Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

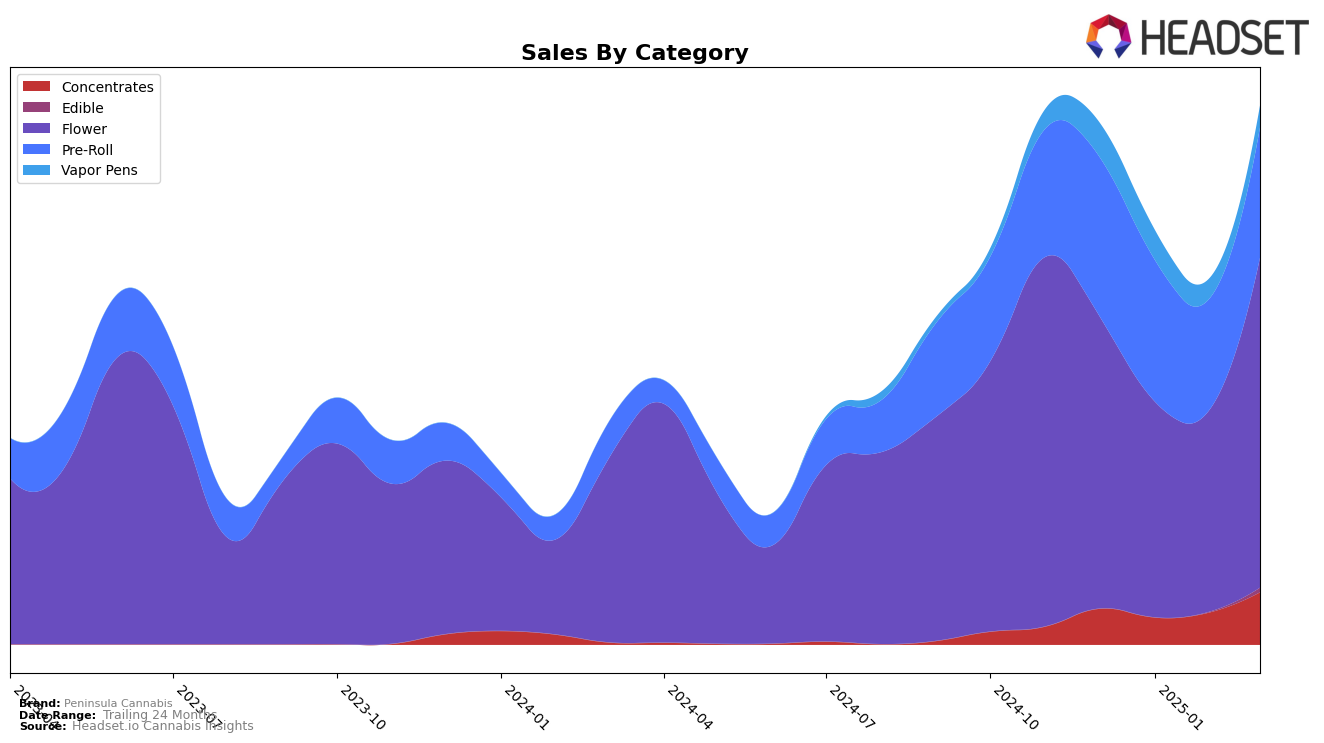

Peninsula Cannabis has shown varying performance across different product categories in Michigan. In the Concentrates category, the brand experienced a notable improvement, climbing from a rank of 46 in February 2025 to 32 by March 2025. This upward movement is indicative of a significant boost in sales during this period, with March 2025 sales reaching $149,423. However, despite this positive trend in Concentrates, the Vapor Pens category presents a different story, where Peninsula Cannabis did not manage to break into the top 30, peaking at rank 72 in December 2024 and declining further to 82 by March 2025. This suggests that while the brand is gaining traction in some areas, it faces challenges in others.

In the Flower category, Peninsula Cannabis has maintained a relatively stable presence, although it has not consistently ranked within the top 30. The brand ranked 31 in March 2025, showing recovery from a dip in January and February, where it was ranked 42 and 41, respectively. The Pre-Roll category shows a slight downward trend, with the brand slipping from rank 17 in December 2024 to 22 by March 2025, indicating potential competition or market shifts. Despite these fluctuations, the Flower category achieved a notable sales increase in March 2025, reaching $942,829, which may signal a resurgence or strategic focus in this area.

Competitive Landscape

In the competitive landscape of the Michigan Flower category, Peninsula Cannabis has experienced notable fluctuations in its rank and sales over the past few months. Starting from December 2024, Peninsula Cannabis was ranked 30th, but it slipped to 42nd in January 2025, before slightly recovering to 41st in February and then improving to 31st in March. This indicates a volatile market position, possibly affected by seasonal trends or competitive pressures. In comparison, Grown Rogue maintained a relatively stable presence, consistently ranking higher than Peninsula Cannabis, despite a dip in February. Carbon also showed strong performance, particularly in January, where it ranked 24th, significantly outperforming Peninsula Cannabis. Meanwhile, NOBO demonstrated a remarkable comeback in March, climbing to 29th place, surpassing Peninsula Cannabis. The sales data reflects these trends, with Peninsula Cannabis experiencing a dip in January and February but rebounding in March, although still trailing behind some competitors. This dynamic market environment suggests that Peninsula Cannabis may need to strategize to stabilize its rank and enhance its competitive edge in the Michigan Flower category.

Notable Products

In March 2025, the top-performing product for Peninsula Cannabis was Runtz Pre-Roll (1g) in the Pre-Roll category, maintaining its number one position from previous months with sales reaching 16,305 units. The Runtz (3.5g) in the Flower category climbed to the second position, improving from third in the prior two months, indicating a resurgence in popularity. Electric Peanutbutter Cookie Pre-Roll (1g) held steady in the third position, despite a slight decline in sales compared to February. A new entrant, Runtz (7g) in the Flower category, debuted strongly in fourth place with notable sales figures. Sherb Pie Pre-Roll (1g) remained in fifth place, showing consistent performance over the months despite fluctuating sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.