Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

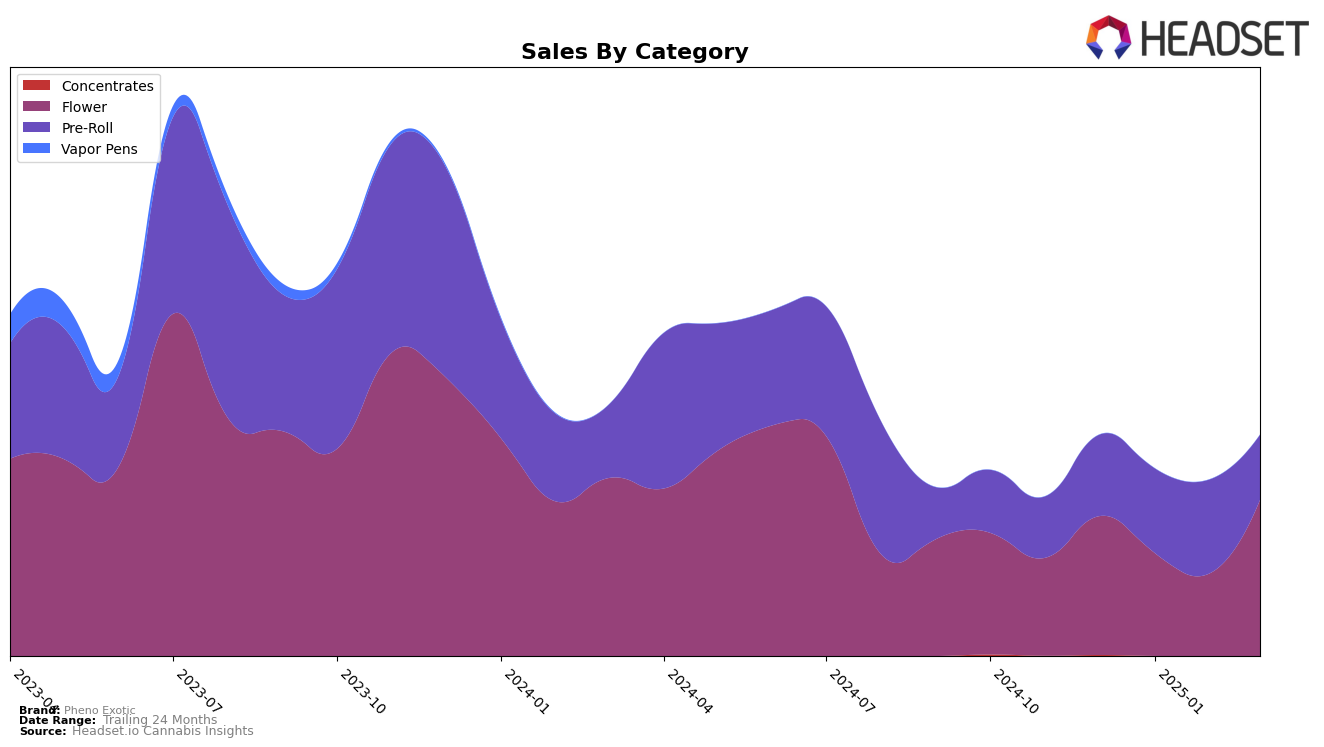

Pheno Exotic has shown mixed performance across different categories in Nevada. In the Flower category, the brand did not make it into the top 30 rankings from December 2024 through March 2025, indicating a challenging market position. However, it's worth noting that despite not being in the top 30, there was a significant upward trend in sales by March 2025, suggesting potential for growth or a strategic shift that could be paying off. Conversely, in the Pre-Roll category, Pheno Exotic fluctuated within the top 30, peaking at 20th place in February 2025 before dropping to 30th in March. This fluctuation might indicate volatility or strong competition in the Pre-Roll market segment.

The sales performance in Nevada presents an intriguing narrative for Pheno Exotic. While the Flower category saw an increase in sales from $64,774 in February to $122,253 in March 2025, this was not enough to break into the top 30, highlighting a competitive market landscape. In contrast, the Pre-Roll category experienced a decline in sales from February to March 2025, which coincided with a drop in their ranking. This suggests that while Pheno Exotic has room to grow in the Flower category, maintaining momentum in Pre-Rolls will require strategic adjustments to regain its higher ranking positions. Exploring the factors behind these trends could provide valuable insights for stakeholders interested in the brand's strategic direction.

Competitive Landscape

In the competitive landscape of the Nevada flower category, Pheno Exotic has shown a notable fluctuation in its market position from December 2024 to March 2025. Initially ranked 49th in December 2024, Pheno Exotic experienced a decline in January and February 2025, maintaining a 50th rank, before making a significant leap to 41st in March 2025. This upward movement in March can be attributed to a substantial increase in sales, surpassing brands like Fleur and Carbon, which saw relatively stable or declining sales during the same period. Despite the competition from higher-ranked brands such as LP Exotics, which consistently maintained a strong presence, Pheno Exotic's March performance indicates a positive trend that could signal a potential for further growth in the coming months.

Notable Products

In March 2025, the top-performing product from Pheno Exotic was I-95 Pre-Roll (1g), which climbed to the number one spot with sales reaching 989 units. PBJ Pre-Roll (1g) secured the second position, showing a slight decrease in sales from February 2025. Zelato Pre-Roll (1g) maintained its third-place ranking, despite a minor drop in sales figures. I-15 (3.5g) entered the top ranks for the first time this month, capturing fourth place. Notably, Pineapple Fruz x Biscotti Sherb Pre-Roll (1g) dropped to fifth place, experiencing a dip in sales compared to January 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.