Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

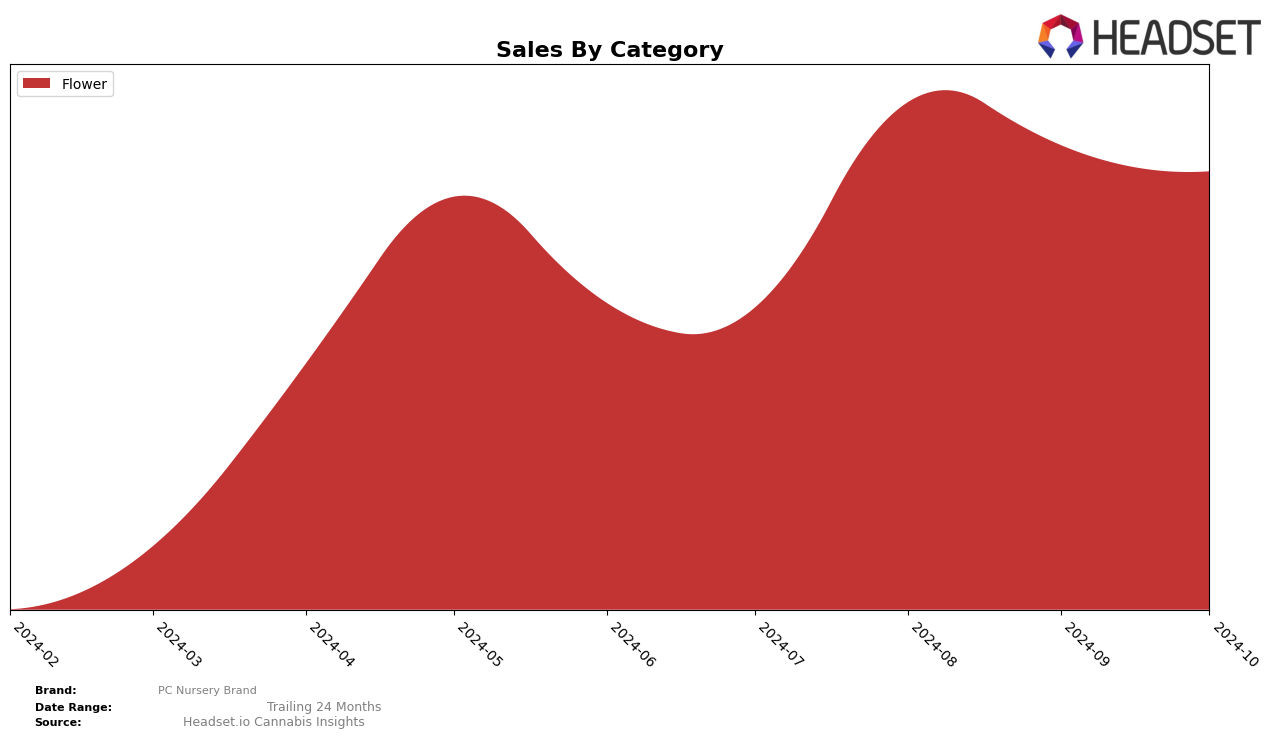

PC Nursery Brand's performance across various states and categories reveals intriguing trends. In the Maryland market, the brand has shown a consistent upward trajectory in the Flower category, advancing from a rank of 34 in July 2024 to 28 by October 2024. This steady improvement suggests a growing consumer base and increased market penetration. Conversely, in Illinois, the brand did not make it into the top 30 rankings for Flower during the observed months, indicating either a highly competitive market or a need for strategic adjustments. Such disparities highlight the importance of regional strategies tailored to the unique dynamics of each state.

In New York, PC Nursery Brand experienced fluctuations within the Flower category, moving from a rank of 53 in July 2024 to 43 in September, before slipping slightly to 48 in October. This indicates a volatile market presence, potentially influenced by shifting consumer preferences or competitive pressures. The brand's absence from the top 30 in certain states underscores the challenges it faces in achieving consistent national prominence. However, the overall trend in Maryland could serve as a blueprint for strengthening its position in other markets, provided the brand can replicate its successful strategies elsewhere.

Competitive Landscape

In the competitive landscape of the Maryland flower category, PC Nursery Brand has shown a notable upward trend in its rankings, moving from 34th in July 2024 to 28th by October 2024. This positive shift indicates a strengthening market presence, despite the competitive pressure from brands like Khalifa Kush and gLeaf (Green Leaf Medical), which consistently maintained higher ranks throughout the same period. While PC Nursery Brand's sales figures have seen a steady increase, the brand still trails behind competitors such as Flower by Edie Parker, which experienced a significant sales surge in October. This suggests that while PC Nursery Brand is gaining traction, there is still room for growth to match the sales volumes of its higher-ranked competitors. The brand's consistent improvement in rank could be a sign of effective marketing strategies or product offerings that resonate well with consumers in Maryland.

Notable Products

In October 2024, Papaya Juice (3.5g) from PC Nursery Brand maintained its top position in the Flower category, despite a slight decrease in sales to 660 units. Divided Sky (28g) made a notable leap to the second position, improving from fifth place in September, with sales rising to 597 units. Bubba's Girl (3.5g) emerged in the third spot, marking its first appearance in the rankings. Lemon Cherry Gelato (3.5g) held steady at fourth position, although its sales declined compared to previous months. Devil's Driver (3.5g) dropped to the fifth position after leading in September, indicating a significant shift in consumer preference.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.