Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

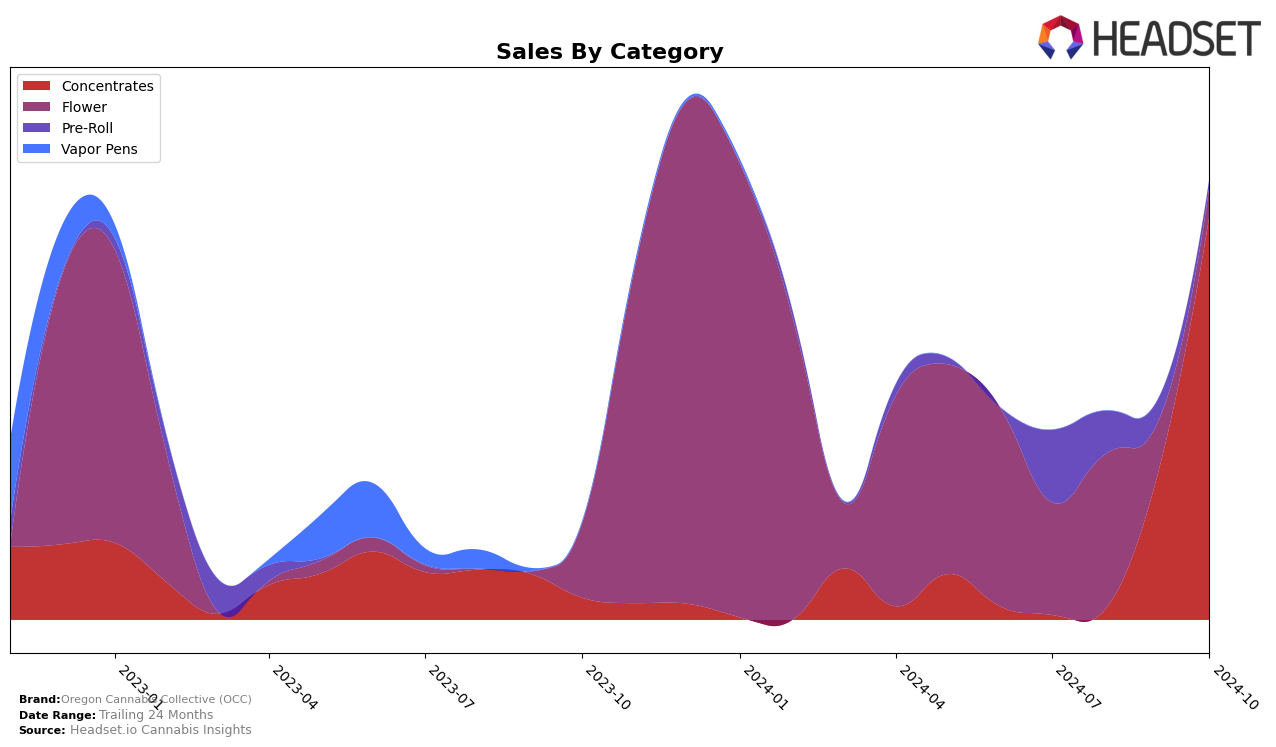

Oregon Cannabis Collective (OCC) has shown a notable trajectory in the Concentrates category within the state of Oregon. Over the past few months, OCC has made a significant leap, entering the top 30 brands in October 2024 with a rank of 25th. This is a substantial improvement from the previous months, where they were not listed in the top 30, indicating a strategic move or increased consumer interest in their products. The jump in rankings suggests a positive reception of their offerings, possibly due to product innovation or effective market penetration strategies in the Concentrates category.

The sales figures for OCC in Oregon also reflect this upward trend, with October 2024 showing a remarkable increase from previous months. In September, OCC was not even in the top 30, which implies that their October performance was a breakthrough, potentially driven by a new product launch or seasonal promotions. While the sales numbers for August and September are not disclosed, the increase in rank suggests a strong recovery or growth phase for OCC. This trajectory highlights OCC's potential to further solidify its position in the Oregon market and possibly expand into other categories or states with similar strategies.

Competitive Landscape

In the competitive landscape of Oregon's concentrates market, Oregon Cannabis Collective (OCC) has shown a notable upward trajectory in recent months. While OCC was not ranked in the top 20 brands for July and August 2024, it made a significant leap to rank 59th in September and further climbed to 25th in October. This upward movement suggests a positive trend in sales performance and market presence. In contrast, competitors like Happy Cabbage Farms maintained a relatively stable position, ranking 20th in September but dropping back to 24th in October. Meanwhile, Sand Castle Hash Co. showed a consistent presence, improving from 26th in July to 23rd in October. The fluctuating ranks of Farmer's Friend Extracts and Calyx Crafts indicate varying sales dynamics, with neither maintaining a top 20 position. OCC's recent rise suggests a growing consumer interest and potential for increased market share, positioning it as a brand to watch in the coming months.

Notable Products

In October 2024, Oregon Cannabis Collective (OCC) saw Guava Moonrocks Cured Resin Sugar Wax (1g) leading the sales charts, securing the top rank in the Concentrates category with a sales figure of 1807. Following closely, Durban Poison Cured Resin Sugar Wax (1g) claimed the second position. Tropicanna Punch Cured Resin Sugar Wax (1g) and Triple OG Cured Resin Sugar Wax (1g) took the third and fourth spots, respectively. Amnesia Haze Cured Resin (1g) rounded out the top five. Notably, these products did not feature in the top ranks in the months leading up to October, indicating a significant rise in popularity and sales performance during this month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.