Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

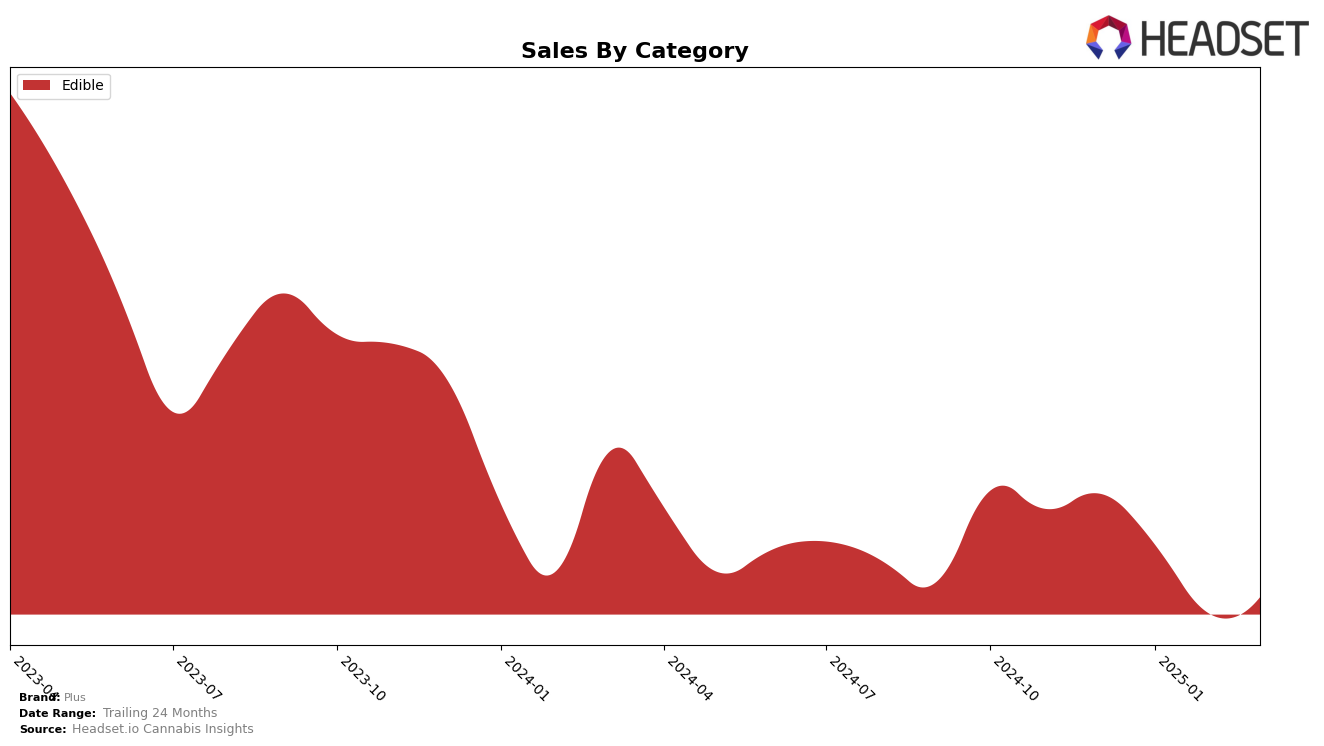

Plus has maintained a consistent performance in the Edible category within California, holding steady at the 8th rank from December 2024 through March 2025. This stability in ranking suggests that Plus has a solid foothold in the California edibles market, even as the sales figures show a slight decline over the months. From December 2024 to March 2025, Plus's sales in California decreased from approximately $1.17 million to around $944,293. This trend might indicate a seasonal dip or increased competition within the market, but the consistent ranking suggests that Plus is still a preferred brand among consumers.

In other states or provinces, Plus did not make it into the top 30 brands in the Edible category, which could be seen as a missed opportunity for the brand to expand its market presence beyond California. The absence from the rankings in other regions might highlight areas where Plus could focus its efforts to increase brand visibility and sales. This could involve strategic marketing initiatives or product diversification to capture a broader audience. However, the consistent performance in California suggests that Plus has a strong brand identity that could be leveraged in other regions with the right approach.

Competitive Landscape

In the competitive landscape of the California edible market, Plus has maintained a consistent rank at 8th place from December 2024 to March 2025. Despite this stability in ranking, Plus experienced a notable decline in sales over the same period, with a significant drop from December to February, before a slight recovery in March. This contrasts with Good Tide, which improved its rank from 9th to 6th, and saw an increase in sales, particularly in March where it surpassed Plus. Meanwhile, Heavy Hitters maintained a higher rank consistently at 6th or 7th, indicating a stronger market position. Brands like Drops and Emerald Sky also showed stable rankings but with sales figures that were consistently lower than Plus, suggesting that while Plus faces challenges in sales growth, its market presence remains resilient against certain competitors.

Notable Products

In March 2025, the top-performing product for Plus was the CBD/CBG/THC 20:5:1 Relief Tart Cherry Gummies 20-Pack, which rose to the first position, achieving sales of $10,685. The Sleep - THC/CBD/CBN 10:5:5 Midnight Berry Sleep Gummies, previously holding the top rank, moved to second place. The PLUS Sleep - THC/CBD/CBN 5:1:1 Cloudberry Sleep Gummies maintained its position at third, consistent with the past months. Sour Watermelon Gummies remained steady at fourth place, showing no change in its ranking from previous months. The Sleep - THC/CBD/CBN 1:2:3 Lychee Sleep Gummies continued to hold the fifth position since January 2025, indicating stability in its market performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.