Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

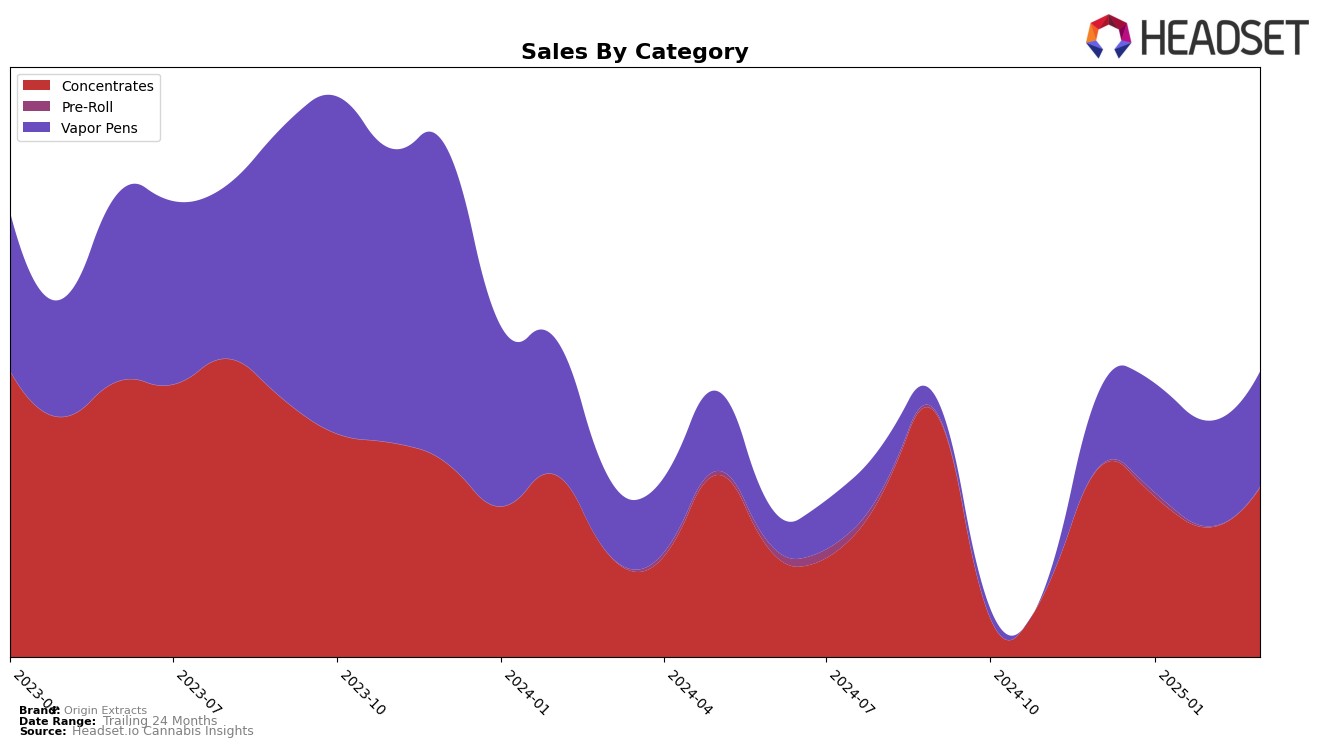

Origin Extracts has shown a notable performance in the Missouri market, particularly in the Concentrates category. Over the span from December 2024 to March 2025, the brand maintained a consistent presence within the top 30 rankings, with a slight dip in January and February where it held the 24th position, before climbing back to 21st in March. This upward movement suggests a positive reception and potential growth in market share within the Concentrates category. However, the sales figures indicate some volatility, with a decrease from December to February followed by a recovery in March. Such fluctuations could point to seasonal demand changes or competitive pressures.

In the Vapor Pens category, Origin Extracts did not rank within the top 30 brands during the observed period, which could be a concern for their market strategy in this segment. Despite not making the top 30, there was an upward trend in sales from December to March, with a notable increase in January. This suggests that while the brand may not be leading in rankings, it is still capturing a portion of the market and may have potential for growth if strategic adjustments are made. The sales trajectory in this category could be indicative of growing consumer interest or effective promotional efforts, although further analysis would be required for a comprehensive understanding.

Competitive Landscape

In the competitive landscape of the Missouri concentrates market, Origin Extracts has shown a steady improvement in its rank over the first quarter of 2025, moving from 23rd in December 2024 to 21st by March 2025. This upward trend suggests a positive reception of their products, despite facing stiff competition. Notably, Smokey River Cannabis, which ranks higher, has experienced a decline in sales from December to March, indicating potential market share opportunities for Origin Extracts. Meanwhile, Bad Pony has seen a drop in rank from 17th to 25th, which could further open up space for Origin Extracts to capitalize on. The consistent rank of Safe Bet and the fluctuating performance of The Standard also highlight the dynamic nature of this market, where Origin Extracts' ability to maintain and improve its position could lead to increased sales and brand recognition.

Notable Products

In March 2025, the top-performing product from Origin Extracts was Menage a Trois Cured Crumble (1g) in the Concentrates category, which climbed to the first rank from its previous third position in February. The Mule Cured Badder (1g) entered the rankings for the first time, securing the second spot with notable sales of 412 units. Golden Goat Cured Crumble (1g) slipped to third place from its previous second position in February, indicating a slight decrease in sales momentum. Grape Distillate Cartridge (1g) in the Vapor Pens category held the fourth rank, maintaining a steady presence in the top five. Strawberry Lemonade Live Badder (1g) maintained its fifth position from February, showing consistent performance in the Concentrates category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.