Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

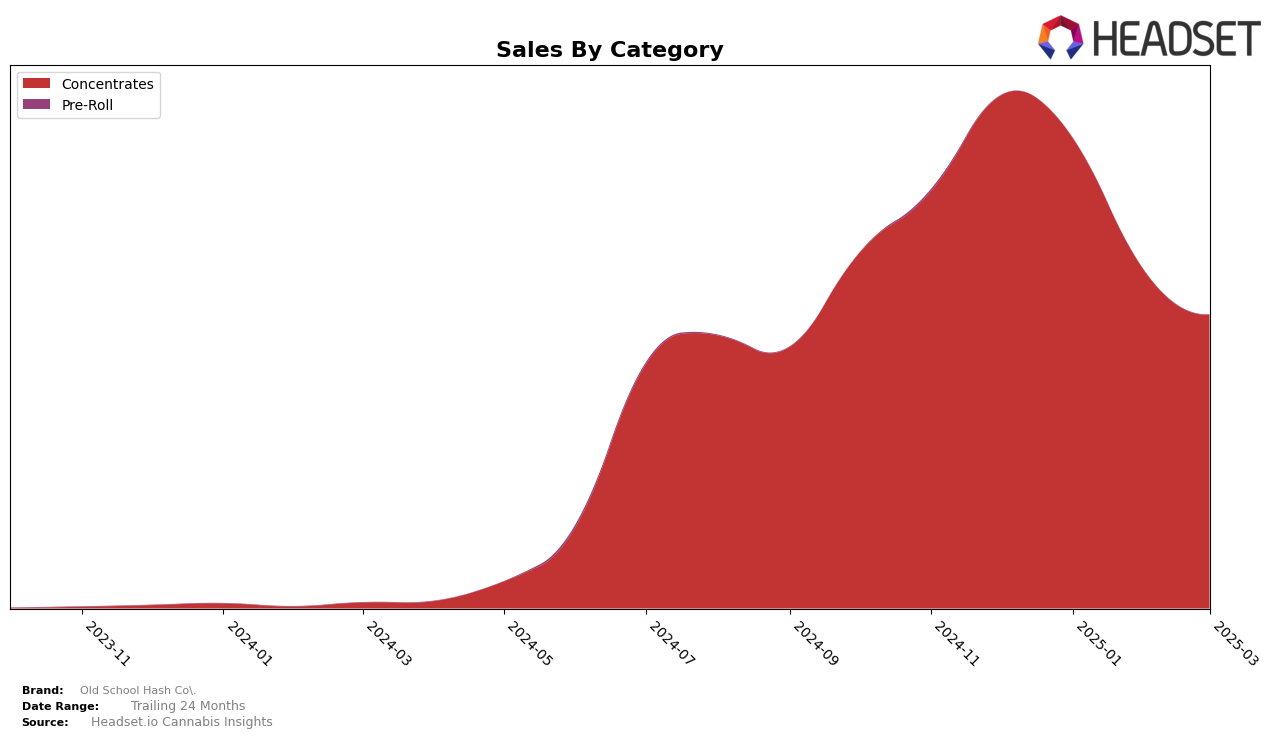

Old School Hash Co. has shown a notable presence in the Michigan market, particularly within the Concentrates category. As of December 2024, the brand held the 11th position, maintaining this rank into January 2025. However, February and March 2025 saw a decline in their standings, dropping to 20th and then 21st place, respectively. This downward trend indicates potential challenges in maintaining market share, possibly due to increased competition or shifts in consumer preferences. The absence of Old School Hash Co. from the top 10 in February and March highlights the need for strategic adjustments to regain their competitive edge.

Despite the decline in rankings, Old School Hash Co.'s sales figures provide a deeper insight into their performance trajectory. From December 2024 to March 2025, there is a clear decrease in sales, with March figures significantly lower than those in December. This trend suggests a need for the brand to reassess its market strategies in Michigan, as sustaining sales and improving rank will be crucial for long-term success. The brand's challenge will be to identify and address the factors contributing to this decline, whether it be market saturation, product differentiation, or consumer engagement.

Competitive Landscape

In the competitive landscape of the Michigan concentrates market, Old School Hash Co. has experienced notable fluctuations in its ranking and sales performance. Starting from December 2024, Old School Hash Co. maintained a strong position at rank 11, but by March 2025, it had slipped to rank 21. This decline in rank coincides with a downward trend in sales, which saw a significant drop from December 2024 to March 2025. In contrast, competitors like GreenCo Ventures showed an upward trajectory, climbing from rank 25 in December 2024 to rank 20 by March 2025, with a notable sales increase in February 2025. Meanwhile, Five Star Extracts and Light Sky Farms both experienced variable rankings, with Five Star Extracts dropping out of the top 20 by March 2025. These shifts highlight the competitive pressures Old School Hash Co. faces, emphasizing the need for strategic adjustments to regain its market position and stabilize sales.

Notable Products

In March 2025, Old School Hash Co.'s top-performing product was Papaya OG Bubble Hash (1g) in the Concentrates category, maintaining its number one rank from the previous months with a notable sales figure of 4332 units. Scarlett Runtz Temple Ball (2g) made a strong entry into the rankings, securing the second position. Scarlett Runtz Bubble Hash (2g) held steady at third place, consistent with its February ranking. Scarlett Runtz Brick Hash (2g) remained in the fourth position, showing a slight improvement from its fifth-place rank in January. Slapz Brick Hash (1g) rounded out the top five, slipping from its previous second-place rank in February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.