Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

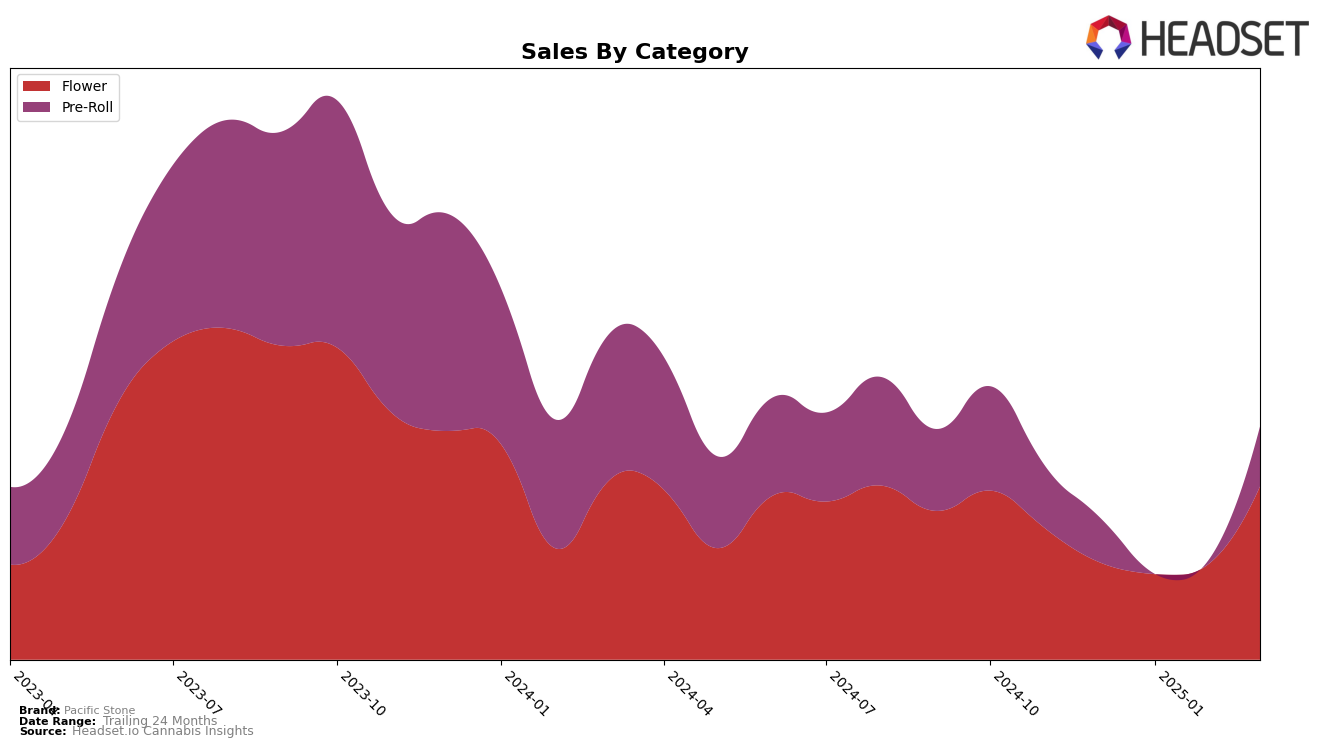

Pacific Stone has shown significant upward momentum in the California market, particularly in the Flower category. Starting from a rank of 11 in December 2024, the brand improved its position to 9 by March 2025. This steady climb indicates a positive reception and growing demand for their Flower products in the state. Notably, their sales figures reflect this trend, with March 2025 sales reaching over $2.1 million, a substantial increase from previous months. The consistent improvement in rankings suggests that Pacific Stone's Flower products are becoming increasingly popular among consumers, although their absence in the top 30 in other states or provinces might indicate a more localized success story.

In the Pre-Roll category, Pacific Stone has also demonstrated a commendable performance in California. Maintaining an 8th rank in December 2024 and January 2025, they moved up to 6th place by March 2025. This advancement in rank, coupled with a notable rise in sales, highlights the brand's effective strategy and appeal in this segment. However, it's worth noting that Pacific Stone did not appear in the top 30 rankings for Pre-Rolls in other markets, which could be seen as a limitation in their geographical reach or market penetration outside of California. This localized success in California suggests potential for expansion if similar strategies are applied in other regions.

Competitive Landscape

In the competitive landscape of California's flower category, Pacific Stone has demonstrated a notable upward trajectory in its rank and sales performance from December 2024 to March 2025. Starting at the 11th position in December 2024, Pacific Stone climbed to 9th place by March 2025, indicating a positive trend in market presence. This improvement is significant when compared to competitors like UpNorth Humboldt, which fluctuated between 9th and 11th positions during the same period, and Fig Farms, which saw a similar rise but ended slightly lower at 11th in March 2025. Meanwhile, Allswell maintained a stronger position, consistently ranking within the top 7, and Gramlin held steady at 8th place. Despite these competitors, Pacific Stone's sales surged notably in March 2025, reflecting a robust growth pattern that could potentially elevate its competitive standing further in the coming months.

Notable Products

In March 2025, Pacific Stone's top-performing product was Blue Dream Pre-Roll 14-Pack (7g), maintaining its number one rank consistently from previous months, with notable sales of 10,662 units. Wedding Cake Pre-Roll 14-Pack (7g) held steady at the second position, showing a consistent performance over the months. The 805 Glue Pre-Roll 14-Pack (7g) remained in third place, continuing its climb from the fourth position in December 2024. Blue Dream Pre-Roll 2-Pack (1g) secured the fourth spot, unchanged from the previous months. Wedding Cake (3.5g) consistently ranked fifth, indicating stable demand in the Flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.