Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

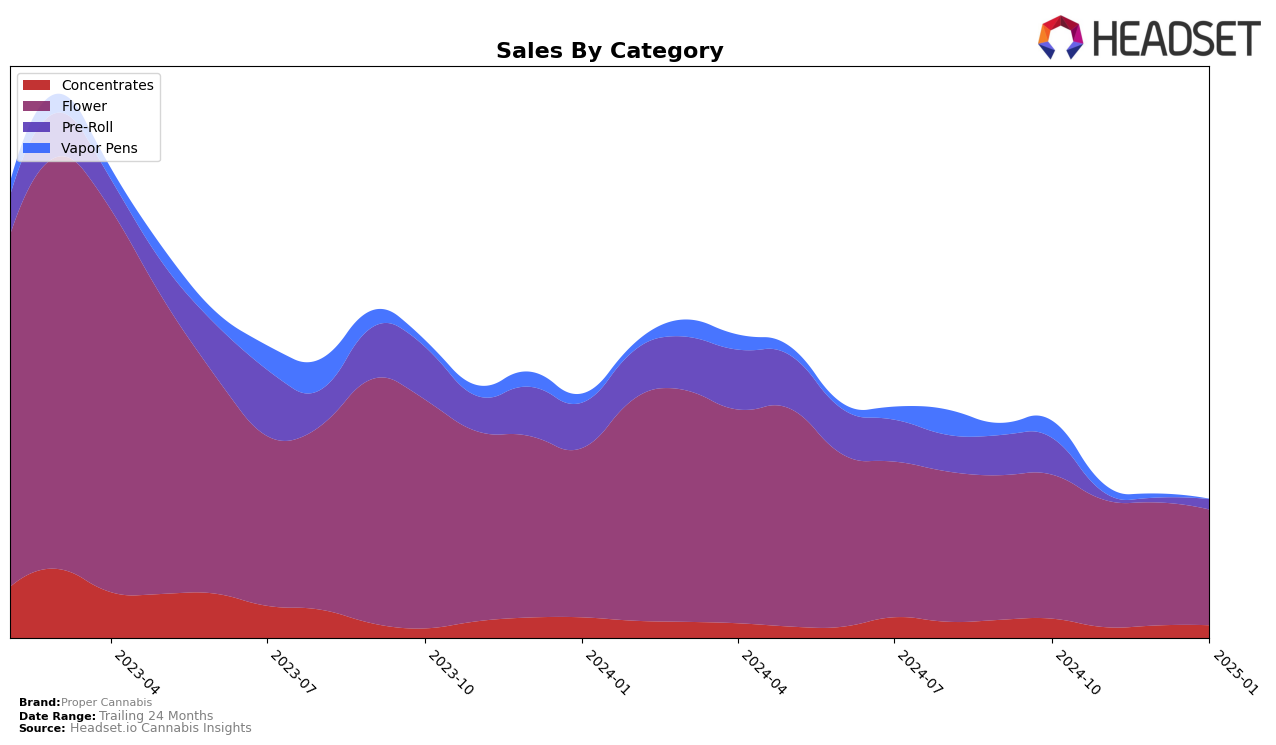

Proper Cannabis has shown a dynamic performance across various categories in Missouri, with notable movements in the concentrates and pre-roll segments. In the concentrates category, the brand improved its ranking significantly from 6th in November 2024 to 2nd by January 2025, indicating a strong upward trend. This upward trajectory is underscored by a steady increase in sales from November to January, suggesting a growing consumer preference for their concentrates. In contrast, the pre-roll category saw fluctuating rankings, dropping to 14th in December before rebounding to 9th in January. This volatility might reflect seasonal demand variations or competitive pressures within the market.

In the flower category, Proper Cannabis maintained a relatively stable position, with rankings hovering around the 10th to 13th positions. Although there was a slight decline in sales from October to January, the brand's consistent presence in the top 15 highlights its resilience in a competitive market. However, the vapor pens category presents a different story, where Proper Cannabis experienced a downward trend, slipping from 23rd to 27th place by January. This decline suggests challenges in capturing market share in this segment, potentially due to intensified competition or shifting consumer preferences. The absence of Proper Cannabis in the top 30 for some categories could indicate opportunities for growth or the need for strategic adjustments.

Competitive Landscape

In the competitive landscape of the Missouri flower category, Proper Cannabis has experienced fluctuations in its market position, with its rank shifting from 10th in October 2024 to 11th by January 2025. Despite a consistent presence in the top 20, Proper Cannabis faces stiff competition from brands like Greenlight, which improved its rank from 12th to 10th over the same period, indicating a stronger upward trend. Local Cannabis Co. also showed a notable rise, climbing from 14th to 9th in December before settling at 12th in January. Meanwhile, Buoyant Bob demonstrated volatility, dropping to 14th in December but recovering to 9th in January. Proper Cannabis's sales have seen a gradual decline, which contrasts with the more dynamic sales patterns of its competitors, suggesting a need for strategic adjustments to maintain its competitive edge in the Missouri market.

Notable Products

In January 2025, Gas Basket #4 (3.5g) emerged as the top-performing product for Proper Cannabis, securing the number one rank with notable sales of 3742 units. Black Maple #22 (3.5g) climbed to the second position, showing a consistent increase from its fifth rank in October 2024. Strawberry Candy #12 (3.5g) also improved its standing, moving up to third place from its previous fifth rank in November 2024. Runtz Live Badder (1g) and Black Maple 22 Pre-Roll (0.5g) rounded out the top five, with both making their debut in the rankings this month. These shifts indicate a growing preference for flower products, particularly Gas Basket #4 and Black Maple #22, as well as a rising interest in concentrates and pre-rolls.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.