Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

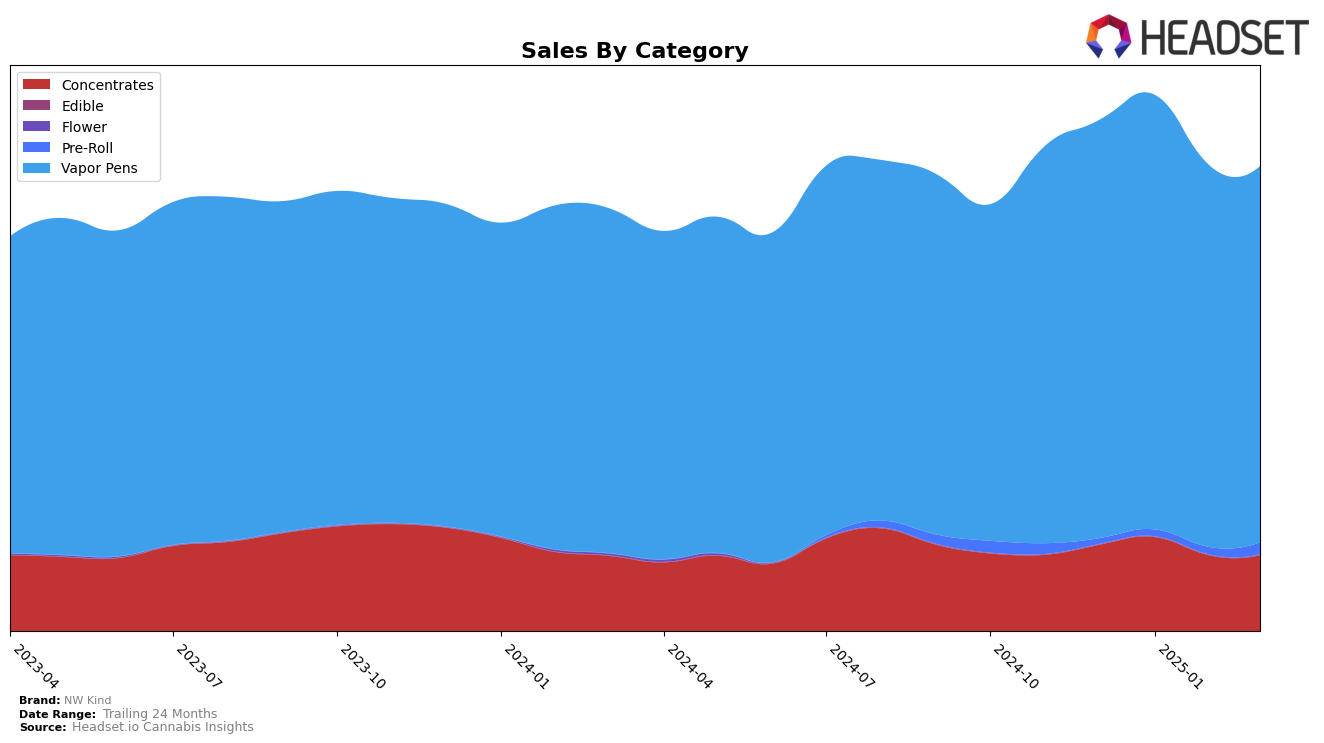

NW Kind has demonstrated a consistent presence in the Oregon cannabis market, particularly within the Concentrates and Vapor Pens categories. In the Concentrates category, NW Kind experienced a slight decline in rank from 6th in December 2024 to 9th by March 2025, indicating some competitive pressure or shifts in consumer preferences. Despite this, NW Kind's sales figures showed resilience, with a notable increase from December to January, though followed by a dip in subsequent months. In contrast, their performance in the Vapor Pens category has been more stable, maintaining a 4th place rank from December 2024 through February 2025, before slipping to 5th in March 2025. This suggests a strong foothold in the Vapor Pens market, with room for improvement to reclaim or advance their position.

The absence of NW Kind from the top 30 rankings in the Pre-Roll category in Oregon during the observed months suggests challenges in gaining traction or possibly a strategic focus on other product lines. This lack of presence could be seen as a potential area for growth if NW Kind decides to pivot resources towards capturing market share in Pre-Rolls. The data reveals a strategic opportunity for NW Kind to explore ways to enhance their offerings or marketing efforts to improve their rankings in this category. Overall, while NW Kind holds strong positions in certain categories, there are areas where they could potentially expand their influence and improve their market performance.

Competitive Landscape

In the competitive landscape of vapor pens in Oregon, NW Kind has maintained a strong presence, consistently ranking within the top five brands from December 2024 to March 2025. Despite a slight dip from 4th to 5th place in March 2025, NW Kind's sales figures have shown resilience, only experiencing a modest decline in the face of competitive pressures. Notably, White Label Extracts (OR) has been a formidable competitor, frequently ranking above NW Kind, except in February 2025 when it briefly fell to 5th place. Meanwhile, Mule Extracts demonstrated a significant upward trajectory, surpassing NW Kind in February 2025, which indicates a dynamic shift in consumer preferences. Hellavated and FRESHY have remained stable but consistently ranked lower, suggesting that NW Kind's main competition remains with the top-tier brands. This competitive analysis highlights the importance for NW Kind to innovate and adapt to maintain its market position amidst evolving consumer trends and competitive advancements in the Oregon vapor pen market.

Notable Products

In March 2025, NW Kind's top-performing product was Funk Mtn #5 Live Resin Cartridge (1g) in the Vapor Pens category, achieving the highest sales with 1,352 units sold. Blue Dream Distillate Cartridge (1g) followed closely as the second-ranking product, indicating strong consumer preference for distillate options. Dosi Punch Live Resin BHO Cartridge (1g) secured the third position, maintaining a steady demand. Strawberry Pie Live Hash Resin Cartridge (1g) and All Gas Distillate Cartridge (1g) rounded out the top five, showing consistent popularity in the live resin and distillate segments. Compared to previous months, these rankings suggest a stable preference for live resin products, with slight shifts among the top contenders indicating a competitive market landscape.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.