Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

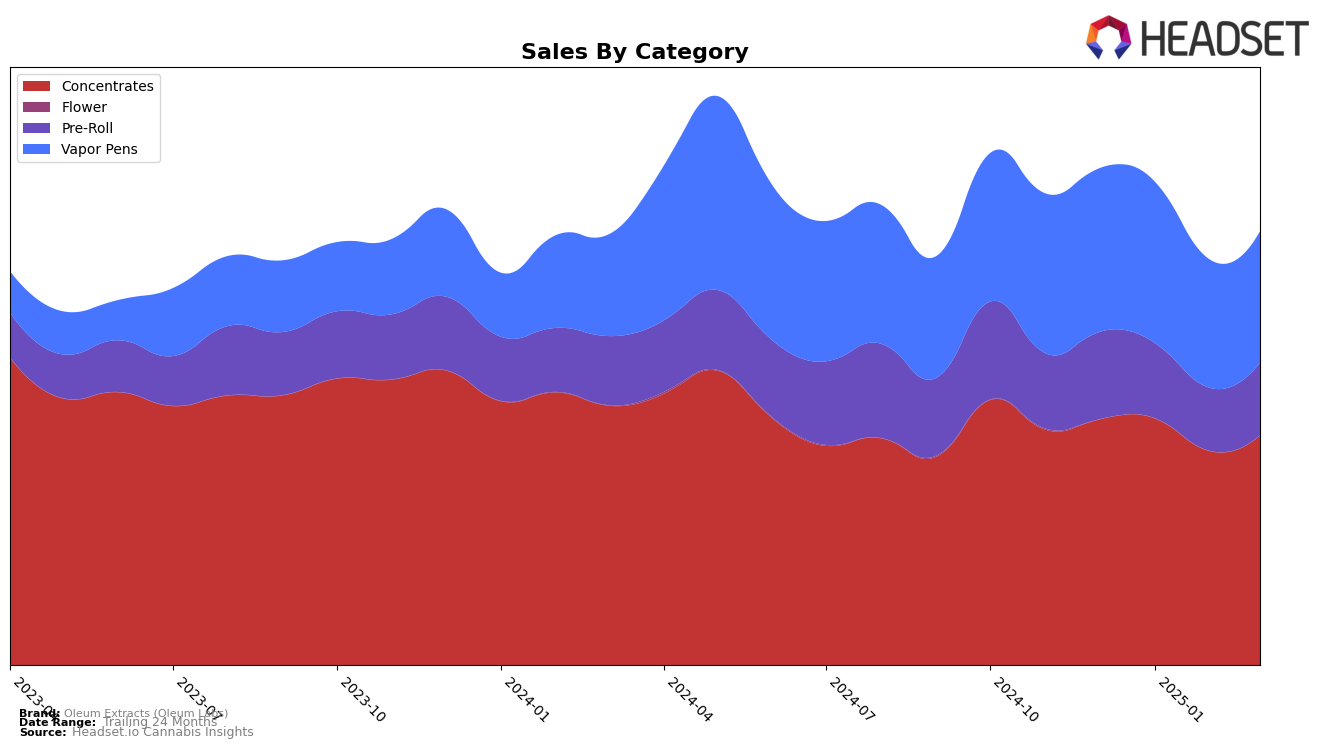

Oleum Extracts (Oleum Labs) has maintained a consistent performance in the Concentrates category within Washington, holding a steady rank of 5th place from December 2024 through March 2025. This stability indicates a strong foothold in the market, despite a slight dip in sales from January to February, followed by a rebound in March. In contrast, the brand's presence in the Pre-Roll category shows a less stable trajectory, with rankings hovering around the 45th to 50th positions, suggesting room for improvement. The sales figures in this category have fluctuated, but the overall trend points to a need for strategic adjustments to enhance their market position.

In the Vapor Pens category, Oleum Extracts (Oleum Labs) has experienced some volatility in Washington. The brand's ranking has varied between 35th and 41st from December 2024 to March 2025, indicating a competitive landscape and potential challenges in maintaining a consistent market share. Despite these fluctuations, the sales figures suggest a slight recovery from February to March. Notably, the absence of Oleum Extracts in the top 30 for this category highlights an area for potential growth and market penetration. These insights underscore the brand's stronghold in the Concentrates market while revealing opportunities for improvement in other categories.

Competitive Landscape

In the Washington concentrates market, Oleum Extracts (Oleum Labs) has maintained a consistent rank of 5th place from December 2024 through March 2025. Despite a steady ranking, Oleum Extracts (Oleum Labs) experienced a decline in sales from $250,800 in December 2024 to $234,364 in March 2025, indicating a potential challenge in maintaining market share. In comparison, Forbidden Farms consistently held the 3rd rank with sales peaking at $317,386 in December 2024, suggesting a strong foothold in the market. Meanwhile, Regulator also maintained a stable 4th rank, with sales slightly decreasing from $269,716 to $243,284 over the same period. Notably, Tasty Terps showed upward momentum, climbing from 10th to 6th place, with sales increasing to $187,326 in March 2025, potentially posing a competitive threat. This competitive landscape highlights the need for Oleum Extracts (Oleum Labs) to innovate and strategize to capture more market share and counteract the sales decline.

Notable Products

In March 2025, Oleum Extracts (Oleum Labs) saw the top-performing product being the Sugar Cone - Wedding Cake Infused Pre-Roll 2-Pack (1g) in the Pre-Roll category, leading the sales with 932 units sold. The Gorilla Glue #4 Honey Crystal (1g) ranked second in the Concentrates category, while the Sugar Cone - Limoncello Infused Pre-Roll 2-Pack (1g) secured the third position. BernieHana Butter Infused Pre-Roll 2-Pack (1g) and Sugar Cone - Purple Haze Infused Pre-Roll 2-Pack (1g) followed in fourth and fifth places, respectively. Notably, these products were not ranked in the previous months, indicating a significant rise in popularity for March 2025. The consistent performance of the Pre-Roll category is evident, dominating four out of the five top spots.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.