Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

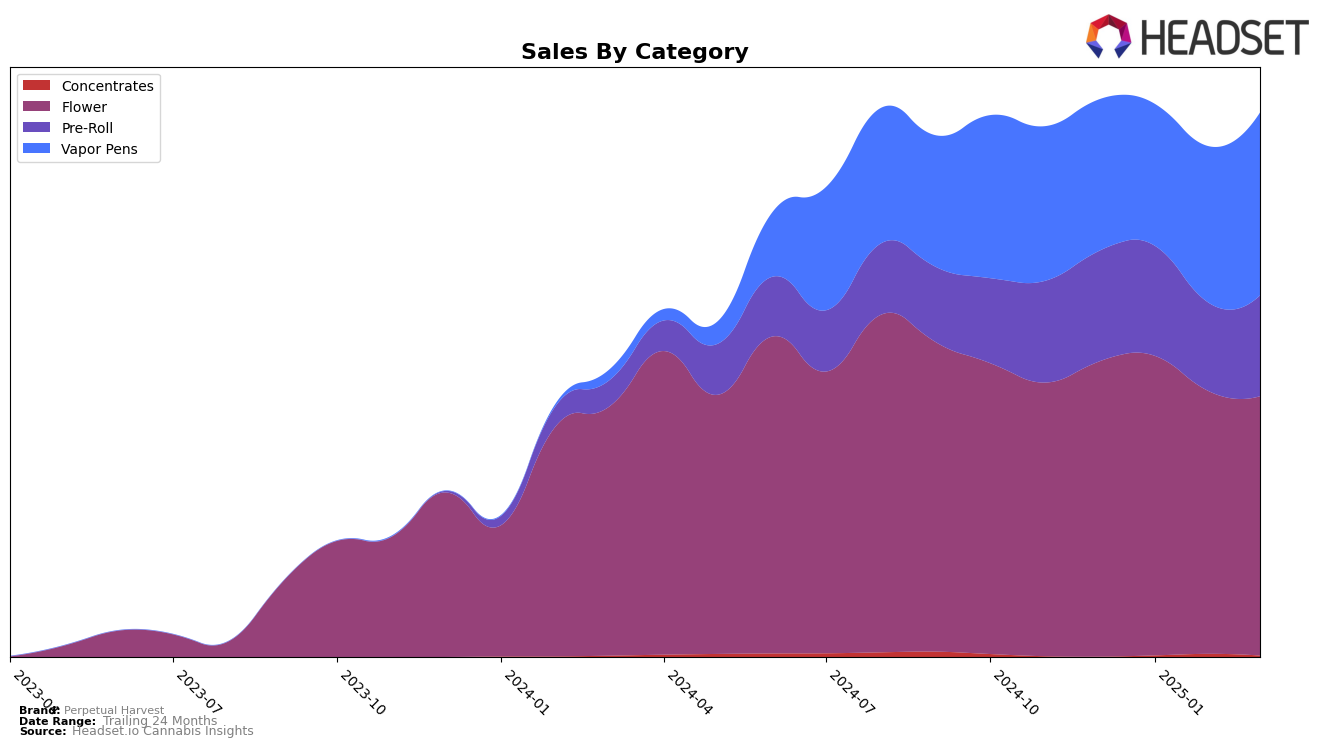

Perpetual Harvest has maintained a strong presence in the Massachusetts market, particularly in the Flower category where they consistently held the third position from December 2024 through March 2025. This stability indicates a solid consumer base and consistent demand for their products in this category. However, in the Pre-Roll category, their performance showed some volatility. They improved their ranking to second place in January 2025 but slipped back to fourth in both February and March. This fluctuation suggests challenges in maintaining market share against competitors or possible supply chain issues affecting product availability or quality.

In the Vapor Pens category, Perpetual Harvest showed positive momentum in Massachusetts, climbing from fifth place in December to fourth place by February and maintaining that rank in March. This upward trend in rankings is accompanied by a notable increase in sales, suggesting effective marketing strategies or product enhancements that resonate with consumers. Despite these gains, it's important to note that Perpetual Harvest did not rank in the top 30 in any other states or provinces across any category, which could imply a strategic focus on Massachusetts or potential areas for expansion. These insights provide a glimpse into the brand's performance dynamics and areas of potential growth or concern.

Competitive Landscape

In the competitive landscape of the Massachusetts flower category, Perpetual Harvest consistently maintained its position as the third-ranked brand from December 2024 through March 2025. Despite a stable rank, Perpetual Harvest faced challenges in sales, with a noticeable decline from January to March 2025. This stability in rank amidst declining sales suggests that other brands may also be experiencing similar market pressures. Leading the category, Simply Herb held the top position consistently, with sales figures significantly higher than Perpetual Harvest, indicating a strong consumer preference. Meanwhile, High Supply maintained its second-place rank, although its sales also fluctuated, particularly with a dip in February 2025. Ozone and Farmer's Cut showed more volatility in their rankings, with Ozone dropping to seventh place in February before recovering to fifth in March, and Farmer's Cut improving its rank from seventh in January to fourth by March. This competitive environment highlights the need for Perpetual Harvest to innovate and potentially adjust its strategies to enhance sales and maintain its competitive edge.

Notable Products

In March 2025, Chocolope Pre-Roll (1g) reclaimed its position as the top-performing product for Perpetual Harvest, with sales reaching 8,546 units, marking a significant comeback from its fifth-place rank in February. Compton Landrace Pre-Roll (1g) emerged as the second best-selling item, despite having no recorded sales or rankings in previous months. Dirty Banana (3.5g) secured the third position, showing a strong entry into the rankings with no prior data. Soap Pre-Roll (1g) maintained its fourth position from previous months, indicating consistent performance. Garlic Juice Pre-Roll (1g) rounded out the top five, debuting in the rankings for the first time this year.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.