flower market.

In other categories, Nuhi's performance has been mixed. The Pre-Roll category saw a dip in rankings from October to November, dropping from 50th to 61st, but then rebounded to 46th by January. Despite these fluctuations, sales figures remained relatively stable, hinting at consistent consumer demand. In the Vapor Pens category, Nuhi has struggled to break into the top 30, maintaining a rank in the 60s throughout the period. This consistent lower ranking, coupled with declining sales, suggests that Nuhi may face stiff competition or lack differentiation in this segment. Overall, while Nuhi shows promise in certain categories like Flower, it faces challenges in others, reflecting a complex landscape in the Colorado cannabis market.

Competitive Landscape

In the competitive landscape of the Flower category in Colorado, Nuhi has demonstrated a notable upward trajectory in rank and sales over the recent months. Starting from a rank of 56 in October 2024, Nuhi made a significant leap to 27 by January 2025, indicating a strong growth trend. This improvement in rank is accompanied by a substantial increase in sales, particularly from November to January. In contrast, Bonsai Cultivation experienced a decline, dropping out of the top 20 by December and showing a downward sales trend. Meanwhile, Boulder Built and Clarity Gardens showed fluctuations in rank, with Boulder Built falling from 23 to 29, and Clarity Gardens maintaining a relatively stable position around the 30s. The Organic Alternative remained strong in the top 20 for most of the period but saw a slight dip in January. Nuhi's impressive climb suggests a growing market presence and consumer preference, potentially positioning it as a formidable competitor in the Colorado Flower market.

Notable Products

In January 2025, De La Sour (Bulk) from the Flower category emerged as the top-performing product for Nuhi, climbing from a third-place rank in December 2024 to first place with impressive sales of 16,628 units. Banana Punch (Bulk), also in the Flower category, slipped from its leading position in December to second place, indicating strong but slightly reduced demand. Rainbow Beltz (Bulk) maintained its presence in the top three, dropping one spot to third place compared to the previous month. Blue Dream Smalls (Bulk) entered the rankings at fourth place, showing a new contender in the Flower category. Chem Lemons Infused Pre-Roll (1g) from the Pre-Roll category, previously ranked fourth in October 2024, reappeared in January 2025 at fifth place, highlighting a resurgence in its popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.