Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

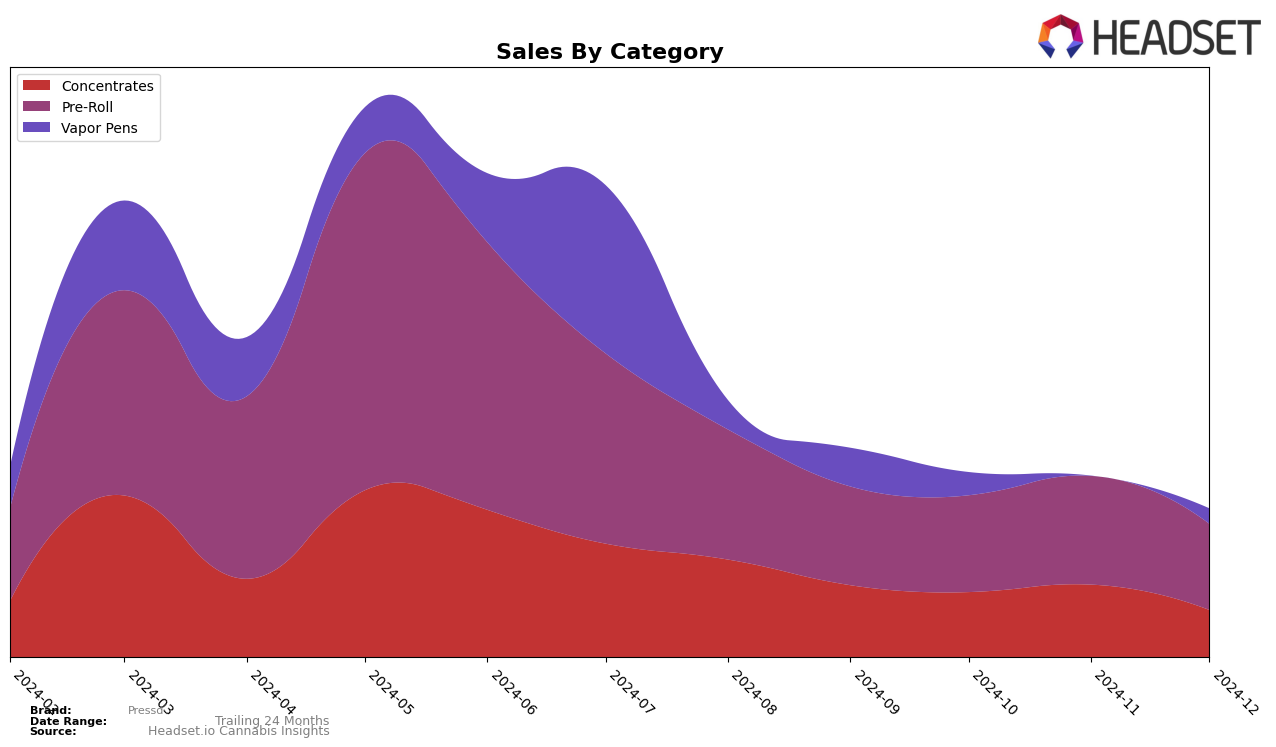

In the state of Arizona, Pressd has shown varied performance across different product categories. In the Concentrates category, Pressd has maintained a presence in the top 30 brands, with a slight fluctuation in its ranking from 29th in September and October to 28th in November, before dropping back to 30th in December. This indicates a relatively stable performance, although the drop in December might suggest an area for improvement. Meanwhile, in the Pre-Roll category, Pressd has not managed to break into the top 30, peaking at 33rd in November. This suggests that while they are making strides, they face stiff competition in this category.

When it comes to Vapor Pens, Pressd's performance in Arizona is more inconsistent. The brand was ranked 56th in September, dropped to 63rd in October, and was not in the top 30 for November, before reappearing at 68th in December. This volatility indicates challenges in maintaining a steady market share in the Vapor Pens category. Despite the fluctuations, the brand's presence across multiple categories suggests a diverse product strategy, but the inconsistency in rankings highlights areas where the brand could focus on strengthening its market position.

Competitive Landscape

In the competitive landscape of the Arizona pre-roll market, Pressd has shown a dynamic performance over the last few months of 2024. While maintaining a relatively stable rank in September and October at 34th position, Pressd saw a slight improvement in November, climbing to 33rd, before dropping to 36th in December. This fluctuation in rank suggests a competitive pressure from brands like Grow Sciences, which consistently held a higher rank, peaking at 33rd in December with a notable upward sales trend. Similarly, MADE also showed a strong performance, improving its rank from 43rd in September to 34th in December, indicating a steady increase in market presence and sales. Meanwhile, Elevate Cannabis Co and Miss Grass demonstrated significant rank volatility, with both brands absent from the top 20 in October but making a comeback in subsequent months. For Pressd, these insights highlight the need for strategic adjustments to maintain competitiveness and capitalize on market opportunities in the Arizona pre-roll segment.

Notable Products

In December 2024, the top-performing product from Pressd was the Honey Bananas Infused Live Rosin Pre-Roll 5-Pack (2.5g), securing the number one rank with sales of 305 units. Following closely was the Frozen Guava Live Rosin Infused Pre-Roll 5-Pack (2.5g) at the second position, indicating strong consumer demand. The Strawberry OG Live Rosin Infused Pre-Roll 5-Pack (2.5g) dropped to third place from its consistent second-place ranking over the previous months. Fluff Fumez Infused Pre-Roll 5-Pack (2.5g) saw a significant drop from the top spot in earlier months to fourth place in December. Prickly Pear Live Rosin Infused Pre-Roll 5-Pack (2.5g) rounded out the top five, showing a decline from its third and fourth positions in October and November, respectively.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.