May-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

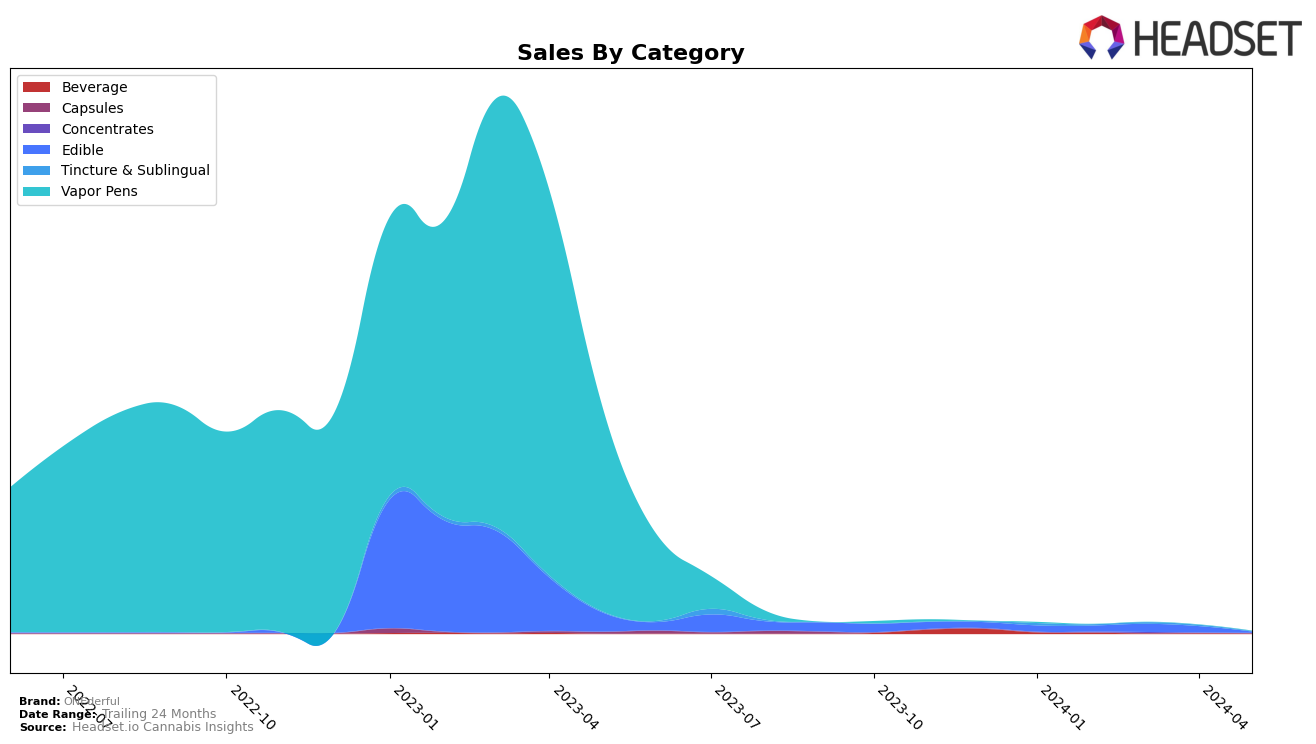

ONEderful has shown significant variability in its performance across different states and categories. In Ohio, the brand's presence in the Edible category has been inconsistent. Notably, ONEderful did not make it into the top 30 brands in February 2024 and subsequently dropped further to 44th place in March 2024. This downward trend suggests that the brand is struggling to maintain a competitive edge in the Ohio Edible market. The absence of rankings for April and May indicates that ONEderful failed to regain its position, highlighting a potential area for improvement or a shift in consumer preferences within the state.

In other states, ONEderful's performance may vary, but the data from Ohio presents a critical case study. The brand's initial sales in February 2024 were $10,387, but the lack of subsequent sales data suggests a possible decline or stagnation. This trend could be indicative of broader challenges the brand faces in maintaining market share across different regions. For a more comprehensive understanding of ONEderful's market dynamics, it would be essential to examine its performance in other states and categories, as well as any strategic changes the brand might implement to bolster its presence.

Competitive Landscape

In the highly competitive Ohio edible cannabis market, ONEderful has faced significant challenges in maintaining its rank and sales. In February 2024, ONEderful did not appear in the top 20 brands, and by March 2024, it ranked 44th, indicating a struggle to gain market traction. Competitors like Lux by CannAscend and Appalachian Pharm have shown more consistent performance, with Lux by CannAscend fluctuating between 21st and 41st place from February to April 2024, and Appalachian Pharm maintaining a steady climb from 22nd to 26th place in the same period. This competitive landscape suggests that ONEderful needs to enhance its market strategies to improve its rank and sales, especially when compared to more established brands like Curaleaf, which held the 30th position in February 2024. The data indicates that while ONEderful is struggling, there is potential for growth if strategic adjustments are made to better compete with these leading brands.

Notable Products

In May-2024, the top-performing product for ONEderful was Pineapple Punch Gummy 10-Pack (550mg) in the Edible category, which secured the first rank with notable sales of 17 units. This product rose from the second position in April-2024. Sativa Black Cherry Lemonade Gummies 10-Pack (110mg) also maintained a strong performance, consistently holding the first rank from February to May-2024. Mellow Mint Spritz Oral Spray (220mg) in the Tincture & Sublingual category was ranked second, showing a stable performance across the months. Hot Cocoa Dissolvables 10-Pack (110mg) in the Beverage category improved its ranking to third in May-2024 from fifth in April-2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.