Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

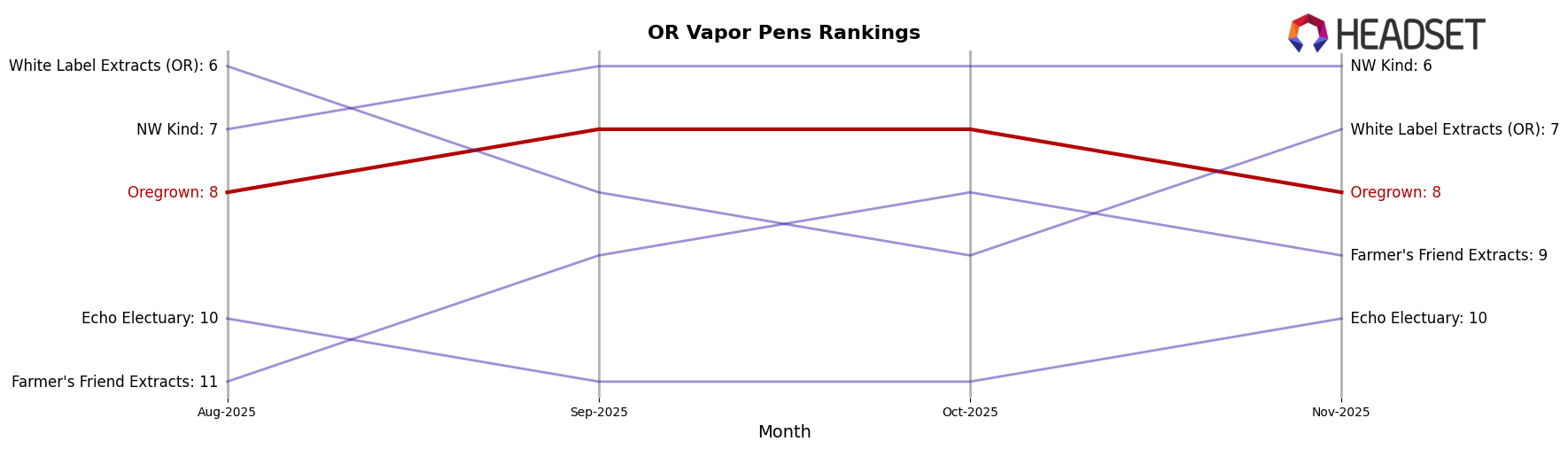

Oregrown has shown a notable performance across various product categories in the state of Oregon. In the Concentrates category, Oregrown maintained a consistent presence in the top three rankings from August to October 2025, and even improved to the second position in November. This upward movement indicates a strengthening market position and possibly an increase in consumer preference or effective marketing strategies. Conversely, in the Vapor Pens category, Oregrown experienced a slight decline, moving from the 7th position in September and October to the 8th position in November, suggesting a competitive landscape or a shift in consumer interest.

In the Flower category, Oregrown showed a significant climb from the 22nd position in August to the 8th position in October, before settling at the 10th position in November. This trend reflects a strong performance and possibly an increase in product quality or variety that resonated well with consumers. However, the Pre-Roll category tells a different story, where Oregrown remained at a stable yet lower ranking of 18th in both October and November, after a peak at 16th in September. This consistent positioning outside the top 15 might indicate challenges in capturing a larger market share in this category or stiff competition from other brands.

Competitive Landscape

In the competitive landscape of Oregon's vapor pen market, Oregrown has experienced some fluctuations in its ranking, maintaining a steady position at 7th place in September and October 2025, but slipping back to 8th in November 2025. This shift is notable as it coincides with a decrease in sales from October to November. In contrast, NW Kind consistently held the 6th position from August through November, with a noticeable increase in sales during this period. Meanwhile, Farmer's Friend Extracts showed a positive trend, climbing from 11th in August to 8th in October, before settling at 9th in November, indicating a competitive push in the market. White Label Extracts (OR) experienced a dip in September but rebounded to 7th place in November, suggesting a recovery in sales performance. These dynamics highlight the competitive pressures Oregrown faces, emphasizing the need for strategic adjustments to regain and sustain a higher market position.

Notable Products

In November 2025, the top-performing product from Oregrown was Hash Burger (Bulk) in the Flower category, which ascended to the number 1 rank from 5th place in October, with sales reaching 1915 units. Hash Burger Live Rosin (1g) in the Concentrates category moved up to the 2nd position from 4th, showing strong performance with notable sales figures. Pineapple Cake Pre-Roll (1g) debuted at the 3rd rank, indicating a successful launch in the Pre-Roll category. Mac #1 Live Resin Disposable (1g) secured the 4th spot in the Vapor Pens category, maintaining consistent performance since its introduction. High Desert Sour Sage (Bulk) in the Flower category remained steady, holding the 5th rank, a slight drop from its 4th position in September.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.