Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

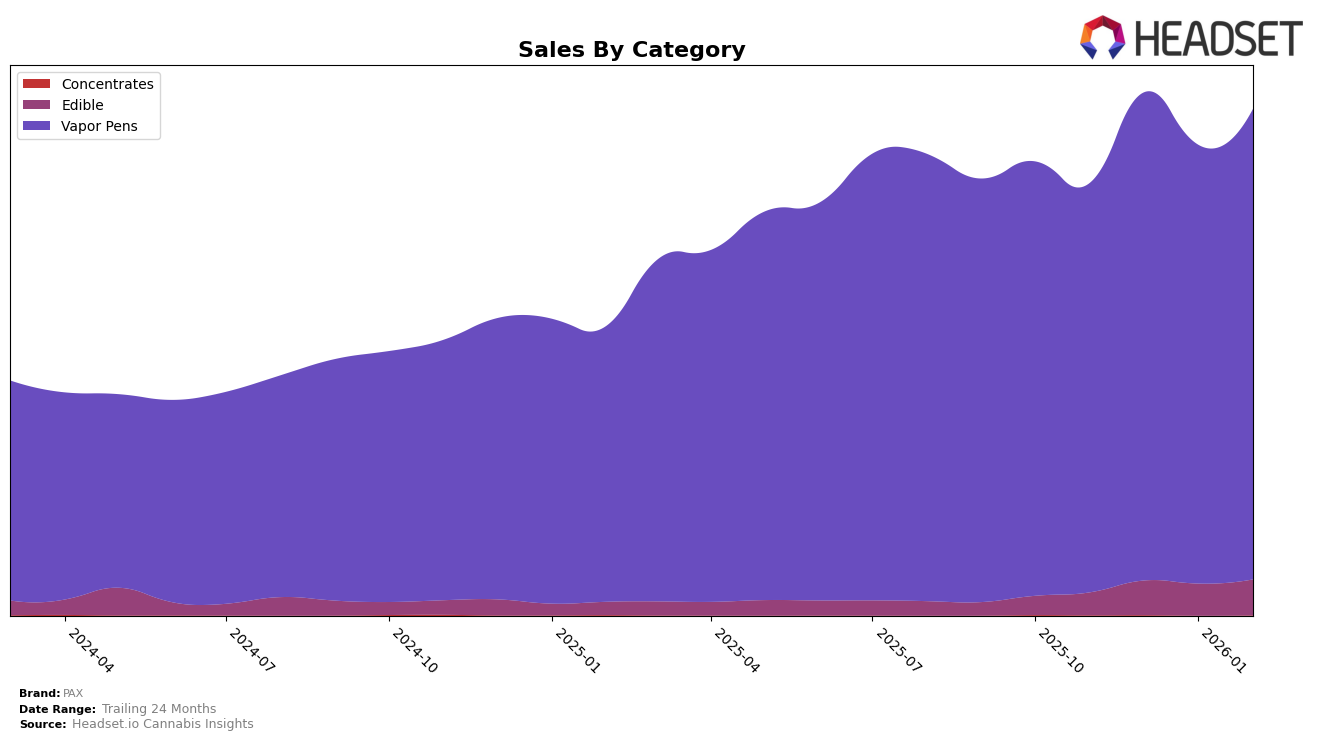

PAX has shown varied performance across different states and product categories. In the vapor pens category, PAX has experienced a steady climb in California, moving from 25th place in November 2025 to 23rd by February 2026. This indicates a positive trend despite a slight dip in sales from December to February. Meanwhile, in Colorado, PAX has maintained a strong presence, holding the top spot in vapor pens by February 2026, a notable improvement from the third position in previous months. However, the brand's absence from the top 30 in Colorado's edible category prior to January 2026 suggests potential areas for growth or strategic shifts.

In Massachusetts, PAX's ranking in vapor pens has declined from 9th in November 2025 to 14th by February 2026, indicating challenges in maintaining market share. Conversely, in New York, PAX has consistently held its position in the top 10 for vapor pens, ranking 7th for several months, which demonstrates a stable consumer base. In the edibles category in New York, PAX's presence is more recent, having entered the top 30 by December 2025 and maintaining a position around the mid-20s, suggesting a gradual but promising entry into this market segment. This mixed performance across states and categories highlights both opportunities and challenges for PAX as it navigates the competitive cannabis landscape.

