Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

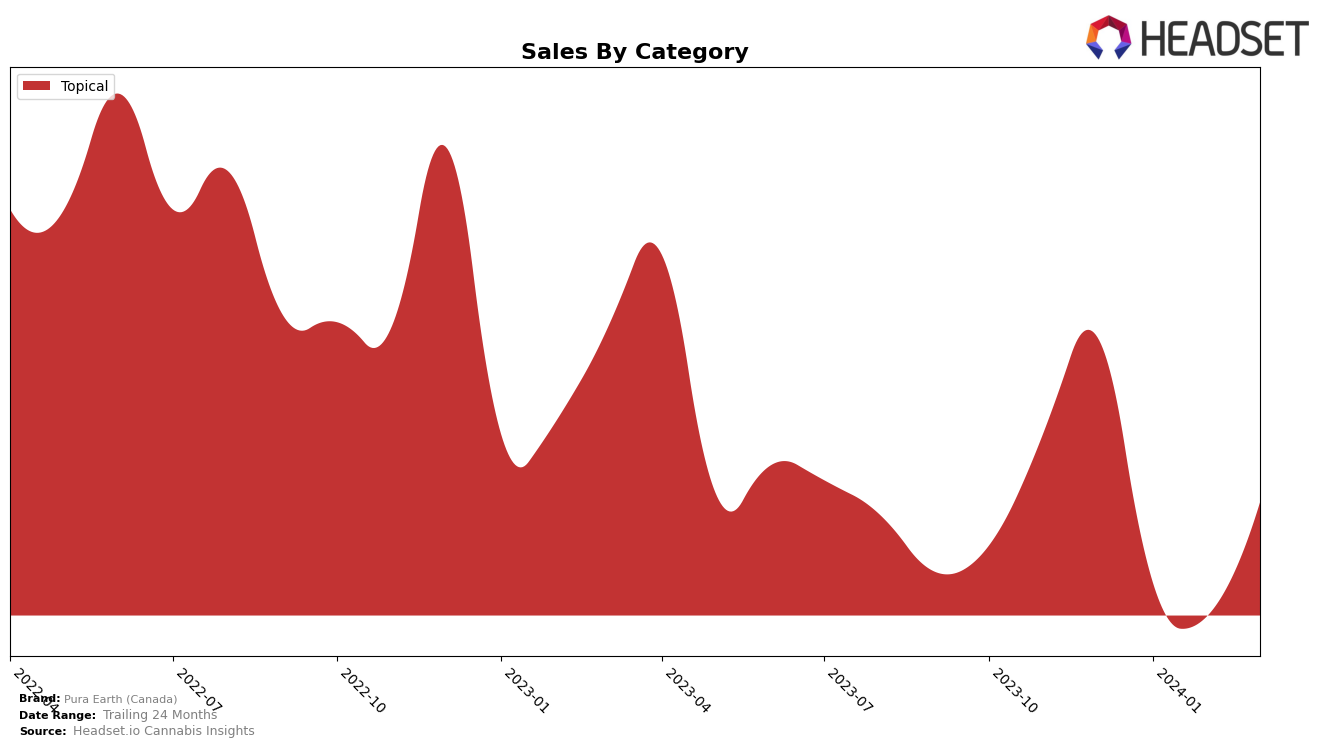

In the topical category, Pura Earth (Canada) has shown a notable presence across several provinces, with a particularly strong performance in Saskatchewan. Here, the brand improved its ranking from 10th place in December 2023 to 8th by March 2024, indicating a positive trend and growing consumer preference. This upward movement is underscored by an increase in sales from 1190 in December 2023 to 1074 in March 2024, despite a dip in February. Such trends suggest that Pura Earth is solidifying its position within the topical category in Saskatchewan, which could be seen as a reflection of effective brand strategies or product offerings that resonate well with the local market.

Contrastingly, in Alberta, Pura Earth's presence in the topicals category appears to have waned, as evidenced by the absence of ranking data from January 2024 onwards. This could indicate a decline in the brand's market share or competitiveness within the province's topical category, which is notable given its 19th place ranking in December 2023. Meanwhile, in Ontario, the brand maintained a consistent 14th place ranking from December 2023 through March 2024. Despite a fluctuation in sales figures during this period, the consistency in ranking suggests a stable market position in Ontario's topical category. This stability, juxtaposed with the brand's dynamic performance in Saskatchewan and its challenges in Alberta, offers a complex picture of Pura Earth's market performance across different regions.

Competitive Landscape

In the competitive landscape of the topical cannabis market in Ontario, Pura Earth (Canada) has maintained a consistent position, ranking 14th from December 2023 through March 2024. This stability in ranking, however, masks underlying fluctuations in sales, with a notable dip in January and February before a rebound in March. Competitors such as Nuveev and ufeelu have shown more significant sales and rank volatility, with Nuveev maintaining a slight lead over Pura Earth throughout the period, while ufeelu, despite a higher rank, has seen a more pronounced fluctuation in sales. Another notable competitor, Apothecary Labs, despite a drop in sales, managed to climb back to its original rank by March 2024. Meanwhile, Lemon and Grass was not consistently in the top 20, indicating a more volatile market presence. This analysis suggests that while Pura Earth (Canada) has maintained a steady rank, the competitive dynamics within the Ontario topical cannabis market are characterized by significant sales fluctuations and rank changes among leading brands, highlighting the competitive pressure Pura Earth faces.

Notable Products

In March 2024, Pura Earth (Canada) saw its CBD Japanese Cedar Bud Face Cream (250mg CBD, 50ml) as the top-selling product in the Topical category, with a notable sales figure of 72 units. Following closely, the CBD Rosemary and Tea Tree Gel Cream (125mg CBD, 50ml) secured the second position, dropping from its previous leading spot in February. The third rank was held by the CBD Colloidal Oatmeal Cream (125mg CBD, 50ml), maintaining its position consistently from February to March. The sales figures indicate a shift in consumer preference towards the Japanese Cedar Bud Face Cream, marking its rise from third to first place over a three-month period. This analysis highlights the dynamic nature of product popularity within Pura Earth's offerings, showcasing the changing consumer interests in their Topical product line.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.