Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

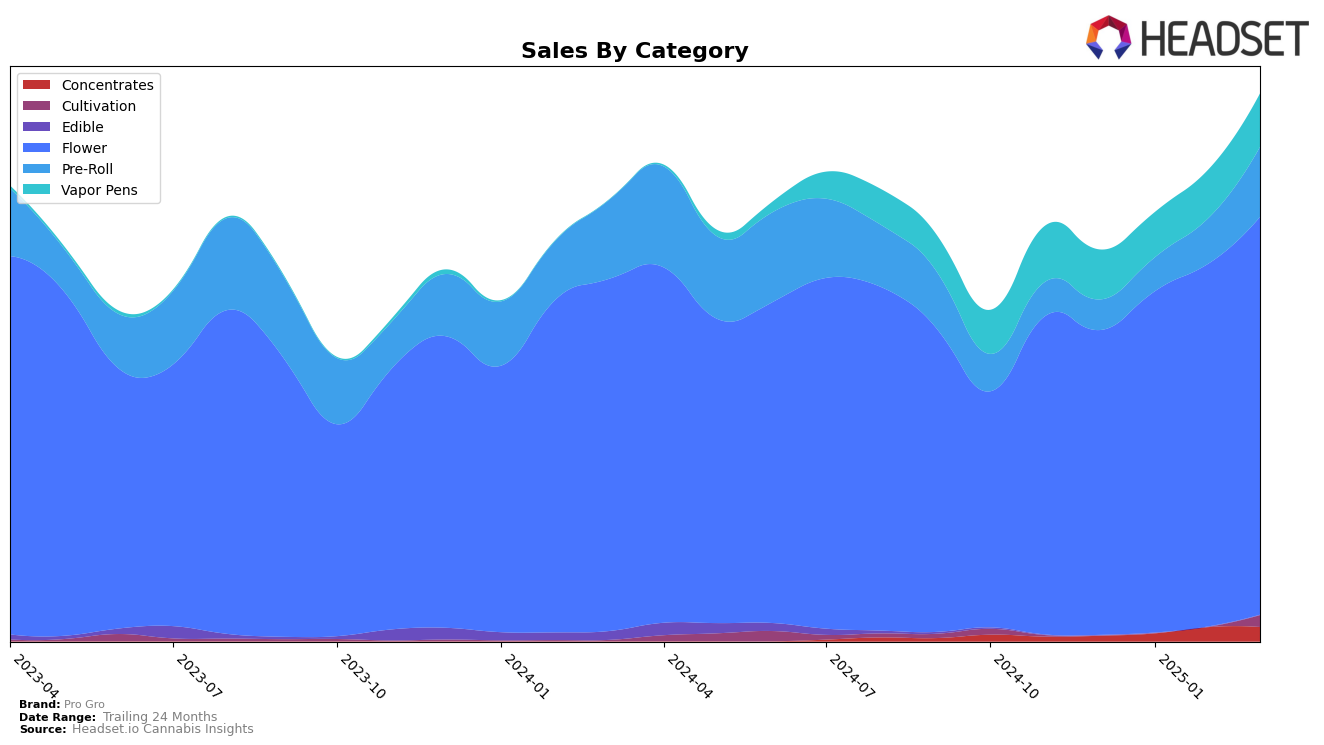

Pro Gro's performance in the Michigan market has shown significant movement across various categories in the first quarter of 2025. Particularly noteworthy is their achievement in the Flower category, where they ascended to the number one spot in February 2025, before settling at third place in March. This indicates strong competitive positioning and potential consumer preference in this segment. In the Pre-Roll category, Pro Gro has demonstrated consistent improvement, moving from the 19th spot in December 2024 to the 10th in March 2025, suggesting a growing demand for their products in this category. However, their presence in the Concentrates category was less prominent until February, when they entered the top 30, peaking at 25th place in March. This entry signals a positive trajectory but also highlights room for growth compared to their other offerings.

In contrast, Pro Gro's performance in the Vapor Pens category in Michigan has been relatively stable, maintaining a position within the top 20 throughout the observed months. Despite the stability, the brand improved slightly from 20th in December 2024 to 18th in March 2025, indicating a modest but steady presence in the market. This stability might suggest a loyal customer base or consistent product quality, though it also implies limited growth compared to other categories. The absence of Pro Gro from the top 30 in some months for certain categories, such as Concentrates before February, could be seen as a challenge, but their eventual entry into the rankings presents an opportunity for expansion and increased market penetration.

Competitive Landscape

In the competitive landscape of the Michigan flower category, Pro Gro has demonstrated notable resilience and growth, particularly in the first quarter of 2025. After starting December 2024 in the third position, Pro Gro climbed to the top rank in February 2025, before settling back into third place by March. This fluctuation highlights the dynamic nature of the market, where brands like High Minded and Society C have also shown strong performances, with High Minded reclaiming the top spot in March. Pro Gro's sales have consistently increased month-over-month, indicating robust demand and effective market strategies, despite the competitive pressure. Meanwhile, Mischief and Play Cannabis have maintained lower ranks, with Play Cannabis notably dropping out of the top 10 in January before recovering. This competitive environment underscores the importance for Pro Gro to continue innovating and adapting to maintain its upward trajectory in sales and market rank.

Notable Products

In March 2025, Pro Gro's top-performing product was OG Kush Small Buds (7g) in the Flower category, maintaining its consistent first-place rank over the past four months with a notable sales figure of 31,498. Bubblegum Gelato Smalls (7g) emerged as a strong contender, securing the second position in its debut month. Lunar Lemon Pre-Roll (1g) entered the rankings at third place, demonstrating a promising start in the Pre-Roll category. Guava Runtz Small Buds (7g) saw a slight drop from second to fourth place compared to the previous month, indicating a shift in consumer preferences. Super Boof Pre-Roll (1g) rounded out the top five, marking its first appearance in the rankings for March 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.