Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

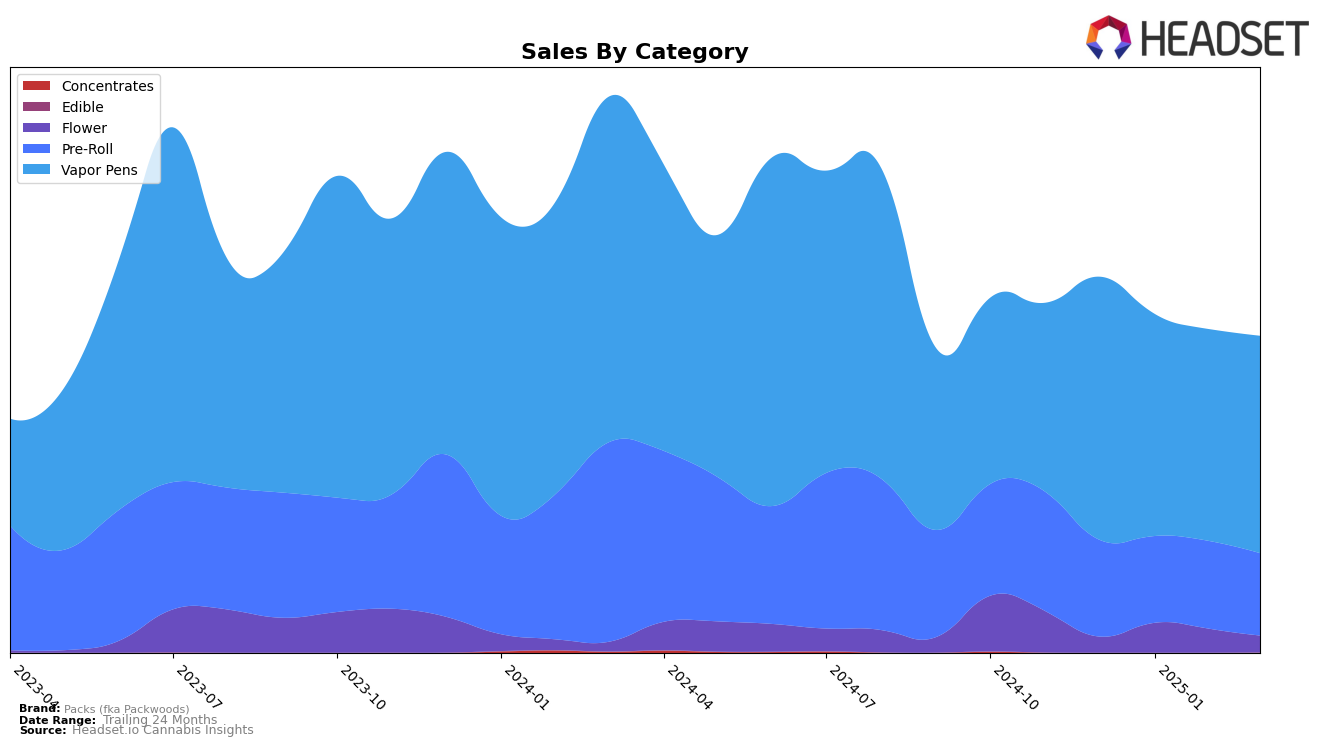

Packs (fka Packwoods) has shown varied performance across different states and product categories. In Colorado, the brand has maintained a strong presence in the Vapor Pens category, consistently ranking 6th from January to March 2025. However, its position in the Pre-Roll category has been more volatile, dropping out of the top 30 in January but recovering to 26th by March. This indicates a potential challenge in maintaining consistent market share in Pre-Rolls, despite a notable sales recovery in March. Meanwhile, in Massachusetts, Packs struggled to break into the top 30 for Pre-Rolls, with rankings steadily declining from 67th in December 2024 to 89th by March 2025, suggesting potential issues in market penetration or competition intensity.

In Michigan, Packs has shown a mixed bag of results. While the Pre-Roll category saw a positive trajectory, with a notable jump from 72nd in January to 55th in February, the Vapor Pens category experienced a decline, slipping from 44th in January to 60th by March. The brand's performance in Nevada also highlights interesting dynamics. Although it failed to appear in the top 30 for Pre-Rolls in January, it made a strong comeback to 18th in February, only to fall back to 26th by March. In the Vapor Pens category, the brand saw a downward trend, dropping from 13th in December 2024 to 20th by March 2025, which might suggest increasing competition or changing consumer preferences. Packs' performance in New York also presents a mixed picture, with a significant drop in the Pre-Roll category from 13th in January to 30th by March, indicating potential market challenges.

Competitive Landscape

In the competitive landscape of vapor pens in Colorado, Packs (fka Packwoods) has maintained a stable position, consistently ranking 6th from January to March 2025. This steadiness is notable given the fluctuations experienced by competitors such as O.penVape, which improved its rank from 9th in January to 7th by March. Meanwhile, Craft / Craft 710 has held a strong 4th place throughout the same period, indicating a robust market presence. Despite a slight dip in sales from December 2024 to February 2025, Packs (fka Packwoods) saw a rebound in March, suggesting resilience and potential for growth. Batch Extracts, another key player, maintained a rank of 5th, indicating a competitive edge over Packs (fka Packwoods) in terms of sales volume. The data highlights the dynamic nature of the vapor pen market in Colorado, where Packs (fka Packwoods) continues to be a significant contender amidst shifting ranks and sales figures.

Notable Products

In March 2025, the top-performing product from Packs (fka Packwoods) was Sour Gushers Live Resin Packspod Disposable (2g) in the Vapor Pens category, climbing to the number one rank with impressive sales of 2995 units. This product improved from its second-place position in the previous two months, demonstrating a strong upward trend. Blue Slurpee Live Resin Packspod Disposable (2g) secured the second spot, although it experienced a decline from its consistent first-place ranking in December and January. Unicorn Sherbet Live Resin Packspod Disposable (2g) fell to third place, which is a drop from its top position in February. Marshmallow Fluff Live Resin Packspod Mini Disposable (1g) debuted in the rankings at fourth place, indicating a positive reception among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.