Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

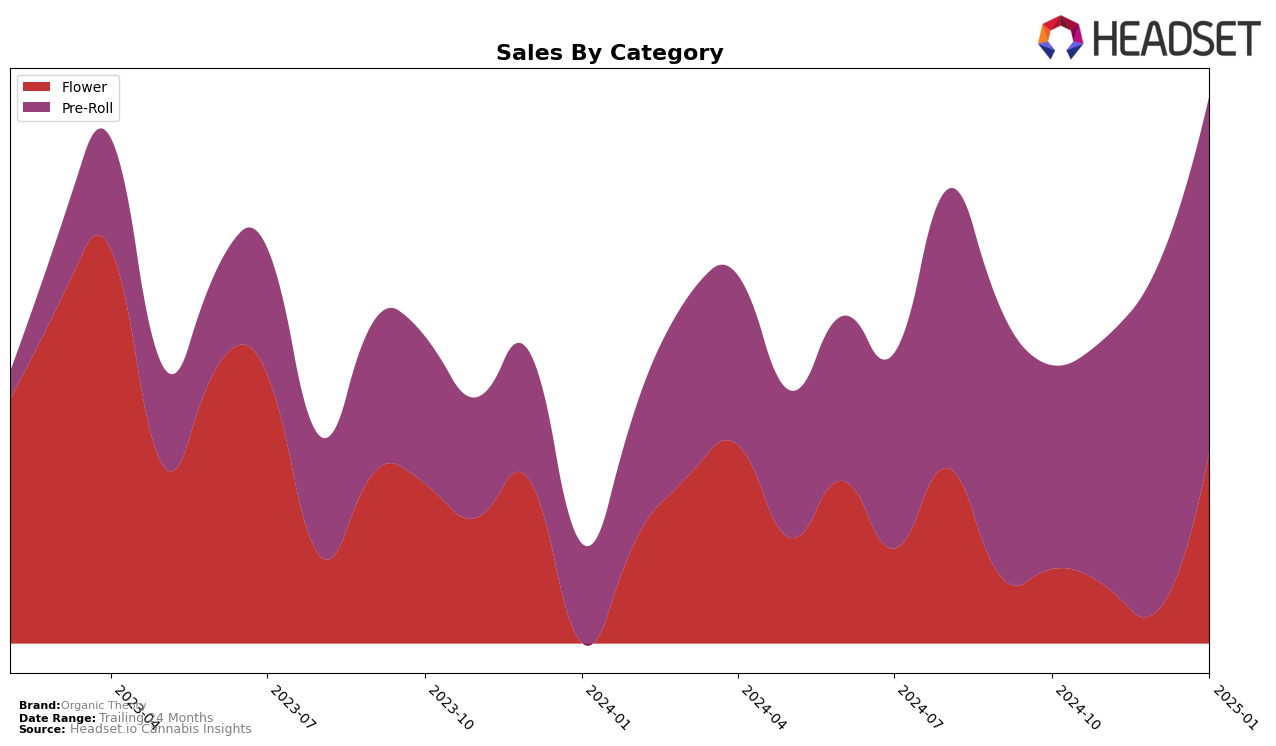

In examining the performance of Organic Theory across different categories and states, notable trends emerge, particularly in the Oregon market. Organic Theory's presence in the Flower category was notably absent from the top 30 rankings over the past few months, indicating potential challenges in gaining traction or visibility in this highly competitive segment. However, the Pre-Roll category tells a different story, with a steady climb from a rank of 44 in October 2024 to 22 by January 2025. This upward trajectory in the Pre-Roll category suggests a growing consumer preference or effective strategic initiatives by the brand, which could be crucial for their overall market positioning in Oregon.

The sales figures for Organic Theory's Pre-Roll category in Oregon reflect a positive growth trend, with sales increasing from $70,177 in October 2024 to $118,272 in January 2025. This consistent increase in sales volume aligns with their improved rankings, highlighting the brand's potential in capturing a larger market share within this segment. The absence of Organic Theory from the top 30 in the Flower category, however, suggests areas for improvement or a potential re-evaluation of market strategies to enhance their presence. Understanding the dynamics and consumer preferences in each category could be pivotal for Organic Theory as they navigate the competitive landscape in Oregon.

Competitive Landscape

In the competitive landscape of the Oregon pre-roll category, Organic Theory has shown a promising upward trajectory in its market rank over the past few months. Starting from a rank of 44 in October 2024, Organic Theory climbed to the 22nd position by January 2025, indicating a consistent improvement in its market presence. This upward trend is noteworthy when compared to competitors like Entourage Cannabis / CBDiscovery, which experienced a decline from 12th to 21st place over the same period, and SugarTop Buddery, which fluctuated but ultimately dropped to 24th. Meanwhile, Emerald Extracts made a significant leap from 54th to 20th, showcasing a competitive edge. Organic Theory's sales have also shown a positive trend, with a notable increase from October to January, contrasting with the declining sales of Entourage Cannabis / CBDiscovery. This suggests that Organic Theory's strategic initiatives are effectively resonating with consumers, positioning it as a rising contender in the Oregon pre-roll market.

Notable Products

In January 2025, Mule Fuel Pre-Roll 2-Pack (2g) maintained its position as the top-performing product for Organic Theory, with an impressive sales figure of 4386 units. Razz Cream Pre-Roll 2-Pack (2g) also held steady at the second rank, showing a consistent performance over the past months. Scooby Kush Pre-Roll 2-Pack (2g) slipped to third place, having debuted in the rankings in December 2024. Allen Wrench Pre-Roll 2-Pack (1.5g) remained in fourth place, while Super Silver Purple Haze Pre-Roll 2-Pack (2g) dropped from third in October to fifth in January. Overall, the rankings have shown stability with only minor shifts, indicating strong brand loyalty and consistent demand for these top products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.