Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

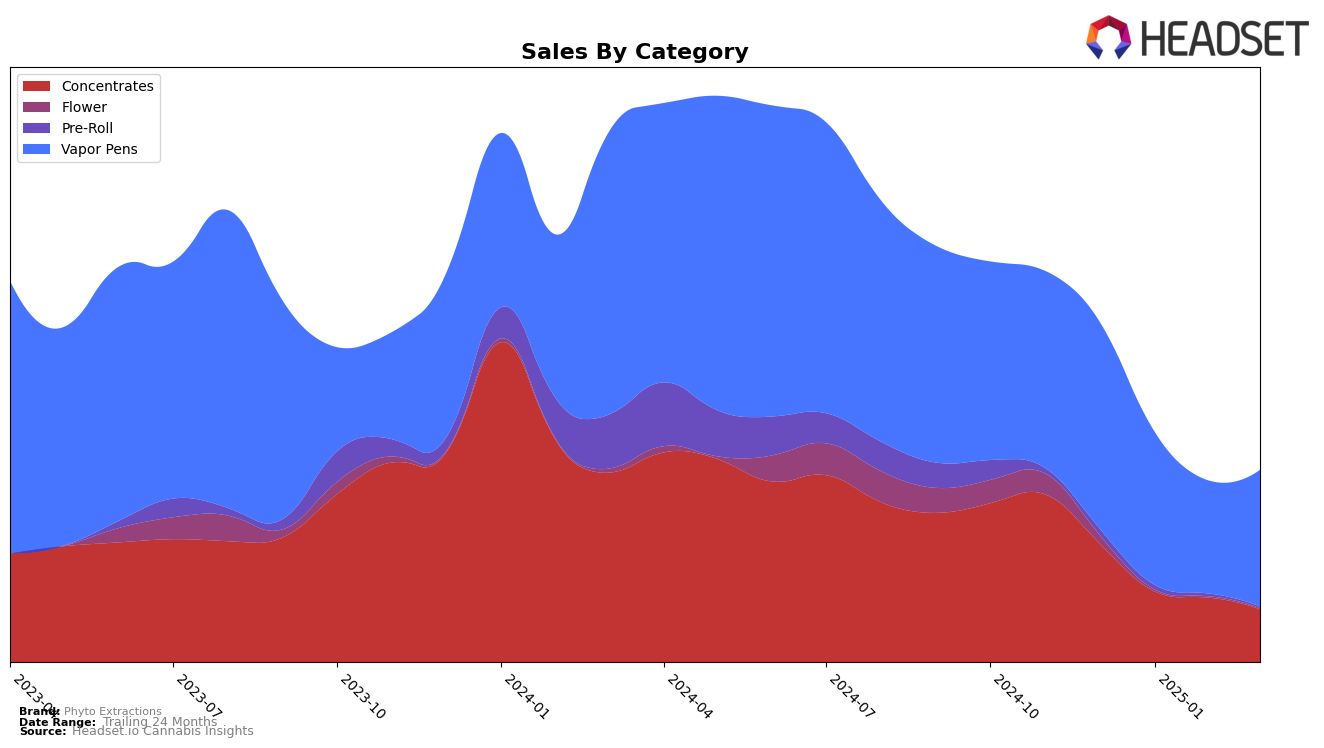

Phyto Extractions has experienced varying performance across different product categories and regions. In the Alberta market, the brand's ranking in the Concentrates category showed some fluctuation, moving from 18th in December 2024 to 27th by March 2025. Despite maintaining a presence within the top 30, the downward trajectory may indicate increased competition or shifting consumer preferences. In contrast, the brand's presence in British Columbia was less stable, as it fell out of the top 30 in March 2025 after ranking 28th in December 2024. This decline suggests challenges in maintaining market share in this province.

In Ontario, Phyto Extractions' performance in the Vapor Pens category remained relatively steady, hovering around the 37th to 40th positions from December 2024 to March 2025. Although the brand did not break into the top 30, its consistent ranking indicates a stable demand for its vapor pen products. However, in the Concentrates category, Phyto Extractions was unable to maintain a top 30 ranking in February 2025, though it managed to re-enter the list by March at 48th place. This volatility in Ontario's Concentrates category may reflect a need for strategic adjustments to enhance brand visibility and consumer engagement.

Competitive Landscape

In the competitive landscape of vapor pens in Ontario, Phyto Extractions has experienced fluctuating rankings, which reflect shifts in the market dynamics and consumer preferences. Over the four-month period from December 2024 to March 2025, Phyto Extractions saw a decline in its rank from 37th to 39th, indicating a slight downward trend in its competitive positioning. This shift is notable when compared to competitors like Gas, which maintained a relatively stable position, improving slightly from 39th to 37th, and Tasty's (CAN), which experienced a more significant drop from 29th to 38th. Despite these changes, Phyto Extractions remains competitive, as evidenced by its ability to stay within the top 40 brands, unlike Wagners and Rizzlers, which were not in the top 20 during this period. The sales trajectory for Phyto Extractions shows a decrease from December to February, followed by a slight recovery in March, suggesting potential for rebound and growth if strategic adjustments are made. These insights highlight the importance of continuous market analysis to adapt to evolving consumer demands and competitive pressures.

Notable Products

In March 2025, the top-performing product for Phyto Extractions was the Fire Stick - Slurriking Distillate Cartridge (1g) in the Vapor Pens category, maintaining its first-place rank since December 2024 with sales of 2561 units. Ice Wreck Shatter (1g) in the Concentrates category held steady in second place, showing consistent ranking over the past months. Grape Stomper Distillate Cartridge (1g) also retained its third position, demonstrating stable demand in the Vapor Pens category. Fire Stick- Rainbow Runtz Distillate Disposable (1g) and Alien Trufflez Shatter (1g) continued to rank fourth and fifth, respectively, in their categories. Notably, while the rankings remained unchanged for these products from December 2024 to March 2025, there was a visible fluctuation in the sales figures, indicating varying consumer purchasing patterns.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.