Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

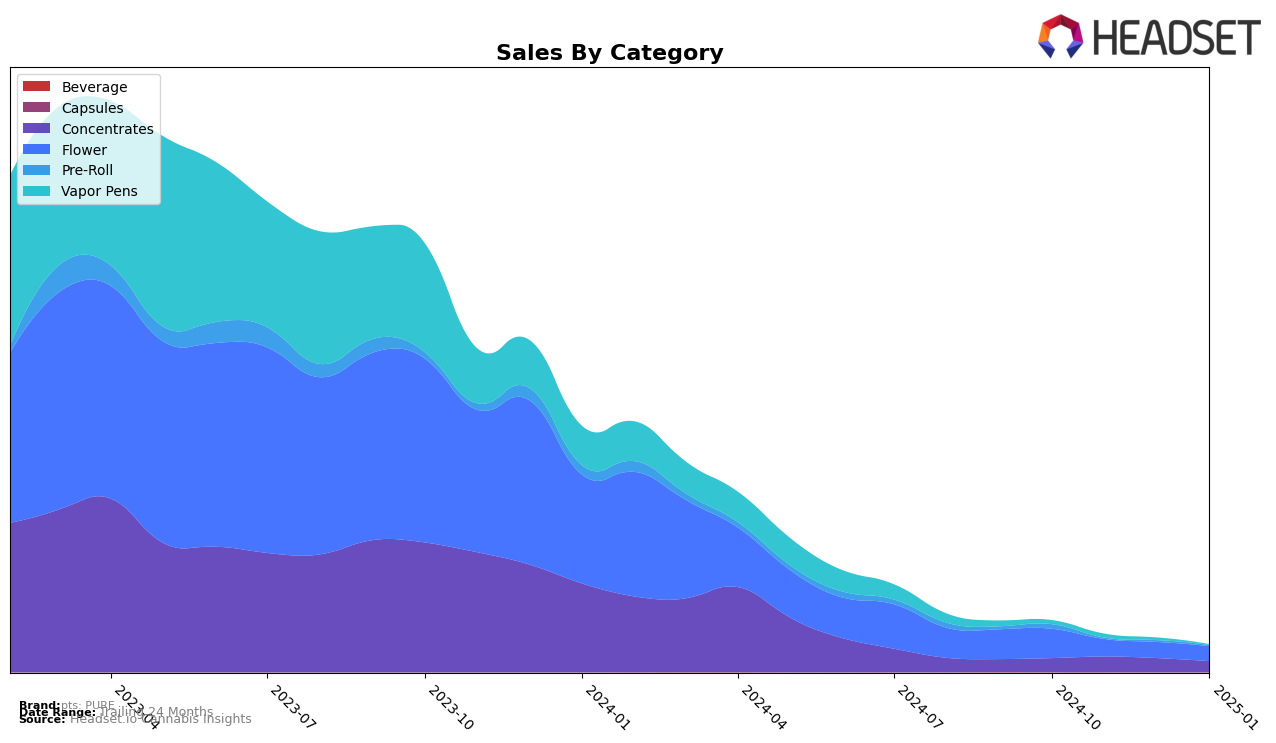

In the state of Illinois, pts: PURE has shown varying performance across different categories. In the Concentrates category, the brand maintained a consistent presence within the top 30, ranking 23rd in both October and November 2024, before slightly dropping to 25th by January 2025. This indicates a relatively stable position despite some fluctuations in sales figures. However, in the Flower category, pts: PURE struggled to break into the top 30, remaining outside this range throughout the observed months. This suggests a potential area for growth or increased competition in this category. Interestingly, the brand's performance in the Pre-Roll category was inconsistent, as it managed to enter the rankings only in October and December, missing out in other months.

When examining the Vapor Pens category, pts: PURE faced challenges in maintaining a competitive ranking. The brand was ranked 63rd in October 2024 and gradually declined, failing to appear in the top 30 by January 2025. This downward trend could indicate increased competition or a shift in consumer preferences within this category. The lack of presence in the top 30 for certain months across categories like Pre-Roll and Vapor Pens highlights areas where the brand may need to bolster its market strategy. Overall, while pts: PURE has shown some stability in Concentrates, there are notable opportunities for improvement in other categories within Illinois.

Competitive Landscape

In the competitive landscape of the Flower category in Illinois, pts: PURE has experienced a slight decline in its ranking, moving from 43rd in October 2024 to 49th by January 2025. This shift indicates a competitive pressure from other brands, such as Classix and Superflux, which have shown fluctuating yet generally stronger sales figures. Notably, Classix maintained a higher rank than pts: PURE throughout this period, despite a significant drop in sales from November to January. Meanwhile, Superflux demonstrated a volatile sales pattern but managed to recover its rank to 48th in January 2025, surpassing pts: PURE. Additionally, Blaze Craft Cannabis Flower (IL) showed resilience by improving its rank to 47th in January, indicating a competitive edge over pts: PURE. These dynamics suggest that pts: PURE may need to strategize to enhance its market position amidst these fluctuating trends.

Notable Products

In January 2025, Champion City Chocolate (3.5g) from pts: PURE maintained its top position in the Flower category, replicating its performance from December 2024 with sales of 1527 units. Macnanna (3.5g) rose to second place in the same category, showing a consistent improvement from its fourth position in October 2024. The Antidote - Bruce Banner 1.0 RSO Syringe (0.5g) emerged as a strong performer in the Concentrates category, securing the third rank in January after not being ranked in the previous months. Bruce Banner (3.5g) experienced a decline, dropping to fourth place from its second position in December. Lastly, The Antidote - Orange Soda RSO Syringe (0.5g) rounded out the top five in January, having slipped from third place in December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.