Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

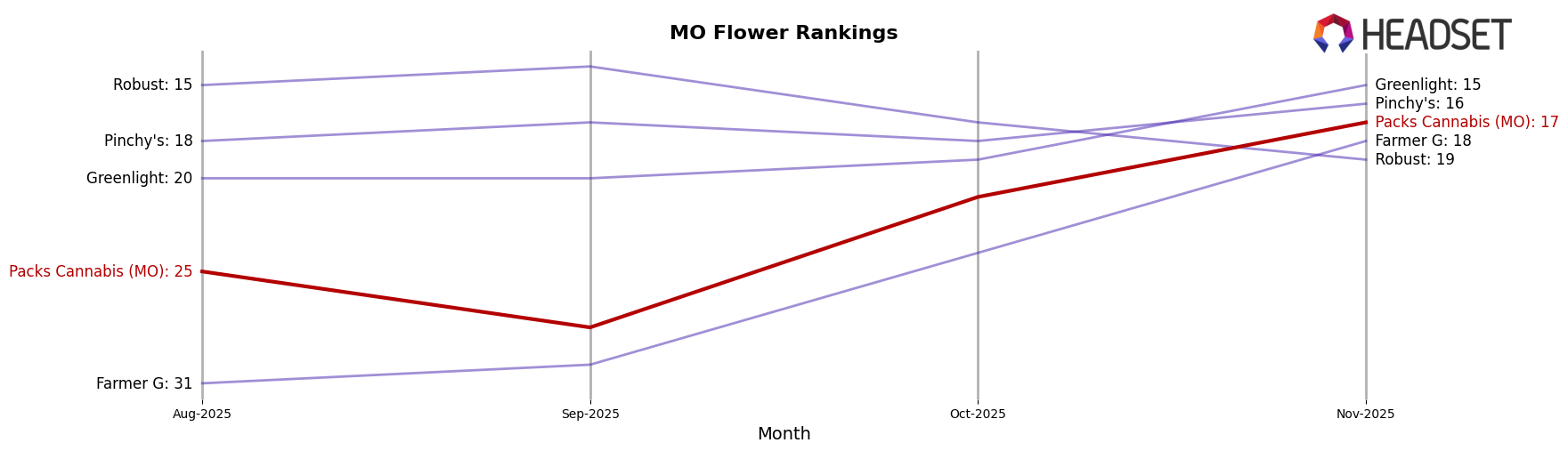

In the Missouri market, Packs Cannabis (MO) has demonstrated a commendable performance in the Flower category. The brand's ranking has improved significantly from 25th in August 2025 to 17th by November 2025. This upward trend is indicative of a strong market presence and increasing consumer preference for their offerings. Such a steady climb in rankings suggests that Packs Cannabis is effectively capturing market share and possibly introducing new products or strategies that resonate well with consumers. However, it is important to note that the brand was not in the top 20 in August, highlighting an area for potential growth and improvement.

In contrast, the Pre-Roll category has shown a more stable performance for Packs Cannabis (MO) in Missouri. The brand maintained its position consistently at 15th place from September through November 2025. While this stability suggests a loyal customer base and consistent sales, it also indicates little movement in climbing higher in the rankings. This could be seen as a missed opportunity for growth, especially when compared to their dynamic performance in the Flower category. The challenge for Packs Cannabis (MO) will be to leverage their strengths in the Flower category to boost their Pre-Roll offerings and climb higher in the rankings.

Competitive Landscape

In the competitive landscape of the Missouri flower category, Packs Cannabis (MO) has shown a notable upward trend in rankings and sales from August to November 2025. Starting outside the top 20 in August, Packs Cannabis (MO) climbed to the 17th position by November, indicating a significant improvement in market presence. This upward trajectory is contrasted with brands like Robust, which experienced a decline from 15th to 19th place over the same period, and Greenlight, which improved from 20th to 15th. Meanwhile, Pinchy's maintained a relatively stable position, slightly fluctuating between 16th and 18th. The data suggests that Packs Cannabis (MO) is effectively capturing market share, potentially at the expense of competitors like Robust, while also keeping pace with the growth of brands like Greenlight and Farmer G, the latter of which also showed a notable rise from 31st to 18th. This dynamic shift highlights Packs Cannabis (MO)'s strategic advancements in the Missouri flower market.

Notable Products

In November 2025, the top-performing product for Packs Cannabis (MO) was Whipz Pre-Roll 2-Pack (1g), maintaining its number one rank from October, despite a sales drop to 4,349 units. California Raisins Pre-Roll 2-Pack (1g) improved its position to second place, with sales increasing to 3,420 units. Apples & Bananas Pre-Roll 2-Pack (1g) saw a decline, moving from second to third place, marking a notable decrease in sales. Black Hole Sun Pre-Roll 2-Pack (1g) made its debut in the rankings at fourth place, while California Raisins Pre-Roll (1g) entered at fifth. Compared to previous months, the rankings show dynamic shifts, particularly with new entries affecting the standings of previously top-ranked products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.