Competitive Landscape

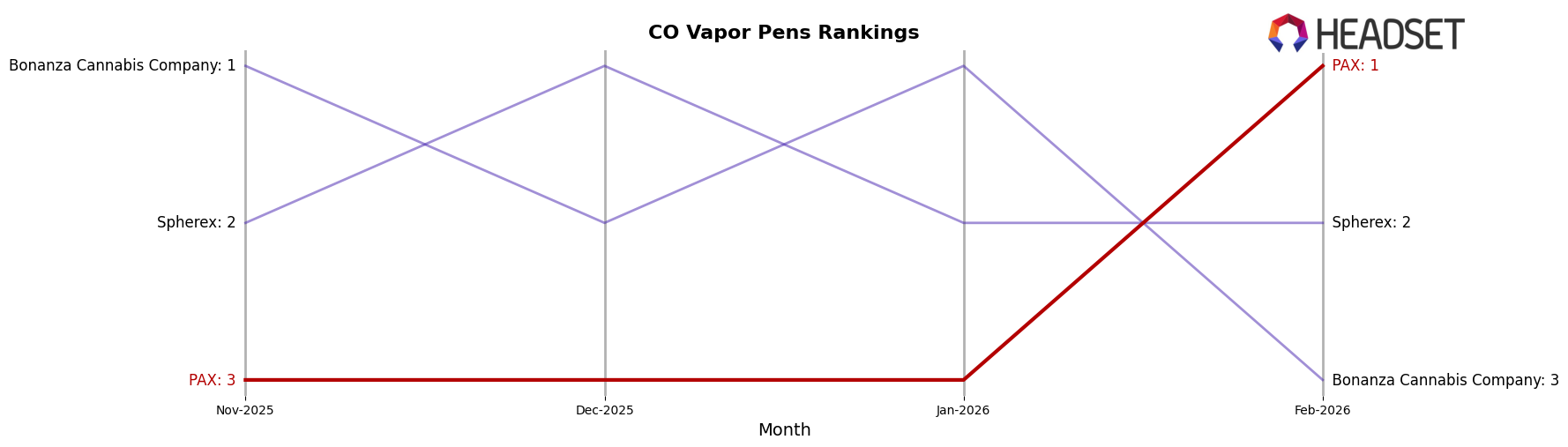

In the competitive landscape of vapor pens in Colorado, PAX has demonstrated a notable upward trajectory, particularly evident in February 2026 when it ascended to the top rank, surpassing established competitors. Despite starting at the third position in November 2025, PAX's strategic advancements and market penetration efforts have paid off, as seen in its leap to the first position by February 2026. This shift is significant given the consistent performance of competitors like Spherex and Bonanza Cannabis Company, who have traditionally dominated the top spots. Notably, while Spherex maintained a strong presence, fluctuating slightly between first and second positions, and Bonanza Cannabis Company experienced a drop to third place in February 2026, PAX's rise indicates a successful capture of market share, likely driven by innovative product offerings and effective marketing strategies. This dynamic shift highlights PAX's growing influence and potential to sustain its leading position in the competitive Colorado vapor pen market.

Notable Products

In February 2026, the top-performing product from PAX was Trip - Blue Dream Fresh Pressed Live Rosin Diamonds Disposable Pax Era Pod (1g) in the Vapor Pens category, maintaining its number one rank consistently since November 2025, with sales reaching 10,202 units. Trip - Maui Wowie Live Resin Diamonds Disposable Pax Era Pod (1g) held its position as the second best-seller, showing a significant increase in sales from January 2026. Trip - Sunset Sherbet Diamond Live Resin Disposable (1g) remained steady at third place, showing consistent performance over the months. Trip - Northern Lights Live Rosin Diamonds Disposable Pax Era Pod (1g) improved its rank from fifth in January to fourth in February, indicating a positive sales trend. Lastly, Trip- Grapefruit Haze Live Rosin Diamonds Disposable (1g) maintained its fifth position, showing slight growth in sales compared to the previous month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.