Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

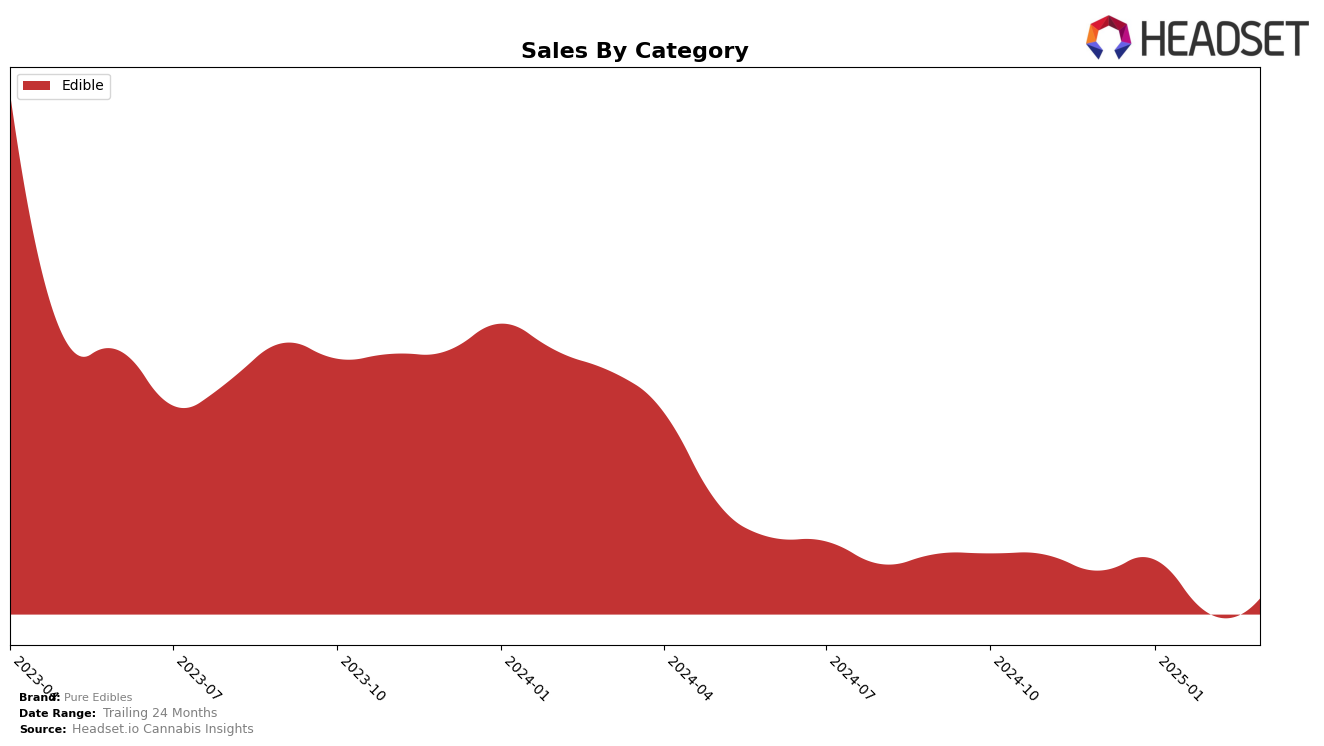

Pure Edibles has demonstrated consistent performance in the Arizona market within the Edible category, maintaining a steady rank of 7th place from December 2024 through March 2025. This consistency in ranking suggests a stable market presence and consumer base in the state. Despite a slight dip in sales from January to February, the brand managed to recover some ground by March. This resilience in the face of fluctuating sales figures highlights the brand's ability to maintain its position among the top competitors in the Arizona edible market.

Interestingly, Pure Edibles did not appear in the top 30 rankings for any other states or provinces during this period, indicating a more localized strength in Arizona. This could be seen as a limitation in their market expansion or a strategic focus on dominating a specific region. The lack of presence in other markets might suggest potential growth opportunities if the brand decides to expand its geographical footprint. The data implies that while Pure Edibles has a solid foothold in Arizona, there is room for growth and increased visibility in other regions.

Competitive Landscape

In the competitive landscape of the Arizona edible market, Pure Edibles maintained a consistent rank of 7th from December 2024 through March 2025. Despite this stability, the brand faces significant competition from others like Smokiez Edibles, which fluctuated between 3rd and 6th place, and Wana, which improved its position from 6th to 5th over the same period. Both competitors have demonstrated stronger sales figures, with Smokiez Edibles consistently outperforming Pure Edibles, and Wana showing a significant increase in sales by March 2025. Meanwhile, Flav and Jams have shown some volatility in their rankings, yet they remain close competitors. The data suggests that while Pure Edibles has maintained its position, there is a pressing need for strategic initiatives to boost sales and improve its competitive standing in the Arizona market.

Notable Products

In March 2025, the top-performing product for Pure Edibles was Indica Watermelon Gummies 10-Pack (100mg), reclaiming the number one rank from the previous month and achieving sales of 5661. The THC/CBN 2:1 Indica Berry Sleepy Gummies (100mg THC, 50mg CBN) closely followed, maintaining its strong presence in the second position. Sativa Mango Gummies 10-Pack (100mg) consistently held the third spot across the months, indicating stable demand. Notably, Sativa Watermelon Gummies 10-Pack (100mg) rose to fourth place from fifth, showing a positive trend in sales. Meanwhile, Indica Fruit Punch Gummies 10-Pack (100mg) slipped to fifth, reflecting a slight decrease in popularity compared to prior months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.