Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

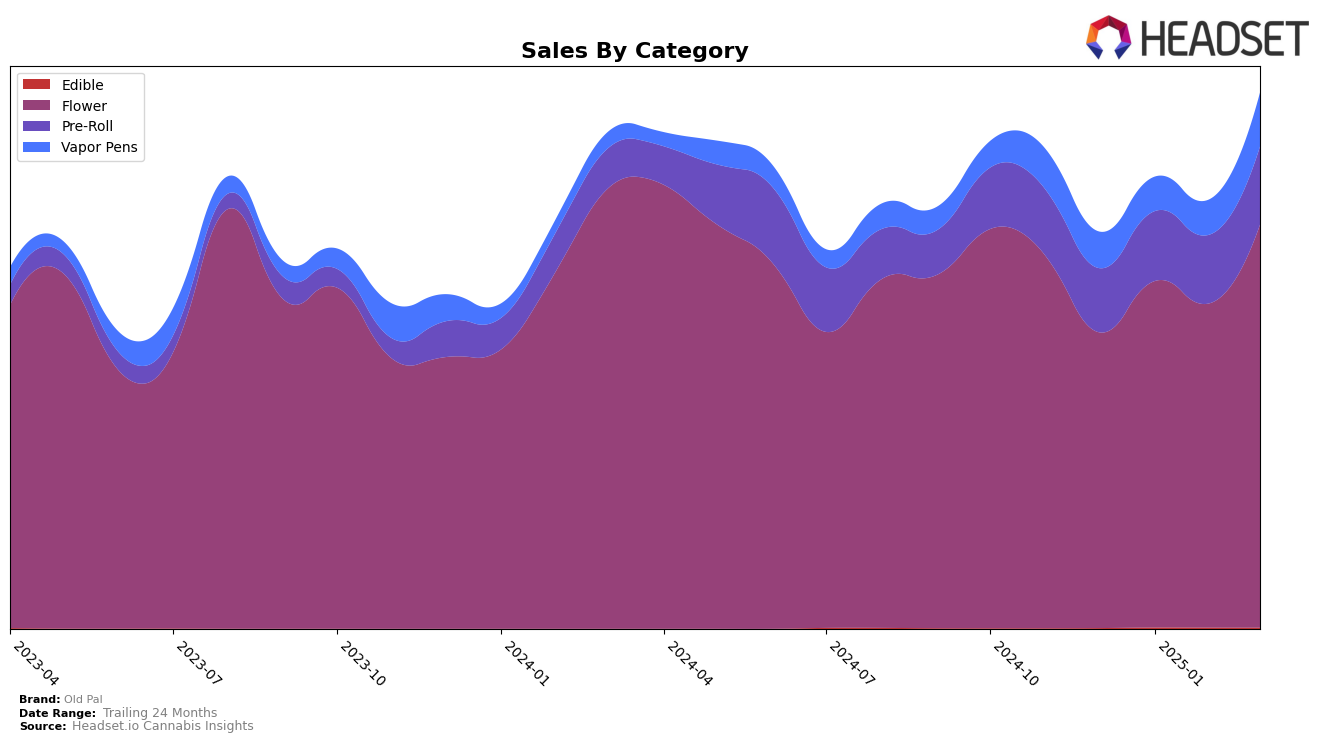

Old Pal's performance across various states and categories demonstrates some intriguing trends. In Arizona, the brand maintains a consistent presence in the Flower category, hovering around the 28th and 29th ranks from December 2024 to March 2025. This stability contrasts with California, where Old Pal made a significant leap in the Flower category from being unranked to securing the 74th position by March 2025. Meanwhile, in Colorado, Old Pal's performance in the Flower category saw a decline from 44th to 64th rank during the same period, while their Pre-Roll category showed a positive trend, climbing from 22nd to 13th rank, indicating a strong foothold in that particular segment.

In Massachusetts, Old Pal's Flower category ranking fluctuated, dropping from 13th in January to 20th by March 2025, suggesting a challenging market environment. Conversely, in Maryland, the brand improved its standing in the Flower category, moving from 33rd to 20th rank, and also showed growth in the Vapor Pens category, climbing to 27th by March 2025. Notably, in New Jersey, Old Pal's Vapor Pens made an entry into the rankings at 36th, indicating a potential new growth area. In New York, the Flower category saw some volatility, with ranks moving from 52nd to 44th, while the Pre-Roll category remained less stable. Meanwhile, in Ohio, Old Pal entered the Flower category rankings at 40th in March 2025, showcasing a new market opportunity for further exploration.

Competitive Landscape

In the competitive landscape of the New Jersey flower category, Old Pal has shown a notable upward trend in its market position, moving from a rank of 25 in December 2024 to 17 by March 2025. This improvement in rank suggests a positive reception among consumers, likely driven by strategic marketing or product offerings that resonate well with the market. In contrast, Cookies experienced a decline, dropping from rank 13 to 18 over the same period, which may indicate challenges in maintaining consumer interest or competitive pricing pressures. Kind Tree Cannabis also saw a decline from rank 10 to 15, despite having higher sales figures, suggesting that while they maintain a strong sales volume, their market share is being eroded by emerging competitors. Meanwhile, Niche made significant strides, climbing from rank 42 to 19, highlighting their rapid growth and potential threat to established brands. Old Pal's ability to improve its rank amidst these dynamics is a testament to its competitive strategy and market adaptability, positioning it favorably against both established and emerging brands in the New Jersey flower market.

Notable Products

In March 2025, Old Pal's top-performing product was Cali Mints (3.5g) in the Flower category, achieving the highest sales figure of 2491 units. Red Bullz (14g) followed closely in second place, with Dreamsicle (14g) securing the third position. Kushberry (14g) and Galactic Goo (3.5g) rounded out the top five, ranking fourth and fifth, respectively. Notably, these products were not ranked in prior months, indicating a significant rise in their popularity or availability. This shift suggests a strategic focus on these offerings, leading to their dominance in March's sales performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.