Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

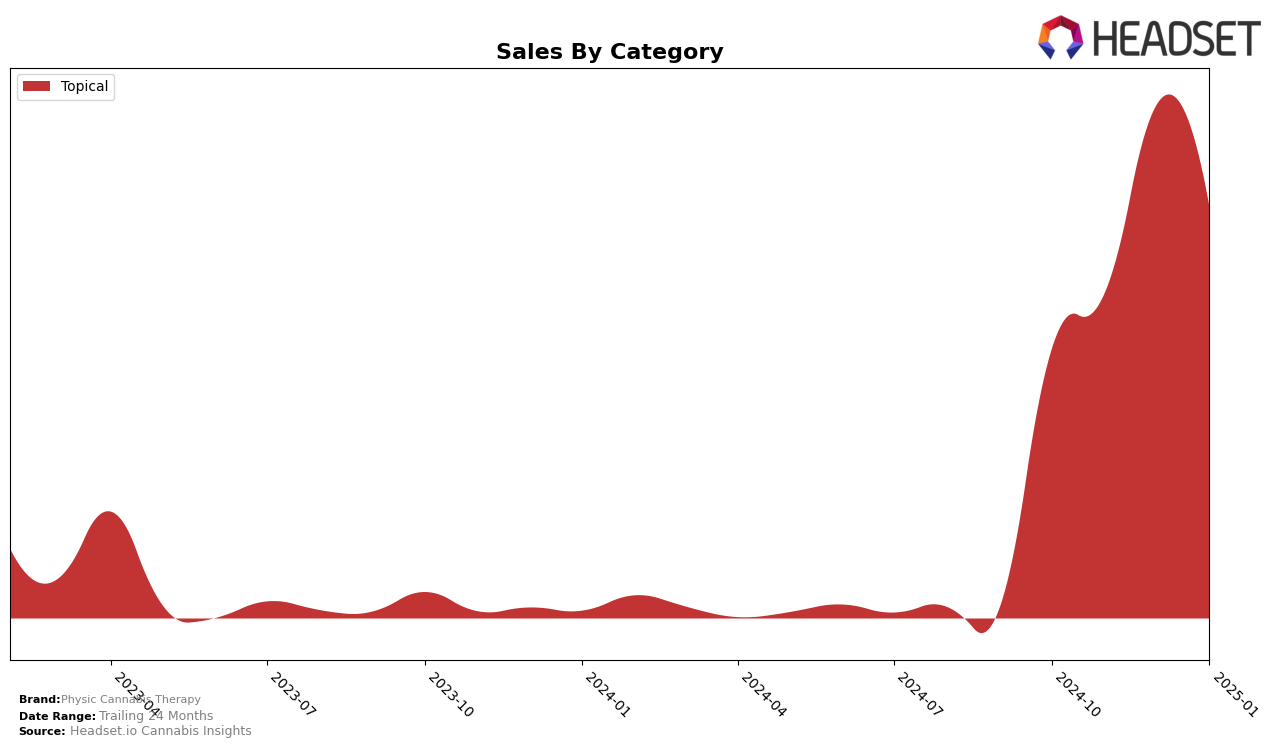

Physic Cannabis Therapy has shown a consistent performance in the Topical category within the state of Oregon. The brand maintained a stable rank of 5th from October to November 2024, before climbing to 4th in December 2024. However, it slipped back to 5th in January 2025. This fluctuation in ranking coincides with a notable increase in sales from November to December, followed by a slight decline in January. The brand's ability to remain within the top five throughout this period highlights its strong presence in the Oregon market.

Despite the positive performance in Oregon, Physic Cannabis Therapy's absence from the top 30 brands in other states or provinces for the Topical category suggests that their market penetration might be limited outside of Oregon. This could indicate an opportunity for expansion or a need to reassess their strategy in other regions. The consistent ranking in Oregon, however, demonstrates a solid foothold in that state, which could serve as a foundation for broader market growth. Understanding the dynamics of consumer preferences in different regions could be crucial for the brand's future success.

Competitive Landscape

In the Oregon Topical cannabis category, Physic Cannabis Therapy has shown a dynamic performance over the last few months, reflecting both opportunities and challenges in the competitive landscape. Starting from October 2024, Physic Cannabis Therapy held the 5th rank, maintaining this position into November before climbing to 4th place in December, only to return to 5th in January 2025. This fluctuation in rank highlights the brand's competitive positioning, especially against strong contenders like Synergy Skin Worx, which consistently outperformed Physic Cannabis Therapy, maintaining a higher rank and showing a significant sales increase in January. Meanwhile, Medicine Farm has remained a dominant force, consistently holding the 2nd rank with stable sales figures. The absence of Peak Extracts from the top 20 in October suggests a less stable market presence, although they managed to secure the 7th position in subsequent months. The competitive dynamics in this category suggest that while Physic Cannabis Therapy is a strong player, there is room for strategic growth to enhance its market share and rank stability.

Notable Products

In January 2025, the top-performing product from Physic Cannabis Therapy was Wood Balm (313mg CBD, 565mg THC), maintaining its first-place ranking for the third consecutive month with sales of 222 units. CBD:THC 1:3 Wood Balms Away (150mg CBD, 450mg THC, 0.18oz) climbed to the second position, improving from its third-place standing in the previous two months. Field Balms Away (45mg THC, 12mg CBD, 0.18 oz) dropped to third place after leading earlier in October 2024. CBD/THC 1:3 Field Balms Away (150mg CBD, 450mg THC, 0.18oz) remained steady at fourth, showing a slight increase in sales. Field Balm (128mg CBD 460mg THC, 1.8 oz) rounded out the top five, climbing up from its previous fourth-place ranking in December 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.