Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

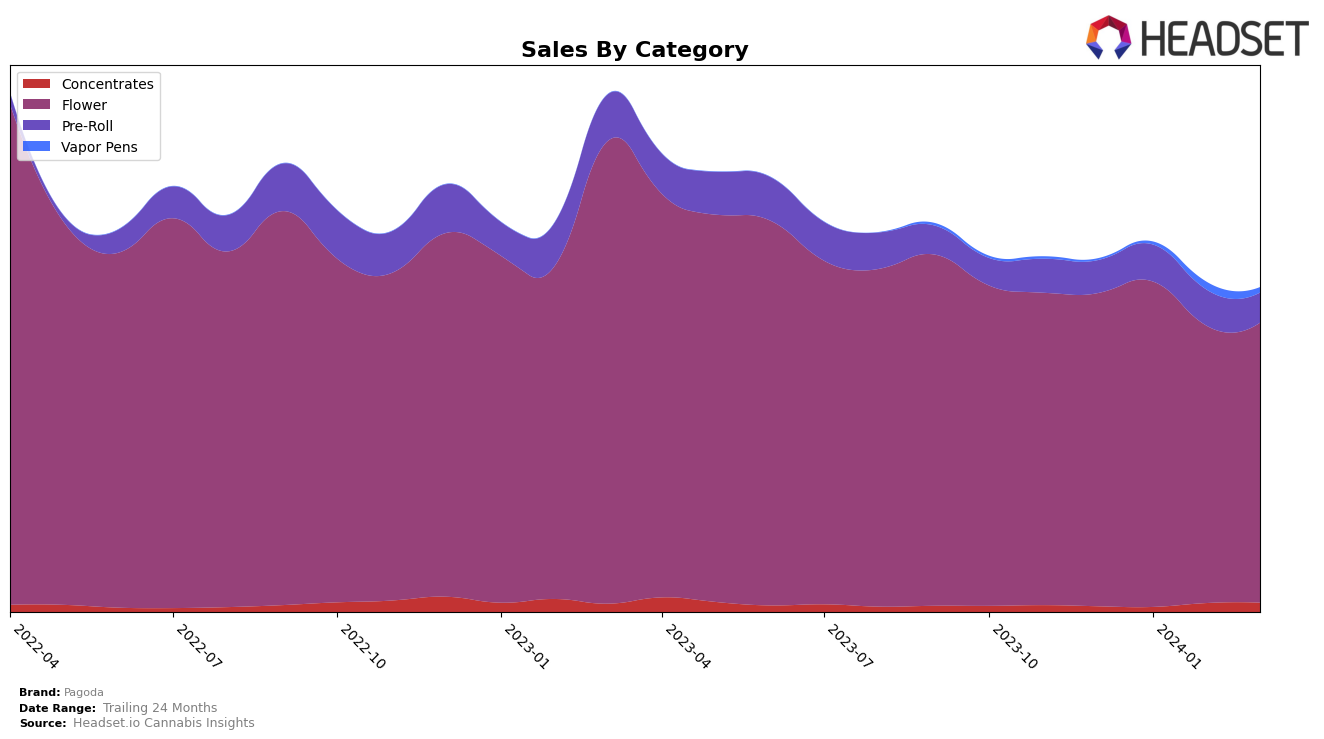

In the Washington market, Pagoda has shown a mixed performance across its product categories. For the Flower category, Pagoda has experienced a slight downward trend in ranking, moving from 17th in December 2023 to 24th by March 2024. Despite the decline in rank, the brand did see a peak in sales in January 2024 with $369,778 but subsequently saw a decrease in the following months, indicating a potential challenge in maintaining its market position amidst competitive pressures. This fluctuation in ranking and sales underscores the volatile nature of the cannabis flower market in Washington and suggests that Pagoda may need to reassess its strategies in this category to regain and improve its standing.

On the other hand, Pagoda's performance in the Pre-Roll category within the same state presents a different narrative. Starting from a lower rank of 97th in December 2023, Pagoda managed to climb to 76th by January 2024, demonstrating a significant improvement. However, this positive momentum did not sustain, as the brand's ranking slightly declined in the following months, settling at 92nd by March 2024. The initial jump in ranking indicates that Pagoda's efforts in the Pre-Roll category had a positive impact, yet the inability to maintain or improve upon this progress suggests challenges in consumer retention or competitive differentiation. The sales in this category also reflect a peak in January 2024, followed by a decline, mirroring the trend seen in the Flower category. This pattern highlights the brand's potential to capture market interest but also points to the need for strategies that ensure long-term growth and stability.

Competitive Landscape

In the competitive landscape of the cannabis flower category in Washington, Pagoda has experienced a notable fluctuation in its market position from December 2023 to March 2024. Initially ranked 17th in December, Pagoda improved to 16th in January, dipped to 21st in February, and then slightly recovered to 24th in March. This trajectory indicates a volatile market presence, with sales peaking in January before experiencing a decline and a modest recovery. Competitors such as Dama, Harmony Farms, Cowlitz Gold, and Falcanna have also seen shifts in their rankings, but Pagoda's fluctuation is particularly notable for its initial rise followed by a more significant fall and partial recovery. This pattern suggests that while Pagoda is capable of gaining ground, maintaining its rank amidst fierce competition remains a challenge. The brand's performance relative to its competitors, some of which have shown more stability or consistent growth, underscores the competitive dynamics within the Washington cannabis flower market and highlights the need for Pagoda to bolster its market strategy to sustain and improve its position.

Notable Products

In March 2024, Pagoda's top-selling product was Bubba Fat Kief Oil Infused Pre-Roll (1g) within the Pre-Roll category, maintaining its first-place position from the previous two months with sales reaching 1003 units. Following closely, Blue Dream (3.5g) from the Flower category secured the second rank, experiencing a notable climb from its absent rank in February to second place, underscoring a significant resurgence in popularity. Sour Gusher Infused Pre-Roll (1g) also made a remarkable entry into the top three, securing the third position after not being ranked in February, highlighting dynamic consumer preferences. The GMO (3.5g) product, another Flower category offering, held steady at the fourth position, indicating consistent consumer demand. Lastly, El Ape Kush Infused Pre-Roll (1g) rounded out the top five, maintaining its fifth position from February, showcasing the sustained appeal of Pagoda's Pre-Roll offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.