Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

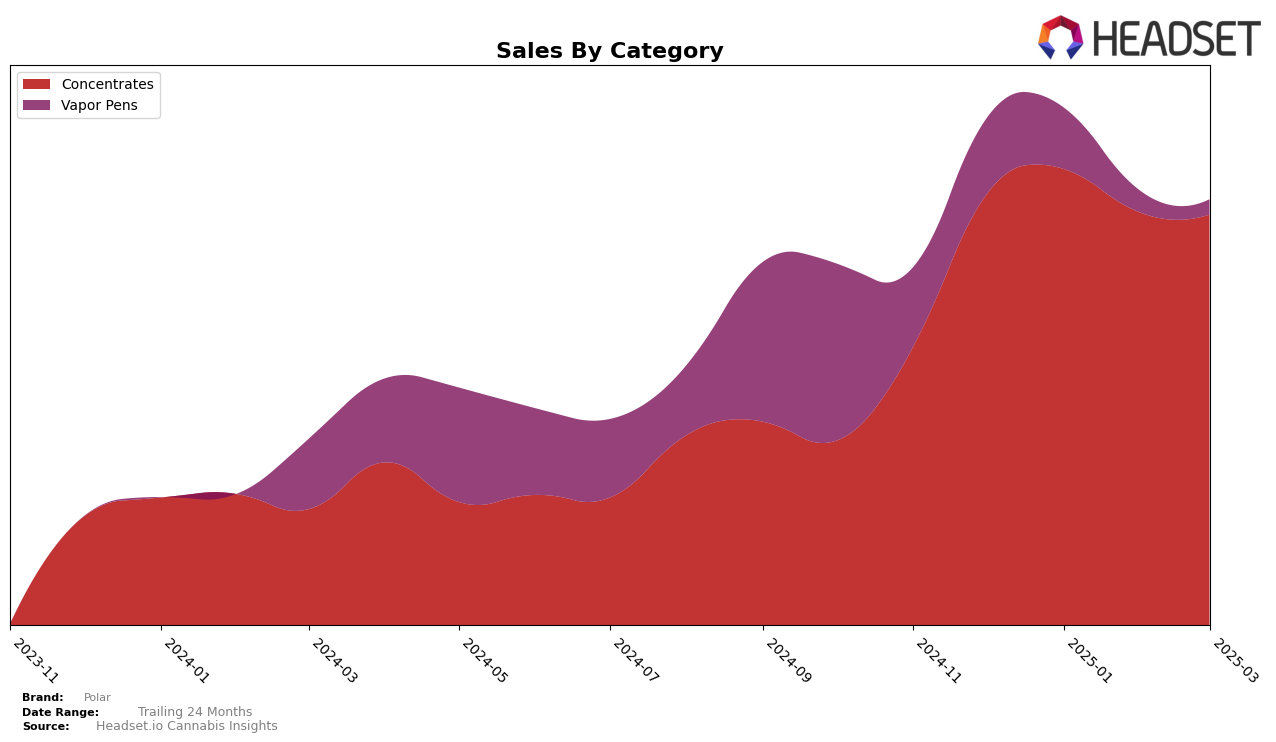

Polar has been making strides in the Ontario market, particularly in the Concentrates category. Starting from December 2024, Polar was not in the top 30 brands, but by January 2025, it managed to secure the 28th position, maintaining this rank in February before slipping slightly to 29th in March. This movement indicates a positive trend in brand recognition and consumer preference in Ontario, despite the slight dip in March. The fact that Polar was outside the top 30 in December but made it into the rankings by January suggests a successful strategic push or market response that could be worth exploring further.

In terms of sales, Polar's performance in the Concentrates category in Ontario showed some variability. From December to January, there was a noticeable increase in sales, suggesting a strong start to the year. However, sales saw a decline in February and March, which coincided with the slight drop in ranking. This fluctuation might reflect market dynamics or seasonal trends affecting consumer purchasing behavior. Understanding these shifts could provide deeper insights into the brand's market strategy and potential areas for growth or adjustment. Further analysis into competitive pressures or consumer trends in Ontario could shed light on the underlying factors influencing these movements.

Competitive Landscape

In the competitive landscape of the concentrates category in Ontario, Polar has shown a steady presence, maintaining a rank within the top 30 from December 2024 to March 2025. Notably, Polar improved its position from 34th in December 2024 to 28th in January and February 2025, before slightly dropping to 29th in March 2025. This consistent performance contrasts with competitors like Kolab, which experienced a downward trend, slipping from 27th to 31st over the same period. Meanwhile, Purple Hills maintained a stronger foothold, ranking consistently higher than Polar, despite a dip in February. The fluctuating positions of Terra Labs and EXKA (XK) highlight the competitive volatility in this market, with both brands experiencing rank changes that suggest a less stable market presence compared to Polar's more consistent performance. This stability in rank for Polar, despite the competitive pressures, indicates a resilient market strategy that could be further leveraged to enhance sales growth in the future.

Notable Products

In March 2025, the top-performing product for Polar was Black Mountain Side Live Hash Rosin (1g) in the Concentrates category, maintaining its first-place ranking for four consecutive months with impressive sales of 871 units. The Bananium Live Hash Rosin (1g), also in the Concentrates category, consistently held the second position, although its sales dropped to 339 units in March. Black Mountain Side Live Rosin Cartridge (1g) in the Vapor Pens category remained steady at third place, despite a significant decrease in sales over the months. This consistency in rankings indicates a strong preference for Polar's Concentrates products, particularly the Black Mountain Side variant. Overall, the sales figures suggest a stable demand for these top-ranked products despite fluctuations in sales volumes.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.