Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

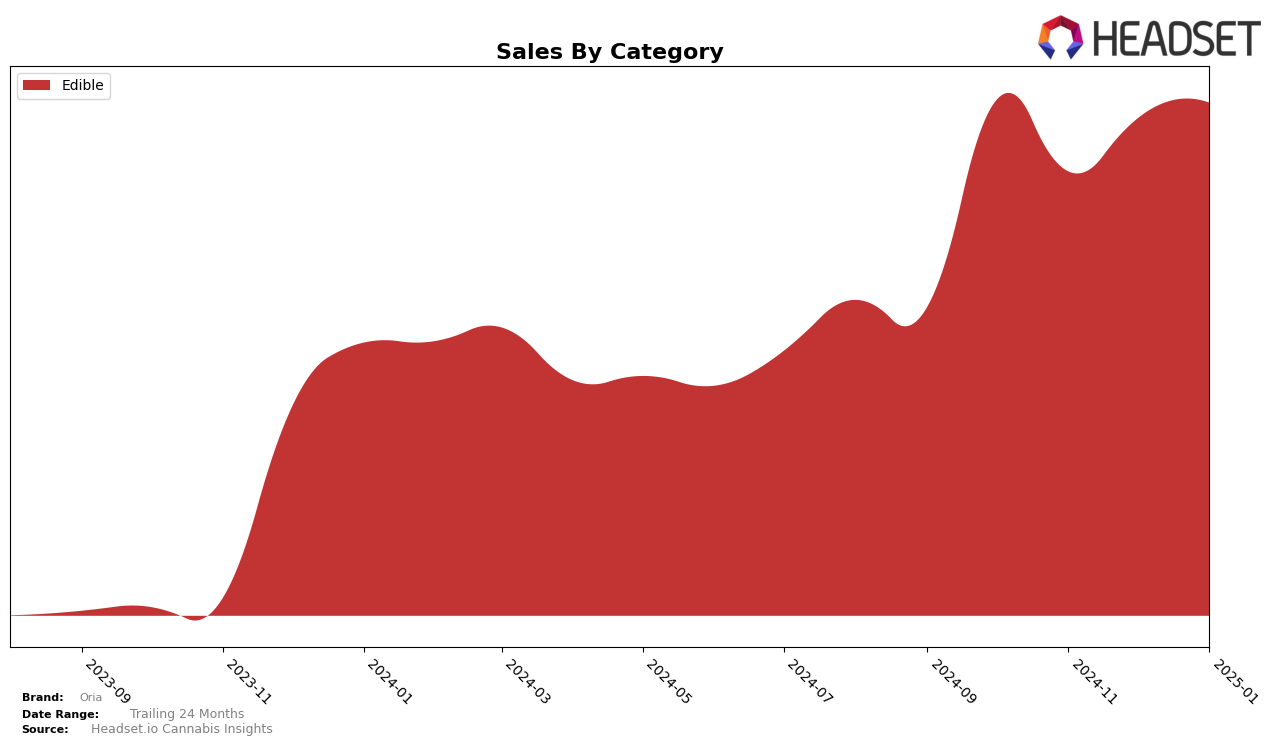

Oria's performance across various states and categories has shown mixed results over recent months. In the Colorado edible market, Oria experienced a downward trend, slipping from the 19th position in October 2024 to 40th by January 2025. This decline is accompanied by a significant drop in sales, indicating potential challenges in maintaining market share within this competitive category. The absence of Oria from the top 30 rankings in November and December suggests that the brand is struggling to retain its foothold in Colorado's edible market.

Conversely, Oria's presence in the Maryland edible market shows a more stable performance, with rankings fluctuating moderately between 22nd and 26th place over the same period. This stability is bolstered by a consistent increase in sales, peaking in January 2025. Meanwhile, in Ohio, Oria has made impressive strides, climbing from 26th position in October 2024 to 15th by January 2025. This upward momentum is reflected in substantial sales growth, suggesting a strengthening brand presence and increased consumer acceptance in Ohio's market.

Competitive Landscape

In the competitive landscape of the edible cannabis market in Ohio, Oria has demonstrated notable progress in terms of rank and sales over the past few months. Starting from a rank of 26 in October 2024, Oria has steadily climbed to 15 by January 2025, showcasing a positive trajectory in the market. This upward movement is significant when compared to competitors such as Neighborgoods, which experienced a decline from rank 3 to 14 during the same period, indicating potential challenges in maintaining their market position. Meanwhile, Lost Farm maintained a relatively stable position, hovering around ranks 12 and 13, but with a downward trend in sales. Oria's consistent improvement in rank, coupled with increasing sales, suggests a strengthening brand presence in Ohio's edible market, positioning it favorably against competitors like Main Street Health and Jams, who have shown fluctuating ranks and sales figures.

Notable Products

In January 2025, the top-performing product from Oria was the THC/CBC 2:1 Citrus Splash Lemon And Lime Gummies 10-Pack, which climbed to the first position with sales reaching 1613 units. The THC/CBC 2:1 Sumatran Sunrise Blood Orange Gummies 10-Pack maintained its consistent performance, holding steady in the second position with 1260 units sold. Black Mamba Citrus & Blackberry Live Resin Gummies made a notable entry at the third rank, indicating a strong debut. The Dreamcatcher - Berries & Whipped Cream Live Resin Gummies remained stable at fourth place, while the Black Mamba Citrus & Blackberry Gummies, which previously held the top spot, dropped significantly to fifth. This shift in rankings highlights a dynamic change in consumer preferences from the previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.