Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

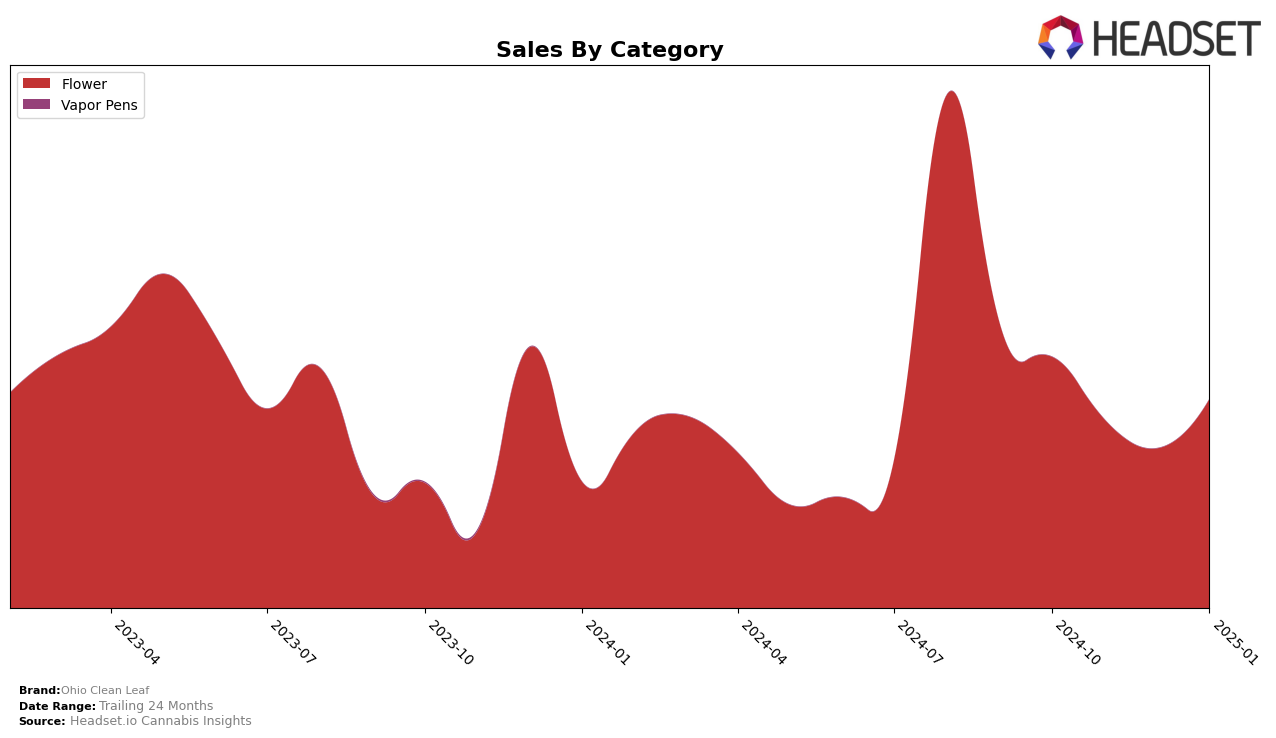

Ohio Clean Leaf's performance in the Ohio market for the Flower category demonstrates some interesting trends over the observed months. In October 2024, the brand was ranked 28th, which marked its highest position during this period. However, the subsequent months saw a decline, with the brand slipping out of the top 30 in November and December, before recovering back to the 28th position in January 2025. This fluctuation in rankings corresponds with their sales figures, which peaked in October and then experienced a downward trend before a partial recovery in January. This pattern suggests a potential challenge in maintaining consistent market presence or possibly seasonal influences affecting sales.

The absence of Ohio Clean Leaf from the top 30 in November and December might indicate increased competition or a dip in consumer demand during these months. Despite this, the brand's ability to regain its position in January could point to successful strategic adjustments or improved market conditions. The sales figures, while not disclosed in detail, reflect a notable recovery in January, aligning with their improved ranking. For businesses and analysts, these data points could signal the importance of adaptive strategies to navigate fluctuating market dynamics effectively. Further insights into consumer behavior and competitive actions during these months could provide a more comprehensive understanding of Ohio Clean Leaf's performance trajectory.

Competitive Landscape

In the competitive landscape of the Ohio flower category, Ohio Clean Leaf has experienced fluctuating rankings, with notable challenges from brands like Classix and Neighborgoods. Ohio Clean Leaf's rank dipped to 36th in December 2024, indicating a struggle to maintain a strong market presence, but it rebounded to 28th by January 2025. In contrast, Classix showed a strong upward trend, reaching 14th in December 2024 before dropping out of the top 20 in January 2025. Meanwhile, Neighborgoods consistently outperformed Ohio Clean Leaf, peaking at 13th in December 2024. These shifts suggest that while Ohio Clean Leaf is making efforts to regain its footing, it faces stiff competition from brands that are capturing more market share and consumer interest in Ohio's flower segment.

Notable Products

In January 2025, the top-performing product for Ohio Clean Leaf was Banana Puddintain (2.83g) in the Flower category, which surged to the first rank with notable sales of 1539 units. Miracle Mints (2.83g), also in the Flower category, secured the second position, dropping from its top spot in December 2024. Solo Burger (2.83g) landed in the third rank, having previously held the first position in October and November 2024. Watermelon Cake (2.83g) maintained its fourth position, showing consistent performance over the past two months. Finally, Blackberry Kush (2.83g) fell to the fifth rank, marking a decline from its second position in November 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.