Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

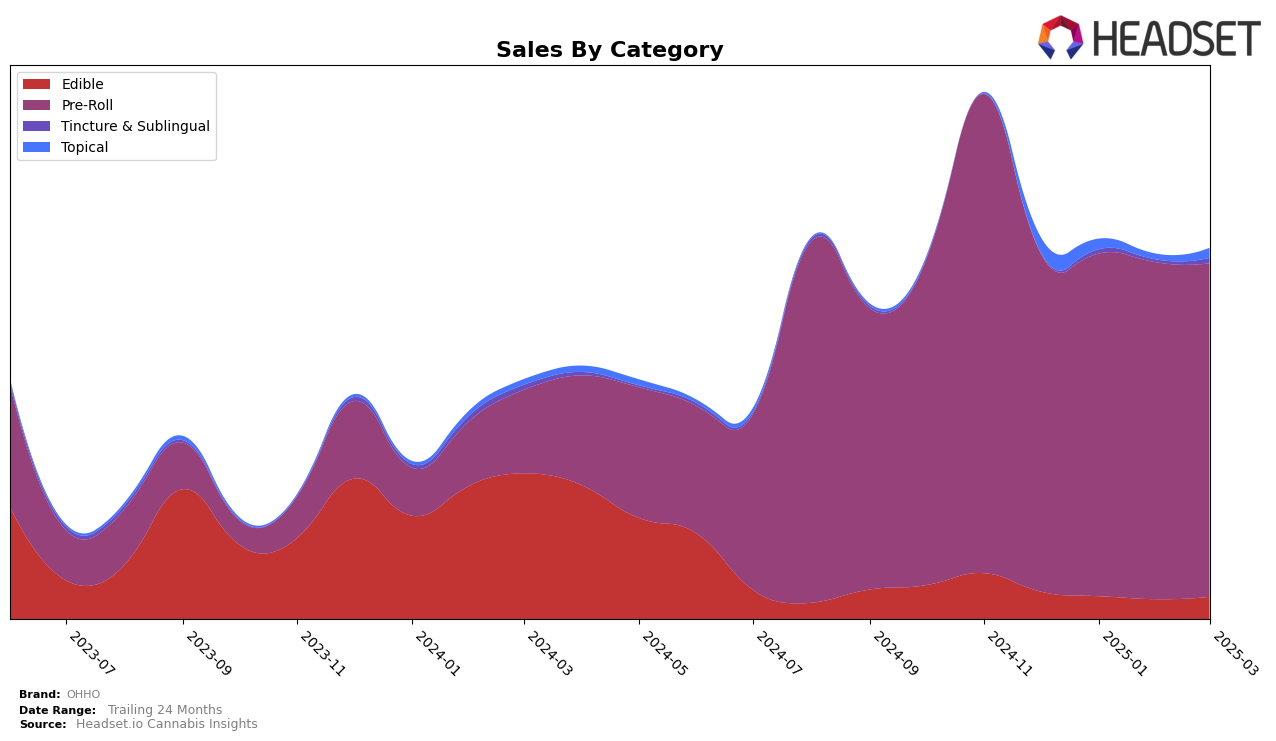

In the New York market, OHHO's performance across different cannabis categories shows varied results. In the Edible category, OHHO did not make it to the top 30 brands from December 2024 through March 2025, indicating a potential area for growth or a need for strategic adjustments. In contrast, the Pre-Roll category presents a more promising picture. OHHO consistently maintained a presence in the top 40, with a slight decline from rank 34 in February 2025 to rank 38 in March 2025. This suggests a relatively stable demand for their Pre-Roll products, although the slight drop may warrant further analysis to understand the underlying factors affecting their ranking.

While OHHO's Edible category performance in New York did not place them in the top 30, their Pre-Roll sales figures indicate a steady presence in the market. The brand experienced a minor fluctuation in sales, peaking in January 2025 with over 129,000 in sales before a gradual decline by March 2025. This trend could reflect seasonal variations or shifts in consumer preferences. The consistent ranking within the Pre-Roll category highlights OHHO's potential to capitalize on its existing market position, but the absence from the top 30 in Edibles suggests a need to reassess their strategy in that segment to enhance visibility and competitiveness.

Competitive Landscape

In the competitive landscape of the pre-roll category in New York, OHHO has shown a relatively stable performance in the rankings from December 2024 to March 2025, maintaining a position within the mid-30s range. Despite a slight dip in March 2025 to 38th place, OHHO's sales figures have remained fairly consistent, indicating a steady consumer base. In contrast, Cheech & Chong's has experienced a significant upward trajectory, climbing from 46th to 33rd place, with a notable increase in sales, suggesting a growing market presence. Meanwhile, FlowerHouse New York has seen a decline in sales, which may have contributed to its drop in rank to 37th in March 2025. House of Sacci and Alchemy Pure have both experienced fluctuations, with Alchemy Pure dropping to 44th place by March 2025. These dynamics highlight the competitive pressure OHHO faces, particularly from brands like Cheech & Chong's, which are gaining momentum in the New York pre-roll market.

Notable Products

In March 2025, OHHO's top-performing product was the Super Lemon Haze Pre-Roll (0.5g) in the Pre-Roll category, maintaining its consistent number 1 rank from previous months, with sales reaching 1846 units. The Jack Herer Pre-Roll (0.5g) rose to the second position, up from third place in February, while the OG Kush Pre-Roll (0.5g) dropped to third place. Durban Poison Pre-Roll (0.5g) held steady at fourth place, showing a slight increase in sales compared to February. The Super Lemon Haze Pre-Roll 7-Pack (3.5g) remained in fifth place, despite a slight decrease in sales from February to March. Overall, these rankings indicate stable performance with minor shifts among the top products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.