Nov-2023

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

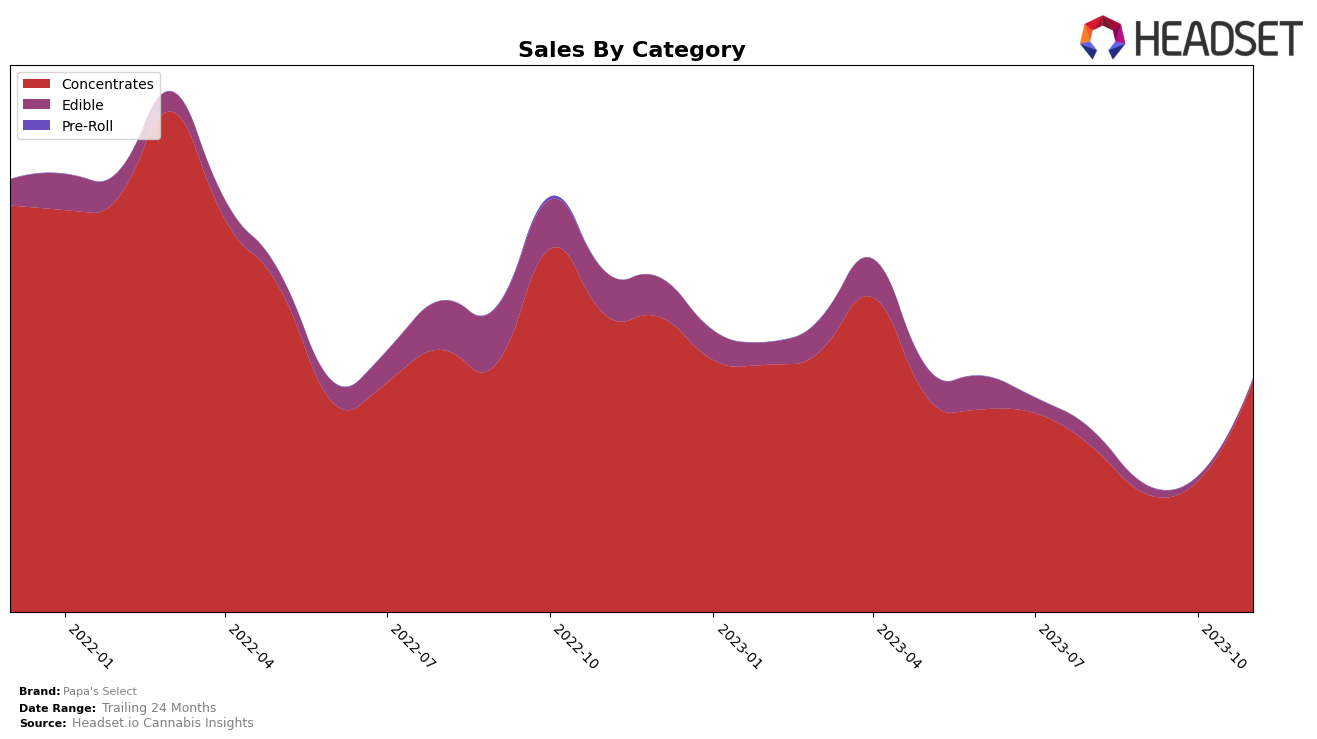

In the category of Concentrates, California-based brand Papa's Select has shown a notable upward trend in its performance. The brand started off at a rank of 18 in August 2023, dipped to 27 in September, and then made a steady climb back up to 16 by November. This shows a strong recovery, despite the initial drop. Interestingly, this trend is mirrored in their sales figures, which started at approximately 202,585 in August, fell to 143,705 in September, and then bounced back to an impressive 281,052 by November.

On the other hand, Papa's Select's performance in the Edible category has been less promising. In August 2023, the brand was ranked 68, but this slipped to 94 by October. By November, the brand was no longer in the top 20 brands in California for this category, indicating a significant decrease in their market share. This downward trend is also reflected in their sales figures, which dropped from approximately 19,913 in August to 5,580 in October. The absence of sales data for November suggests a continued decline in this category.

Competitive Landscape

In the Concentrates category in California, Papa's Select has seen a fluctuating performance over the recent months. In August 2023, it ranked 18th, dropped to 27th in September, slightly improved to 25th in October, and then jumped significantly to 16th in November. This indicates a positive trend in the latter part of the year. In comparison, Nasha Extracts and Locals Only Concentrates have maintained a more stable, but slightly declining rank over the same period. Almora Farms and Hash and Flowers, on the other hand, have consistently ranked higher than Papa's Select, but have also seen a slight downward trend in their ranks. Despite the rank fluctuations, Papa's Select's sales have been increasing, suggesting a growing customer base or increased product availability.

Notable Products

In November 2023, Papa's Select top-selling product was the Berry Cream Smoothie Second Press Live Rosin Badder (1g) with impressive sales of 1956 units. Following this, the Strawberry Cooler Live Rosin (1g) ranked second in sales. The Peanut Butter Crunch Rosin Badder (1g) took the third spot, while the Garlic Cookies Rosin (1g) and Koffee Breath Premium Rosin (1g) ranked fourth and fifth respectively.

Notably, the Berry Cream Smoothie Second Press Live Rosin Badder (1g) made a significant jump from being unranked in the previous months to becoming the top-seller in November. On the other hand, the Koffee Breath Premium Rosin (1g) which was the top product in September, slipped down to the fifth position in November.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.