Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

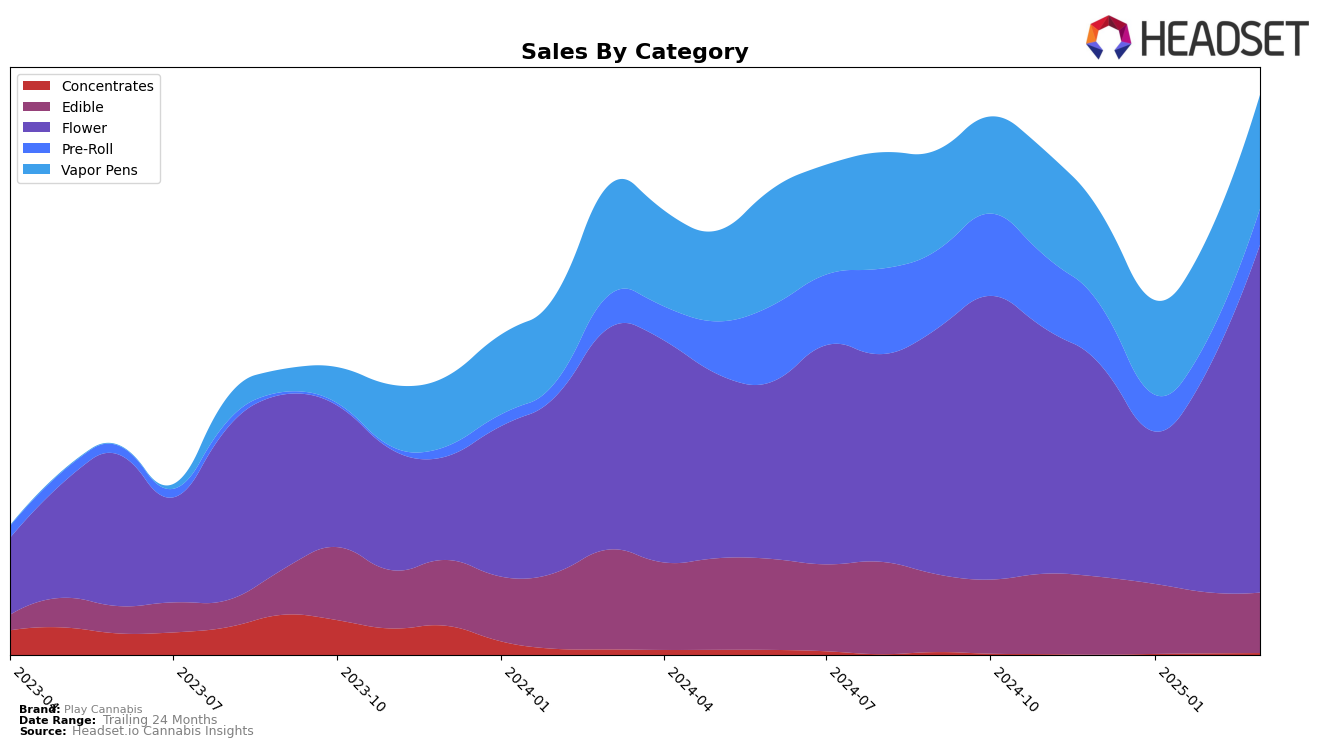

In the state of Michigan, Play Cannabis has shown varied performance across different product categories. In the Edible category, the brand saw a gradual decline in its ranking, moving from 5th place in December 2024 to 9th by March 2025. This downward trend was accompanied by a consistent decrease in sales figures. On the other hand, Play Cannabis experienced a notable fluctuation in the Flower category, starting at 4th place in December, dropping to 11th in January, and then rebounding to reclaim the 4th spot by March. This recovery was supported by a significant increase in sales, suggesting a successful strategy to regain market share.

Conversely, the Pre-Roll category presented challenges for Play Cannabis, as its ranking remained outside the top 10, fluctuating between 11th and 20th positions from December 2024 to March 2025. This consistent lower ranking points to potential areas for improvement or increased competition in this segment. Meanwhile, in the Vapor Pens category, Play Cannabis maintained a stable position, holding the 9th rank from January to March 2025, while experiencing a steady rise in sales. This stability and sales growth indicate a strong foothold in the Vapor Pens market, contrasting with the more volatile performance in other categories.

Competitive Landscape

In the competitive Michigan flower market, Play Cannabis has experienced notable fluctuations in its rank and sales performance over the past few months. Starting from December 2024, Play Cannabis held a strong position at rank 4 but saw a significant drop to rank 11 in January 2025, before recovering to rank 5 in February and maintaining a stable position at rank 4 in March. This volatility in rank is mirrored in its sales, which dipped in January but rebounded strongly by March. In contrast, Pro Gro consistently performed well, reaching the top rank in February, while Society C fluctuated between the top three positions, indicating strong competition at the top. Meanwhile, Ozone showed a remarkable improvement from rank 15 in January to rank 6 by March, suggesting a potential threat to Play Cannabis's market share. The dynamic shifts in rank and sales among these competitors highlight the competitive pressures Play Cannabis faces, emphasizing the need for strategic adjustments to maintain and improve its market position.

Notable Products

In March 2025, the top-performing product from Play Cannabis was Strawberry Gummies 4-Pack (200mg), which climbed to the first position with impressive sales of 39,154 units. Cherry Gummies 4-Pack (200mg) held steady at second place, showing a slight decline from previous months. Blue Razz Gummies 4-Pack (200mg) dropped to third place after leading in February. Green Apple Gummies 4-Pack (200mg) maintained its fourth position, showing a sales increase compared to February. Grape Gummies 4-Pack (200mg) remained in fifth place, continuing a downward trend since December 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.