Aug-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

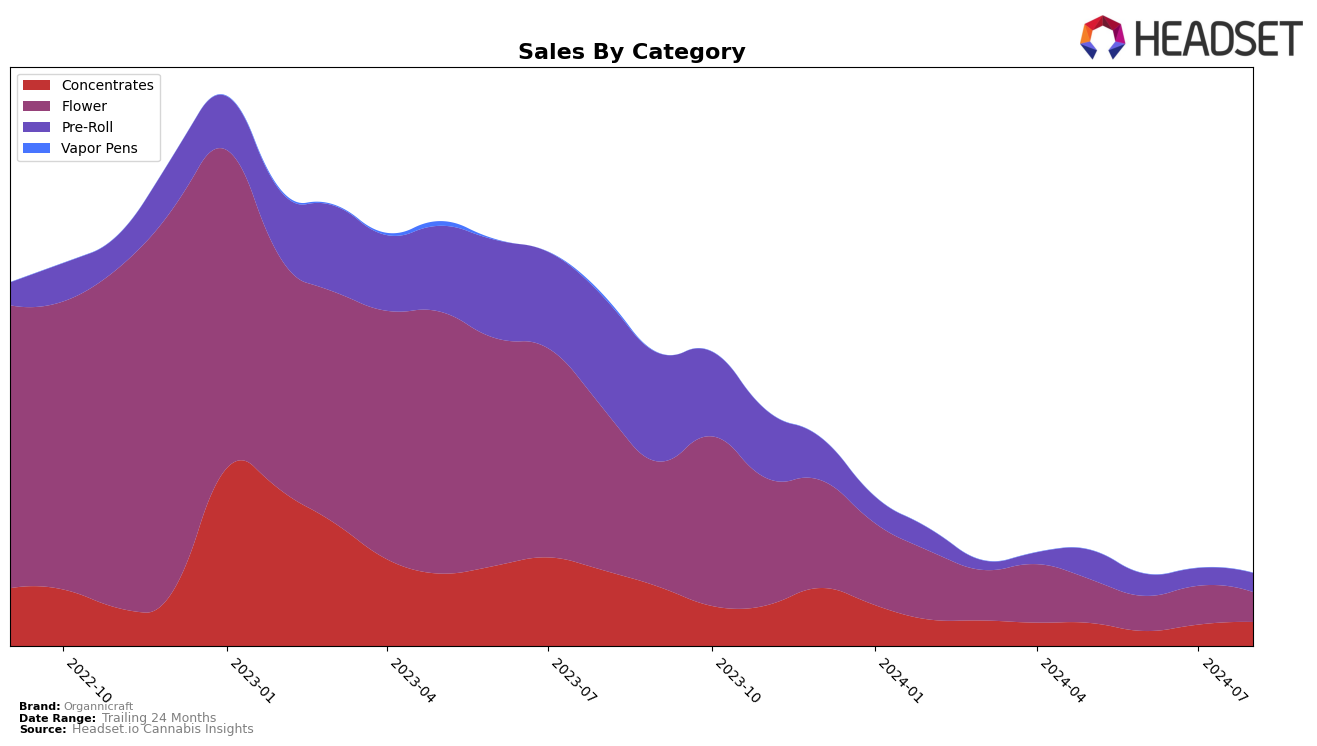

Organnicraft has shown varied performance across different categories and provinces. In Alberta, the brand's presence in the Concentrates category has seen fluctuations, ranking 25th in May 2024, dropping to 30th in June, and then improving to 27th by August. This indicates a recovery trend after a mid-year dip. Notably, the sales figures reflect this movement, with a significant drop in June followed by a rebound in August. This performance suggests that Organnicraft is gaining traction again in Alberta's Concentrates market, though it still faces challenges to maintain a top 30 position consistently.

In British Columbia, Organnicraft's performance in the Flower category has been less stable, with rankings outside the top 30 for most months. The brand ranked 83rd in May, dipped to 94th in June, improved to 78th in July, but fell back to 95th in August. This volatility indicates that Organnicraft is struggling to establish a strong foothold in the Flower category in this province. In the Pre-Roll category, Organnicraft maintained a consistent ranking of 84th in May, June, and August, with a slight drop to 92nd in July. The consistency in Pre-Roll rankings, despite not breaking into the top 30, suggests a steady but limited market presence. Meanwhile, in Ontario, Organnicraft only appeared in the Concentrates category in July, ranking 49th, indicating a new or less competitive presence in this market.

Competitive Landscape

In the competitive landscape of the British Columbia pre-roll category, Organnicraft has experienced notable fluctuations in its rank and sales over the past few months. Despite maintaining a consistent rank of 84th in both May and June 2024, Organnicraft saw a dip to 92nd in July before recovering back to 84th in August. This indicates a resilient performance amidst a competitive market. In comparison, Solei and DOJA were not in the top 20 for most of these months, highlighting a relative stability for Organnicraft. However, Virtue Cannabis and Magi Cannabis have shown stronger performances, with Virtue Cannabis holding a rank as high as 79th in May and Magi Cannabis peaking at 77th in the same month. These competitors have seen more significant sales figures, suggesting a higher market penetration. For Organnicraft, the key takeaway is the need to bolster its market strategy to climb higher in the ranks and close the sales gap with top-performing brands.

Notable Products

In August 2024, the top-performing product from Organnicraft was Platinum Oranges Pre-Roll 2-Pack (1.5g), which regained its top spot from May and June after slipping to third in July, with sales reaching 1003 units. Organnicraft X Wildcard - Platinum Grapes Shatter (1g) held the second position, maintaining consistent performance and closely following the leader. Platinum Grapes (3.5g) dropped to third place after holding the second rank for three consecutive months. Platinum Grapes Pre-Roll 2-Pack (1.5g) remained stable in fourth place throughout the observed months. Lastly, Platinum Orange (3.5g) continued its steady performance in fifth place, though its sales figures showed a noticeable decline.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.