Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

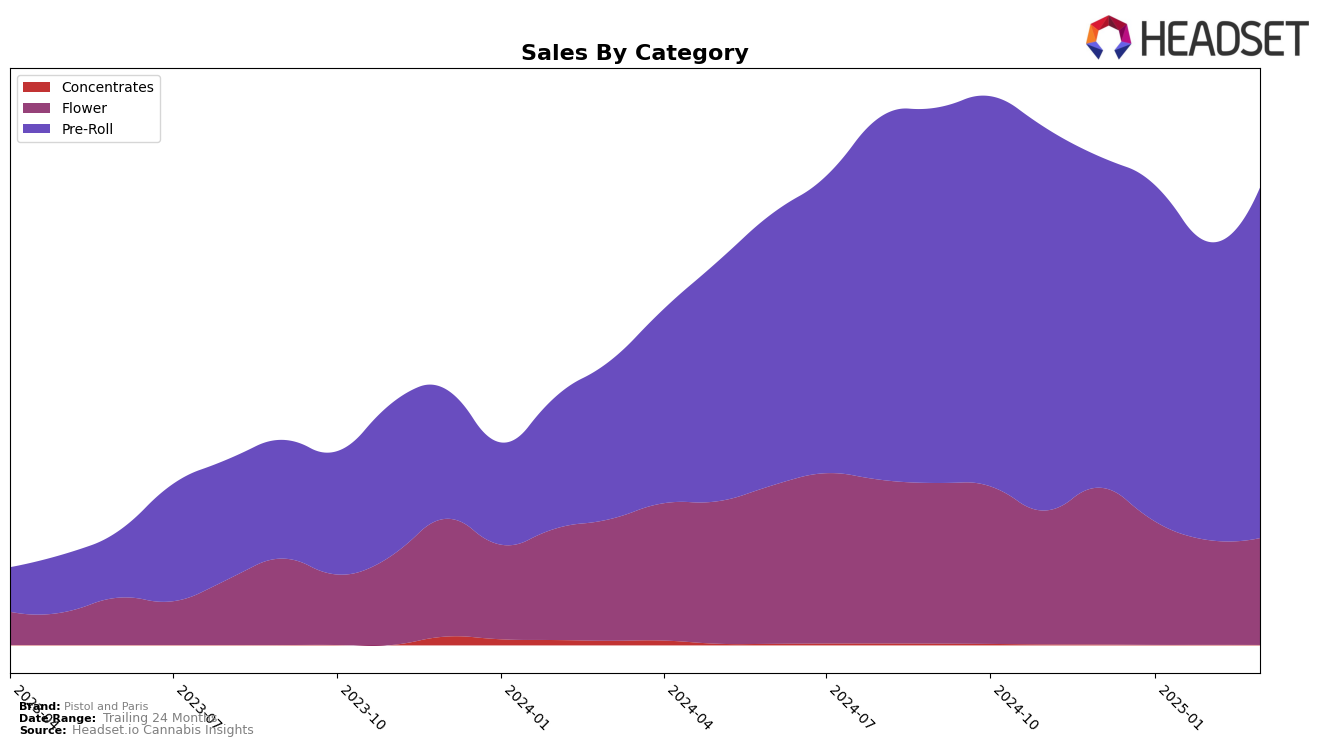

Pistol and Paris has shown varied performance across different categories and regions, with some notable trends emerging. In Alberta, their presence in the Flower category has seen a decline, with rankings falling from 55 in December 2024 to 78 by March 2025. This drop indicates a decrease in market prominence, as they failed to make it into the top 30 during these months. Conversely, in the Pre-Roll category in Alberta, the brand maintained a more stable presence, with a slight dip in rankings but still managing to stay within a competitive range. This suggests a stronger foothold in the Pre-Roll segment compared to Flower in this region.

In British Columbia, Pistol and Paris demonstrated a more robust performance in the Pre-Roll category, consistently ranking within the top 10 throughout the observed months. Their Flower category performance in British Columbia, however, showed fluctuations, with rankings ranging from 35 in February 2025 to 43 by March 2025, indicating a more volatile position in this segment. In Ontario, the brand's Flower category rankings experienced some recovery by March 2025, moving up to 60 after a previous dip, while maintaining a steady presence in the Pre-Roll category. This suggests a potential shift in consumer preference or competitive dynamics within these markets.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in British Columbia, Pistol and Paris has shown a steady performance, maintaining a consistent rank between 7th and 8th place from December 2024 to March 2025. This stability is notable given the dynamic shifts observed among competitors. For instance, Thumbs Up Brand demonstrated a significant upward trajectory, climbing from 11th to 5th place, which suggests a strong increase in consumer preference or strategic market moves. Meanwhile, Color Cannabis experienced a decline from 5th to 9th place, indicating potential challenges in maintaining its market position. Station House and Dab Bods have shown more stability, with Station House consistently holding the 5th or 6th rank, and Dab Bods fluctuating slightly but remaining competitive. These shifts highlight the competitive pressure Pistol and Paris faces, emphasizing the importance of strategic marketing and product differentiation to enhance its market share and rank.

Notable Products

In March 2025, Pink Goo Pre-Roll (1g) maintained its top position in the Pistol and Paris lineup, with sales reaching 9043 units. Rockstar Pre-Roll 3-Pack (1.5g) remained steady in second place, mirroring its ranking from February. Death Bubba Pre-Roll 3-Pack (1.5g) consistently held the third position over the past three months, indicating stable demand. Pink Goo Pre-Roll 3-Pack (1.5g) and Variety Flavours Pre-Roll 3-Pack (1.5g) rounded out the top five, with the latter showing improvement from February. Overall, product rankings remained largely unchanged, suggesting a strong preference for these established offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.