Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

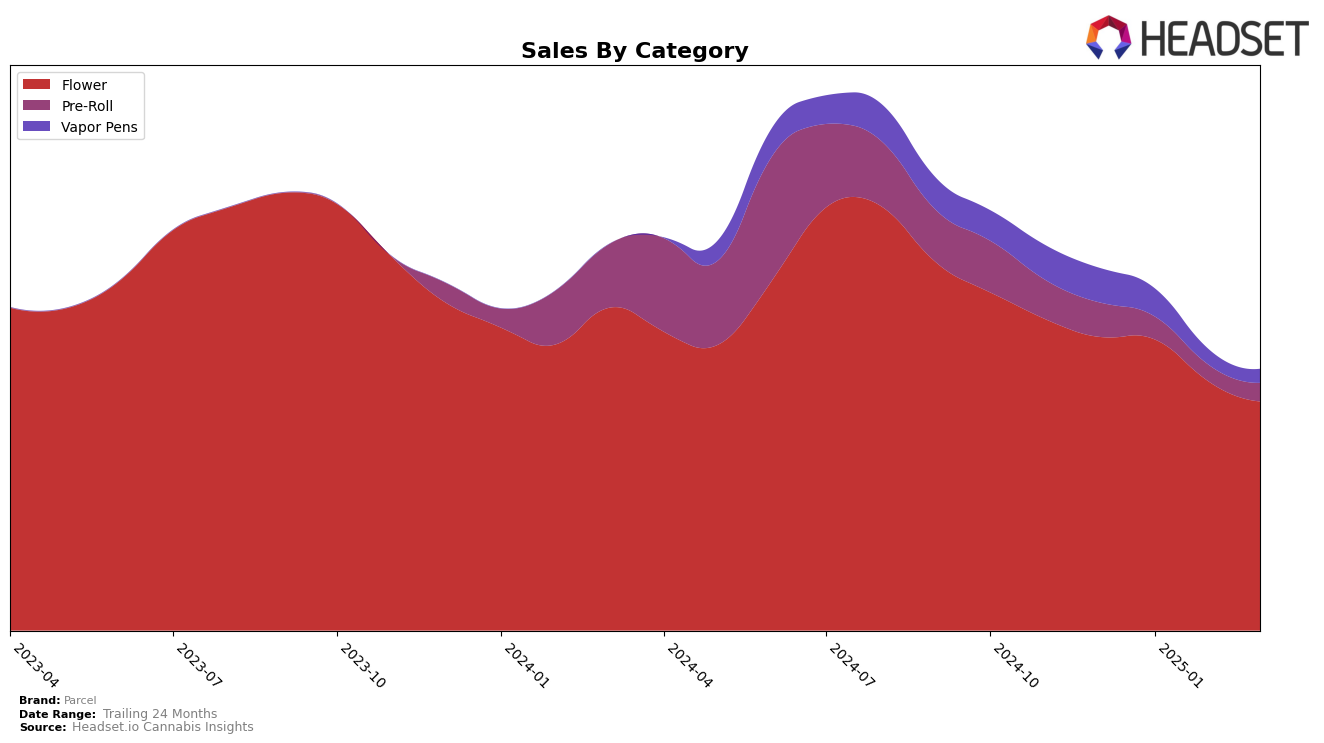

Parcel's performance across various categories and states has shown some intriguing patterns over recent months. In British Columbia, Parcel has maintained a strong presence in the Flower category, consistently ranking within the top 20 from December 2024 to March 2025. However, their performance in the Pre-Roll category was less stable, with the brand failing to rank in the top 30 in February 2025, which could be seen as a setback. Meanwhile, in Ontario, the brand saw a decline in the Flower category, slipping from 29th to 35th by March 2025, indicating potential challenges in maintaining market share in this highly competitive segment.

In Alberta, Parcel's performance in the Flower category did not make it into the top 30 rankings from December 2024 to March 2025, which highlights a significant area for improvement. Despite this, the brand experienced some fluctuations, with sales figures showing a slight recovery in March 2025. On the other hand, in Ontario's Vapor Pens category, Parcel's ranking dropped from 54th in December 2024 to 66th by March 2025. This decline suggests that Parcel might need to reassess its strategy in this category to regain traction. Overall, while Parcel has demonstrated resilience in certain areas, there are clear opportunities for growth and strategic adjustments across different markets and categories.

Competitive Landscape

In the competitive landscape of the Flower category in British Columbia, Parcel has shown a consistent presence, maintaining a rank within the top 20 from December 2024 to March 2025. Despite a slight dip in March 2025, where it fell to 17th place, Parcel's sales figures have remained relatively stable, indicating a loyal customer base. In contrast, Spinach experienced significant fluctuations, peaking at 7th place in January 2025 before dropping to 15th by March, suggesting volatility in consumer preference or marketing strategies. Meanwhile, Grasslands demonstrated a positive trajectory, climbing from 23rd in December 2024 to 16th by March 2025, potentially posing a growing threat to Parcel's market share. Tweed and Woody Nelson both saw declines in their rankings, with Tweed dropping from 12th to 19th and Woody Nelson from 13th to 18th, which could indicate opportunities for Parcel to capitalize on their weakening positions. Overall, while Parcel remains a steady player, the dynamic shifts among competitors highlight the need for strategic adjustments to enhance its market position.

Notable Products

In March 2025, Sweet Notes 3.5g from Parcel maintained its top position in the Flower category, continuing its lead from February with sales of 7,379 units. Sweet Notes 14g closely followed, consistently holding the second rank since January. Citrus Notes Milled 7g remained steady in third place throughout the past four months. A new entrant, Grape Cream Cake 14g, debuted in the fourth position in March. Tiger Blood Distillate Cartridge 0.95g, a Vapor Pens product, held a steady fifth rank, showing a gradual decline in sales over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.