Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

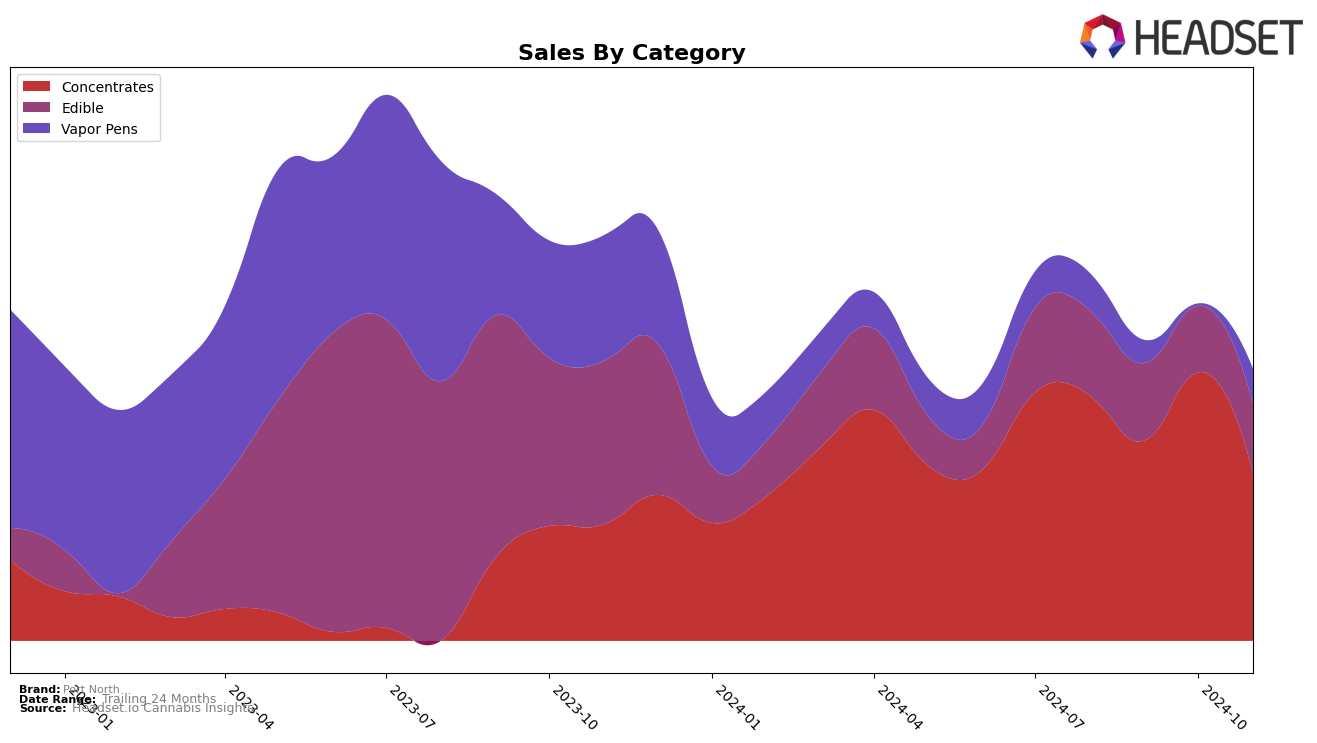

Port North's performance in the Ontario market has shown varying trends across different product categories. In the concentrates category, Port North experienced a decline in ranking, moving from 35th in August 2024 to 42nd by November 2024. This downward trend is accompanied by a decrease in sales, with a notable drop from August to November. The edible category paints a different picture; Port North maintained a presence in the top 35 until September but fell out of the top 30 by October, indicating a potential challenge in maintaining competitive positioning in this category.

The absence of Port North in the top 30 rankings for edibles in October and November could signify increased competition or changing consumer preferences in Ontario. It's important to note that while the brand's performance in concentrates shows a consistent ranking, the sales figures suggest some volatility, which might be worth exploring further for those interested in market dynamics. The fluctuations in rankings and sales across these categories highlight the challenges Port North faces in sustaining its market position amidst evolving consumer trends and competitive pressures.

Competitive Landscape

In the Ontario concentrates market, Port North has experienced notable fluctuations in its ranking over the past few months, which could impact its market position and sales strategy. In August 2024, Port North held the 35th rank, but by November, it had slipped to 42nd. This decline in rank coincides with a decrease in sales from October to November, suggesting potential challenges in maintaining market share. In contrast, competitors such as 7 Acres and Tuck Shop have shown more stable or improving trends. 7 Acres improved its rank from 45th in August to 41st in November, while Tuck Shop climbed from 46th to 40th in the same period, with a consistent increase in sales. Meanwhile, Phant and 5 Points Cannabis have not shown significant upward movement, with Phant fluctuating around the 40th position and 5 Points Cannabis not making it into the top 20. These dynamics highlight the competitive pressures Port North faces and the importance of strategic adjustments to regain its footing in the Ontario concentrates market.

Notable Products

In November 2024, Apricot Kush Full Spectrum Hash Soft Chews 2-Pack (10mg) maintained its position as the top-performing product for Port North, with sales reaching 1962 units. Sour Cherry Hashers Soft Chews 2-Pack (10mg) climbed back to the second rank after a dip in October, while Cherry Boat Hand Rolled Ice Water Hash (1g) shifted down to third place. Triangle Kush Full Spectrum Live Rosin Syrup Cartridge (0.5g) debuted in the rankings at fourth place, indicating a strong entry into the market. Lemon Z Ice Water Hash (1g) slipped one position to fifth place from its previous rank in October, suggesting a slight decrease in popularity. Overall, the top products for November show a mix of consistent performers and new entries, highlighting dynamic changes in consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.