Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

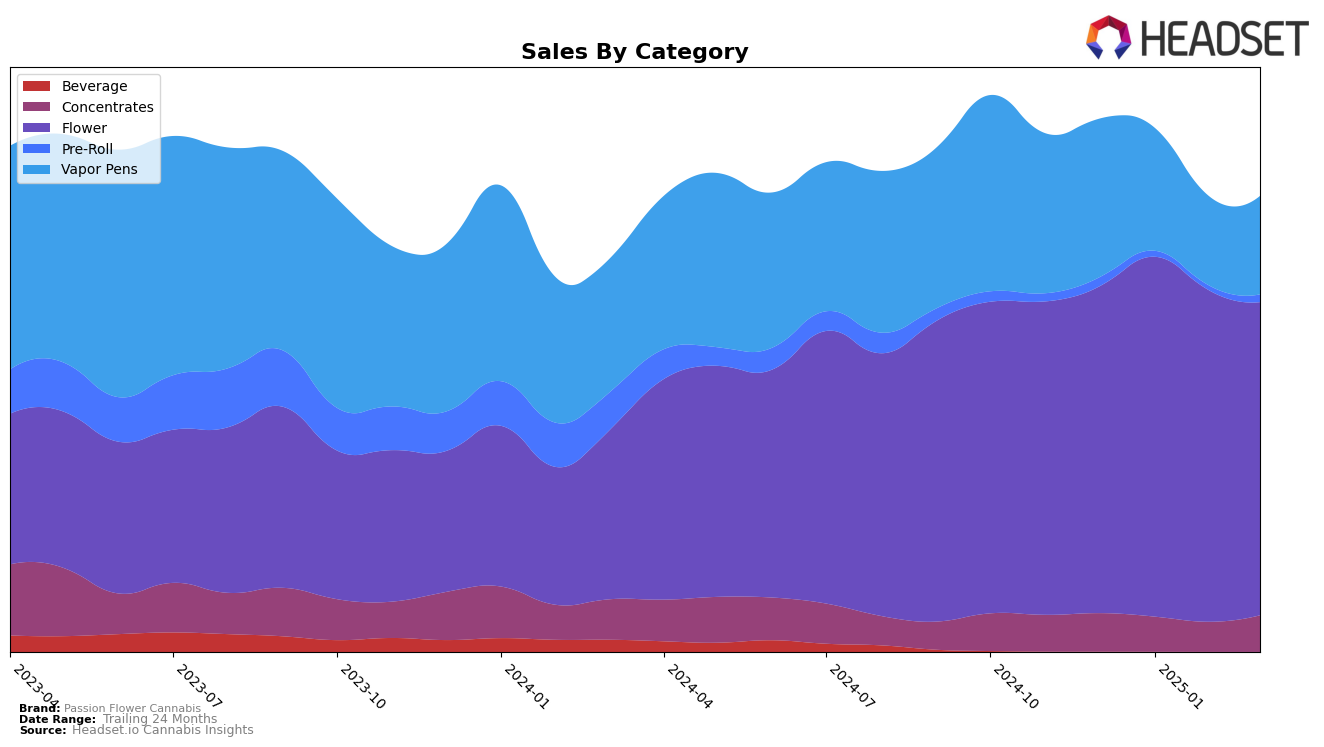

Passion Flower Cannabis has shown varied performance across different product categories in Washington. In the Concentrates category, the brand has struggled to break into the top 30, maintaining a rank just outside this range over the past few months, which may be a cause for concern. The Flower category, however, has been a more consistent performer for Passion Flower Cannabis. Although there was a slight dip in March 2025, the brand managed to stay within the top 30, indicating a relatively stable position in this competitive category. This suggests that while Concentrates may need strategic attention, Flower remains a stronghold for the brand.

Vapor Pens have presented a different challenge for Passion Flower Cannabis in Washington. The brand's ranking in this category has been on a downward trend, slipping from 42nd in December 2024 to 55th by March 2025. This decline in ranking aligns with a decrease in sales during the same period, highlighting potential issues with market penetration or consumer preference. The contrasting performance across these categories suggests that while Passion Flower Cannabis has a foothold in Flower, there may be opportunities to explore growth strategies in Concentrates and Vapor Pens to enhance overall brand performance in the state.

Competitive Landscape

In the competitive landscape of the Washington flower category, Passion Flower Cannabis has demonstrated notable resilience and adaptability. Over the months from December 2024 to March 2025, Passion Flower Cannabis saw fluctuations in its rank, starting at 23rd, peaking at 18th in January, and then settling at 24th by March. This indicates a competitive edge, especially when compared to brands like Royal Tree Gardens, which consistently ranked lower and experienced a downward trend, dropping from 20th to 25th. Similarly, Sweetwater Farms faced a more significant decline, falling out of the top 20 entirely by January and struggling to regain its position. Meanwhile, SKÖRD showed volatility, with a sharp drop in January but a quick recovery by February. Despite these fluctuations, Passion Flower Cannabis maintained a stable sales trajectory, outperforming Torus, which, despite improving its rank, did not surpass Passion Flower Cannabis in sales. This competitive analysis highlights Passion Flower Cannabis's ability to maintain a strong market presence amidst dynamic shifts in the Washington flower market.

Notable Products

In March 2025, Lemon Meringue 3.5g maintained its position as the top-selling product for Passion Flower Cannabis, with sales reaching 1770 units. Dark Star 3.5g rose to the second position, sustaining its impressive February sales figures of 1190 units. Slurricane 3.5g, which held a consistent second rank in previous months, slipped to third place. Meanwhile, Slurricane 7g, previously ranked third, moved down to fourth place. Lemon Meringue 7g re-entered the rankings at fifth place, having missed a ranking in January, showing a decline from its peak in December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.