Aug-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

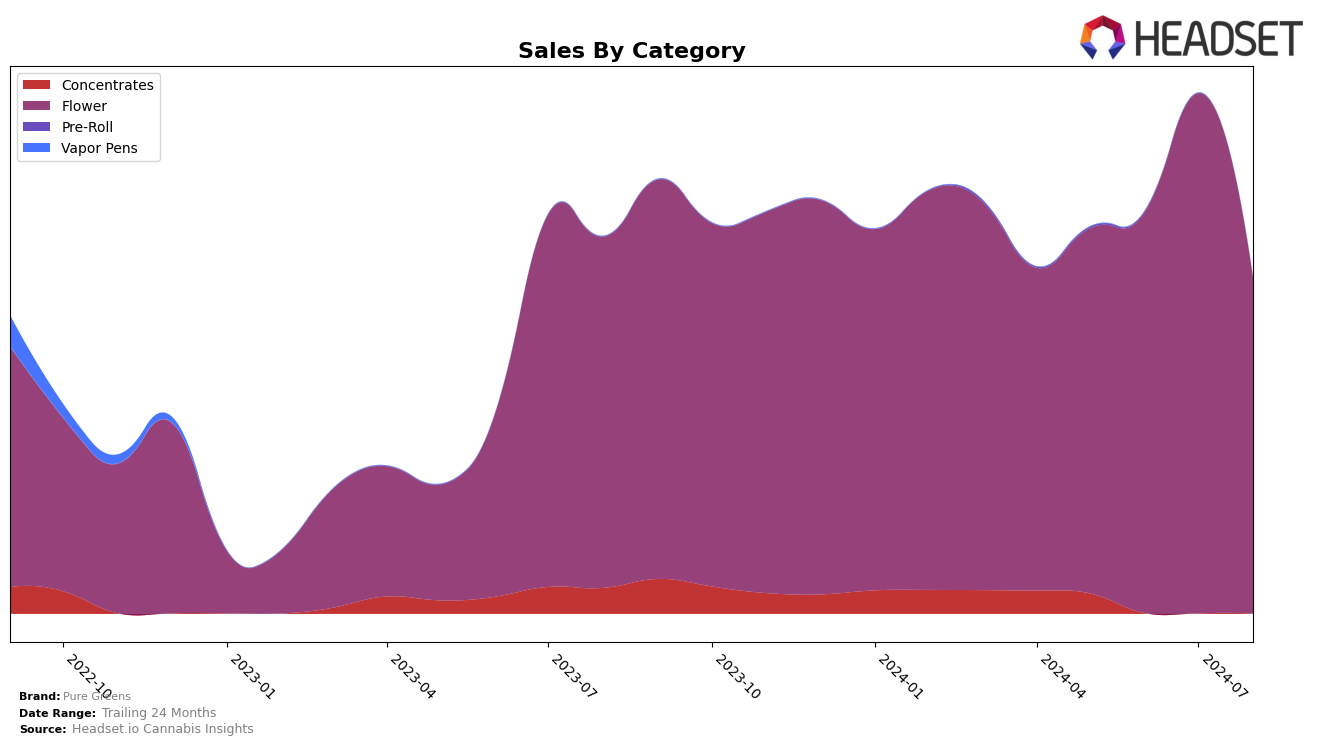

Pure Greens has demonstrated a mixed performance across categories and states in recent months. In Colorado, the brand's presence in the Concentrates category has been notably absent from the top 30 rankings since May 2024, indicating a potential area of concern or an opportunity for growth. Conversely, in the Flower category, Pure Greens has shown significant movement, peaking at the 20th position in July 2024 before dropping back to the 29th position in August 2024. This fluctuation suggests a volatile but competitive standing within the Flower market in Colorado.

When examining the sales trends, Pure Greens experienced a notable increase in Flower sales from May to July 2024, with a peak in July, followed by a decline in August 2024. This pattern indicates a surge in popularity during the summer months, potentially driven by seasonal demand or successful marketing campaigns, but also highlights the challenge of maintaining consistent sales momentum. The absence from the top 30 in the Concentrates category suggests that while Pure Greens has a foothold in the Flower market, there is room for improvement and strategic focus in other product categories within Colorado.

Competitive Landscape

In the competitive landscape of the Colorado Flower category, Pure Greens has shown notable fluctuations in its rank and sales over the past few months. In May 2024, Pure Greens was ranked 29th, climbed to 28th in June, reached its peak at 20th in July, but then dropped back to 29th in August. This indicates a volatile performance, with a significant spike in July sales but a decline in August. In comparison, Freedom Road and Sunshine Extracts have shown more consistent, albeit lower, rankings, with Freedom Road fluctuating between 26th and 34th, and Sunshine Extracts between 23rd and 34th. Meanwhile, LEIFFA and Kind Love have experienced more dramatic changes, with LEIFFA jumping from 52nd to 27th and Kind Love from 45th to 28th. These trends suggest that while Pure Greens has the potential for high sales, maintaining a stable rank remains a challenge, highlighting the need for strategic adjustments to sustain its competitive edge in the Colorado market.

Notable Products

In August 2024, Tropical Banana (3.5g) emerged as the top-performing product for Pure Greens, with sales reaching 1411 units. Apricot Scone (3.5g) followed closely in second place. Free Mac (3.5g) secured the third position, while Tropical Banana (7g) and Apricot Scone (1g) took the fourth and fifth spots, respectively. Compared to previous months, Tropical Banana (3.5g) and Apricot Scone (3.5g) showed significant improvement, climbing to the top two positions. The overall sales figures for Pure Greens products indicate a strong preference for their flower category in August 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.