Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

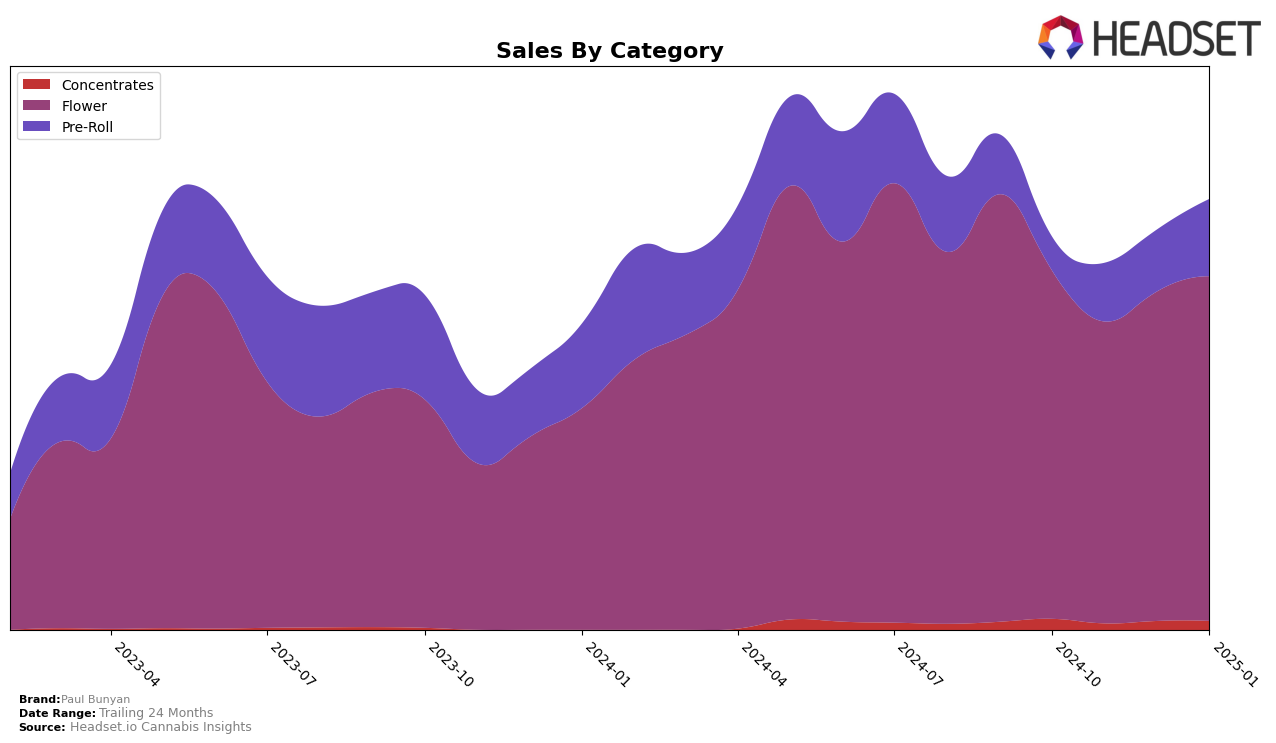

Paul Bunyan's performance in the cannabis market demonstrates varied success across different categories and states. In Illinois, the brand has shown a strong presence in the Flower category, consistently ranking within the top 20, even reaching the 12th position in both October 2024 and January 2025. This indicates a stable demand for their flower products in the state. However, their performance in the Concentrates category tells a different story, where they only managed to secure a 30th place ranking in October 2024 and January 2025, with a drop out of the top 30 in November 2024. This suggests a potential area for improvement or a shift in focus to bolster their market presence in concentrates.

In the Pre-Roll category, Paul Bunyan has shown a positive trajectory in Illinois, moving from the 34th position in October 2024 to the 16th spot by January 2025. This upward trend highlights growing consumer interest and possibly effective marketing or product improvements. Contrastingly, in Michigan, the brand's presence in the Pre-Roll category is less robust, failing to make it into the top 30 for most months, with a brief appearance at 99th in November 2024 and 93rd in January 2025. This indicates a significant challenge in gaining traction in Michigan's pre-roll market, which could be due to competitive pressures or differing consumer preferences.

Competitive Landscape

In the competitive landscape of the Illinois flower category, Paul Bunyan has experienced notable fluctuations in its rankings over the past few months. Starting at 12th place in October 2024, Paul Bunyan saw a dip to 16th in both November and December, before rebounding to 12th in January 2025. This fluctuation contrasts with competitors like Cresco Labs, which consistently maintained a top 10 position, peaking at 9th in November and December before slightly dropping to 11th in January. Meanwhile, Aeriz showed a downward trend, starting from 9th in October and falling to 14th by January, which might suggest a potential opportunity for Paul Bunyan to capitalize on Aeriz's decline. Additionally, Revolution Cannabis demonstrated a positive trajectory, climbing from 15th in October to 10th by January, indicating increased competition. These dynamics highlight the importance for Paul Bunyan to strategize effectively to regain and sustain a higher rank amidst shifting market positions.

Notable Products

In January 2025, Paul Bunyan's top-performing product was the Orange Soda Pre-Roll (1g), which achieved the number one rank with sales of 6008 units. The Lemon Cherry Gelati Pre-Roll (1g) followed closely, moving up from third place in December to second place in January, with sales reaching 5853 units. Macnanna (3.5g) saw a notable improvement, climbing from fourth in November to third in January, with sales of 5262 units. Lilac Breath Pre-Roll (1g), previously ranked first in December, dropped to fourth place in January. Purple Punch (3.5g) entered the top five for the first time, securing the fifth position with 3783 units sold.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.