Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

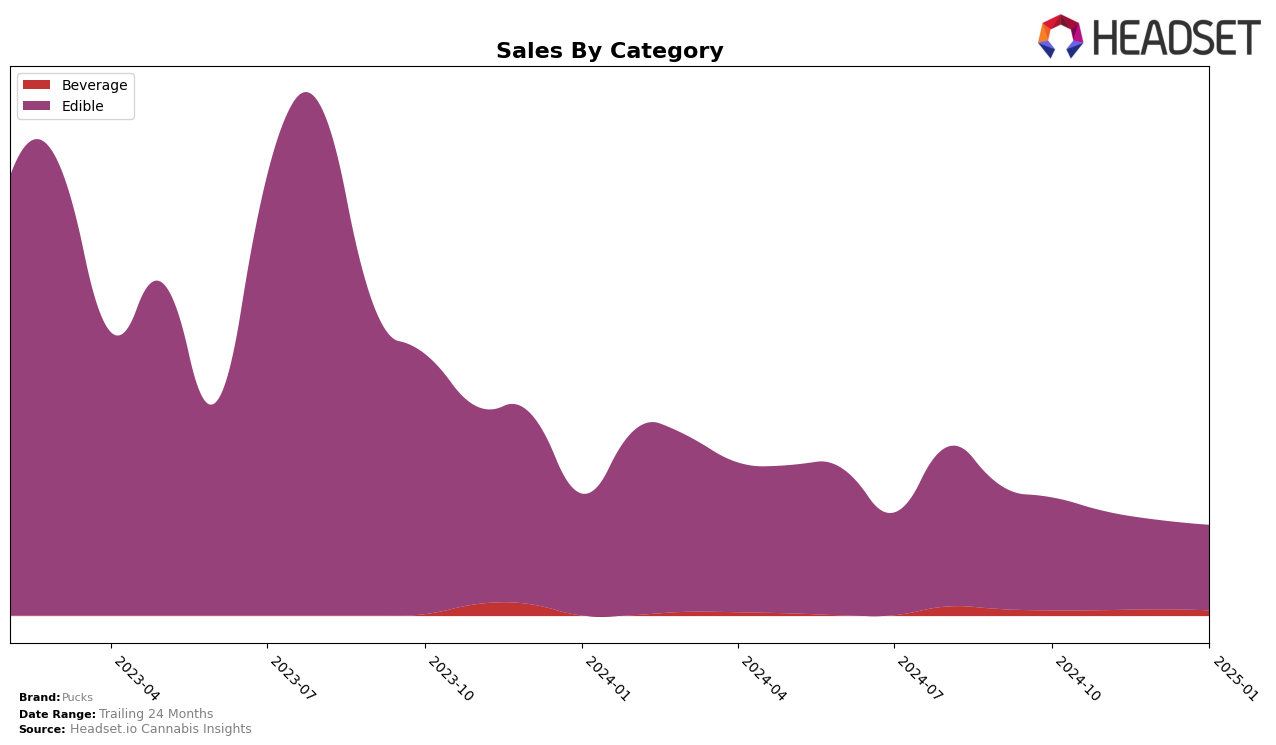

In the state of Arizona, Pucks has shown a consistent presence in the Edible category, although it has struggled to maintain a top 30 position over the last few months. Starting from October 2024, Pucks was ranked 32nd, then saw a slight decline, moving to 36th in November and 35th in December, before improving slightly to 33rd by January 2025. This indicates a subtle but persistent challenge in gaining a stronger foothold in the competitive edible market within Arizona. The decrease in sales from October to January reflects this struggle, with a notable drop from $33,024 to $24,967, suggesting that Pucks may need to reassess its strategy to climb into the top 30 rankings.

While Pucks has not been able to break into the top 30 in Arizona, this data prompts a closer examination of their performance in other states and categories, which could reveal contrasting trends. The absence of Pucks in the top 30 rankings across other states might indicate a need for broader market penetration or product diversification. The brand's current trajectory in Arizona is a microcosm of potential challenges or opportunities it may face in other regions. Understanding these dynamics could provide deeper insights into Pucks' overall market strategy and future prospects.

Competitive Landscape

In the competitive landscape of the edible cannabis market in Arizona, Pucks has experienced notable fluctuations in its ranking over the past few months, which could indicate shifts in consumer preferences or competitive pressures. As of January 2025, Pucks holds the 33rd position, showing a slight improvement from December 2024 when it was ranked 35th. This upward movement is significant, especially when considering the performance of competitors like Chew & Chill (C & C), which saw a decline from 29th in December to 32nd in January. Meanwhile, Tipsy Turtle has maintained a relatively stable position, consistently ranking around 30th. Despite a decrease in sales from October 2024 to January 2025, Pucks' ability to improve its rank suggests a resilience in brand loyalty or effective marketing strategies that could be leveraged further. However, the absence of Pucks in the top 20 brands during this period highlights a potential area for growth, especially when compared to brands like Kiva Chocolate, which consistently ranks higher, albeit with a downward trend in sales. This dynamic environment underscores the importance of strategic positioning and product differentiation for Pucks to enhance its market share and climb higher in the rankings.

Notable Products

In January 2025, the top-performing product from Pucks was Taffy Banana Dream Candy 10-Pack (100mg) in the Edible category, reclaiming its top position from October and November 2024 with sales of 502 units. The CBD/THC 3:1 PM Gummies 10-Pack (150mg CBD, 50mg THC) followed closely, dropping to second place after leading in December 2024. The Taffy Rainier Cherry Candy 10-Pack (100mg) maintained a steady third place, consistent with its November 2024 ranking. Taffy Mystery Flavor Candy 10-Pack (100mg) experienced a decline, moving from second in October 2024 to fourth in January 2025. The newly introduced Hybrid Blue Raspberry Gummies 10-Pack (100mg) entered the rankings at fifth place, indicating a promising start.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.