Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

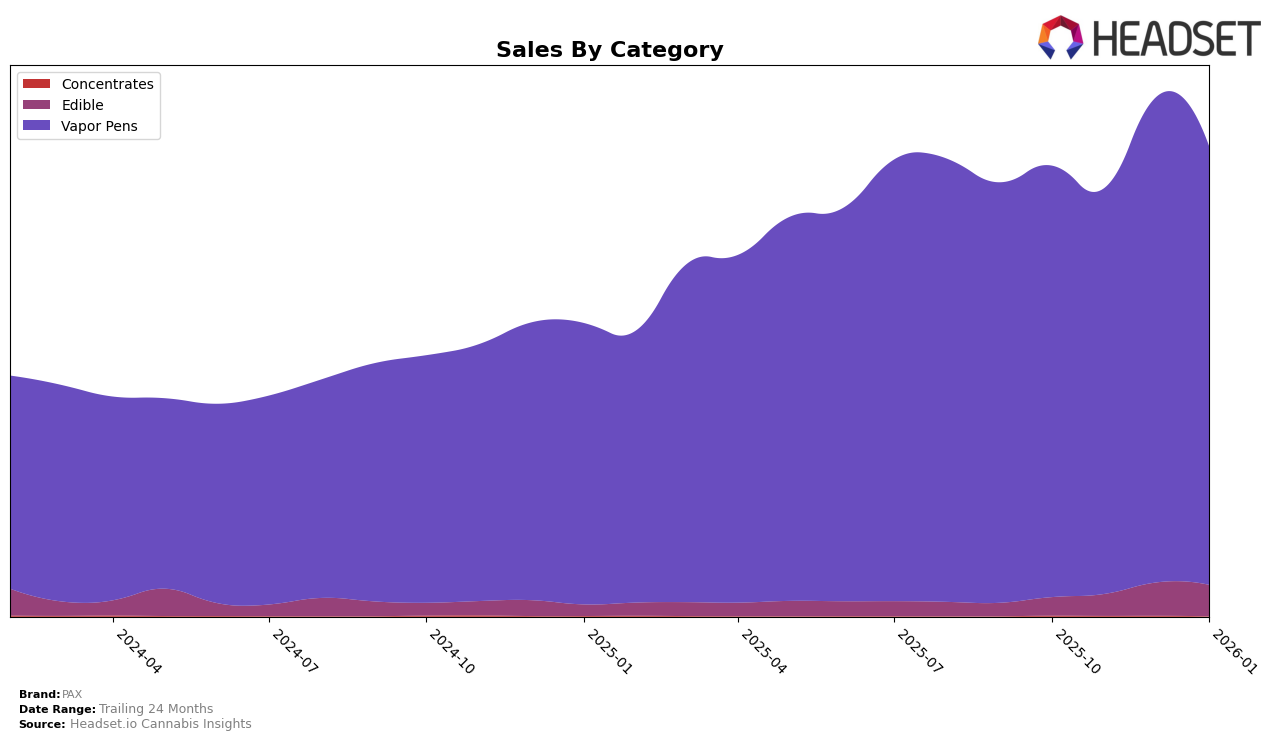

PAX has shown consistent performance in the Vapor Pens category across several states, maintaining a strong presence in Colorado where it has consistently held the third position from October 2025 through January 2026. This stability in ranking indicates a solid market foothold and consumer preference in the state. In California, PAX has experienced slight fluctuations, moving from 26th to 24th and back to 25th position, reflecting a competitive landscape. Meanwhile, in Massachusetts, the brand saw a slight drop from 10th to 12th position, suggesting potential challenges or increased competition in the market.

In the New York market, PAX's performance in the Edible category is noteworthy as it entered the top 30 rankings for the first time in December 2025 at 23rd position and maintained a close rank at 24th in January 2026. This entry into the rankings could signify an emerging presence or growing consumer interest in PAX's edible offerings. In the Vapor Pens category in New York, PAX held steady, remaining within the top 10, which highlights its strong brand recognition and consumer loyalty in this segment. The absence of PAX from the top 30 in the Edible category prior to December 2025 could indicate either a new product introduction or a strategic shift in focus that is beginning to pay off.

Competitive Landscape

In the competitive landscape of vapor pens in Colorado, PAX consistently maintained its position at rank 3 from October 2025 through January 2026, indicating a stable presence in the market. Despite this consistency, PAX faces stiff competition from brands like Spherex and Bonanza Cannabis Company, which alternated between the top two positions during this period. Notably, Spherex saw a slight decline in sales from October to January, while Bonanza Cannabis Company experienced a sales increase, ultimately overtaking Spherex in January 2026. Meanwhile, Jetty Extracts showed a notable upward trend, climbing from rank 9 in October to rank 5 by January, which could signal increasing competition for PAX if this trend continues. Despite these dynamics, PAX's ability to hold its rank suggests a loyal customer base and effective market strategies, though it may need to innovate or adjust its approach to challenge the top two contenders more aggressively.

Notable Products

In January 2026, the top-performing product for PAX was Trip - Blue Dream Fresh Pressed Live Rosin Diamonds Disposable Pax Era Pod (1g) in the Vapor Pens category, maintaining its number one rank from previous months with sales of 8881 units. The Trip - Maui Wowie Live Resin Diamonds Disposable Pax Era Pod (1g) made a significant leap to the second position from an unranked status in December 2025, with an impressive sales figure. Sunset Sherbet Diamond Live Resin Disposable (1g) slipped to third place from its consistent second position in the prior months. The Trip- Grapefruit Haze Live Rosin Diamonds Disposable (1g) rose to fourth place, improving from fifth in December 2025. Finally, the Trip - Northern Lights Live Rosin Diamonds Disposable Pax Era Pod (1g) dropped to fifth place, showing a slight decline in its ranking over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.