Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

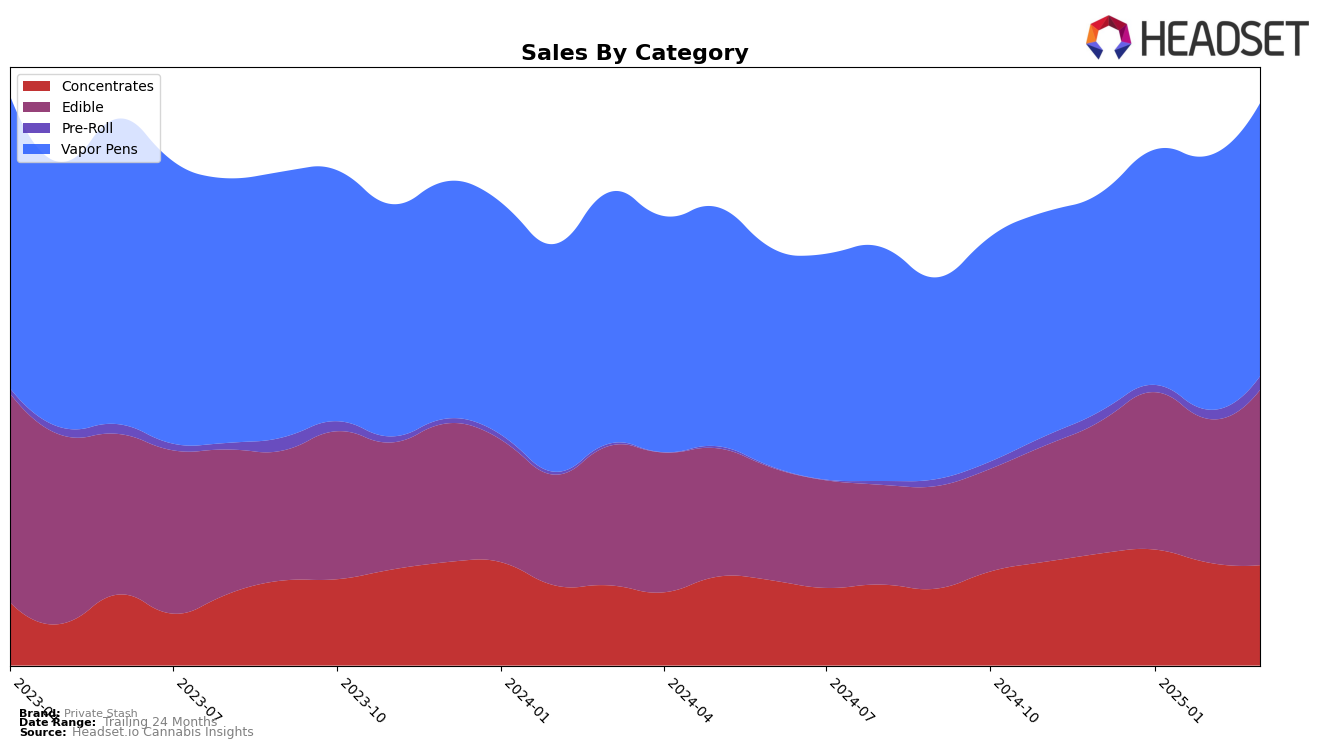

In the state of Oregon, Private Stash has shown varied performance across different product categories. Concentrates saw a slight decline in rank from 13th in December 2024 to 16th by March 2025, indicating a potential challenge in maintaining market share despite a decent start to the year. On the other hand, the Edible category has been a consistent performer for Private Stash, holding steady at 8th place from January through March 2025, which suggests a strong foothold in this segment. Notably, their Pre-Roll products, which were not ranked in January and February 2025, made a notable comeback to 76th place in March, hinting at a possible resurgence or strategic change that could be worth monitoring in the coming months.

The Vapor Pens category presents a positive trajectory for Private Stash in Oregon, with a steady climb from 23rd place in December 2024 to 20th by March 2025. This upward movement is accompanied by a consistent increase in sales, suggesting growing consumer interest and potential for further growth. The absence of rankings in the top 30 for Pre-Rolls earlier in the year could be seen as a gap in their portfolio, yet the eventual appearance in March might indicate strategic adjustments or new product introductions. Overall, while there are areas for improvement, particularly in Concentrates and Pre-Rolls, the brand's performance in Edibles and Vapor Pens demonstrates a solid base to build upon in the competitive Oregon market.

Competitive Landscape

In the competitive landscape of Oregon's Vapor Pens category, Private Stash has demonstrated a notable upward trajectory in its rankings and sales from December 2024 to March 2025. Starting from a rank of 23 in December 2024, Private Stash climbed to the 20th position by March 2025, indicating a consistent improvement in market presence. This positive trend is further underscored by a steady increase in sales over the same period. In contrast, Bobsled Extracts experienced a decline, dropping from 14th to 18th place, with sales showing a downward trend. Meanwhile, Elysium Fields remained relatively stable outside the top 20, while Feel Goods showed a slight improvement, moving from 22nd to 19th place. These dynamics suggest that Private Stash is effectively capturing market share, positioning itself as a rising competitor in the Oregon Vapor Pens market.

Notable Products

In March 2025, the top-performing product for Private Stash was the Hybrid Pink Lemonade Full Spectrum Fruit Chew Blast (100mg) in the Edible category, maintaining its first-place ranking consistently from previous months with notable sales of $11,446. Mango Serrano Full Spectrum Fruit Chew Blast 2-Pack (100mg) rose to the second position, up from fourth in January and February, indicating a growing preference among consumers. The Hybrid Strawberry Is My Jam Fruit Chew Blast (100mg) held steady in third place, showing consistent performance over the months. Meanwhile, Bohemian Blue Razzberry Fruit Chew Blast (100mg) slipped to fourth place despite a slight increase in sales figures. A new entrant, Hybrid You're a Fineapple Fruit Chew Blast (100mg), debuted at fifth place, marking its initial entry into the rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.