Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

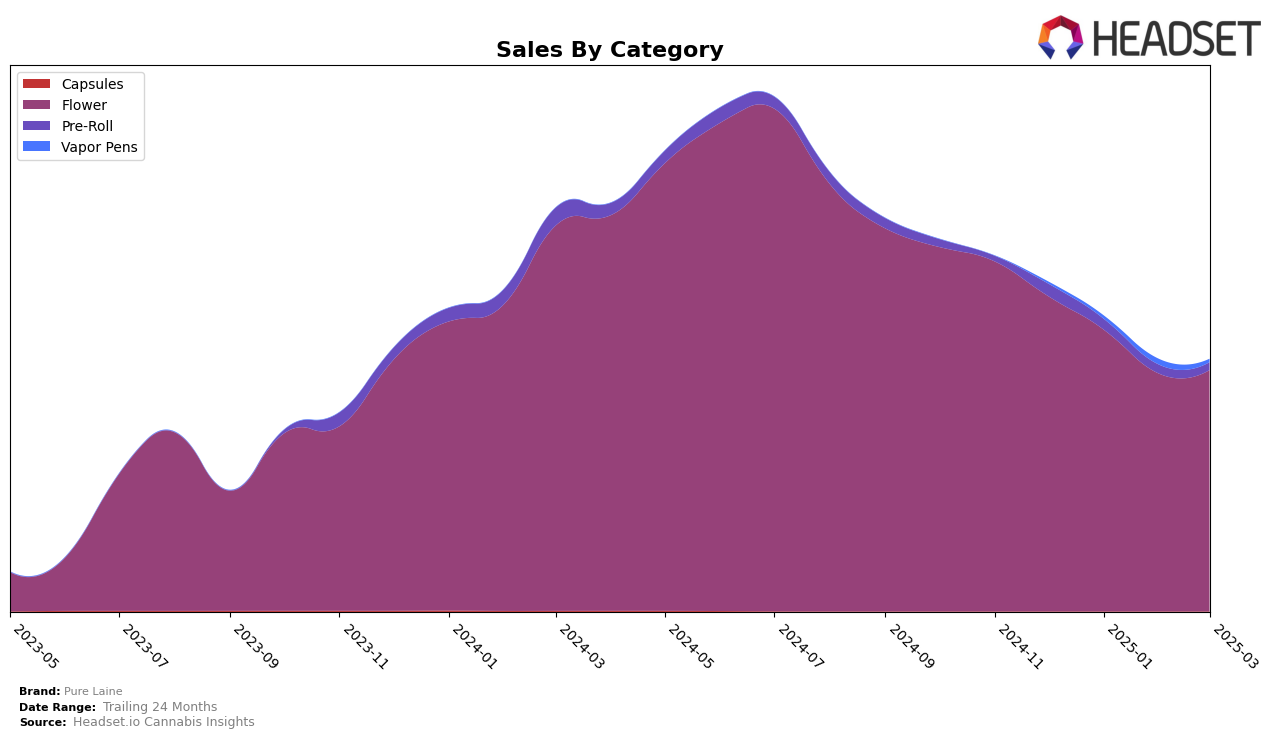

Pure Laine's performance in the Flower category shows notable fluctuations across different provinces. In Alberta, the brand maintained a steady presence, with rankings fluctuating slightly from 22nd to 25th before improving to 20th by March 2025. This suggests a recovery in their market position despite a decline in sales from December to February. Meanwhile, in Ontario, Pure Laine experienced a slight drop in ranking from 9th to 13th over the same period, which might indicate increasing competition or market shifts, despite a significant sales volume. In Saskatchewan, the brand maintained a consistent 21st position, reflecting a stable but less dynamic market presence. This consistency, however, might mask underlying sales challenges, as evidenced by the sales figures.

The Pre-Roll category in Alberta presents a different story for Pure Laine. The brand did not make it into the top 30 rankings from February onwards, indicating potential challenges in maintaining a competitive edge in this category. This absence from the top ranks could be seen as a negative indicator, suggesting that the brand might need to reassess its strategies in the Pre-Roll market. The lack of ranking in subsequent months could imply either a strategic withdrawal or a struggle to capture market share. Without more detailed insights, it's difficult to pinpoint the exact causes, but these movements certainly highlight areas for potential improvement or strategic pivoting.

Competitive Landscape

In the competitive landscape of the Flower category in Ontario, Pure Laine has experienced notable fluctuations in its ranking and sales over the past few months. Starting from December 2024, Pure Laine was ranked 11th, and it improved its position to 9th in January 2025. However, by March 2025, it had slipped to 13th place. This decline in rank is mirrored by a decrease in sales, which peaked in December 2024 and gradually decreased through February 2025 before stabilizing in March. In contrast, FIGR showed a consistent presence, maintaining a rank within the top 15, while The Loud Plug experienced a more volatile trajectory, dropping from 7th in December to 15th in February before recovering to 12th in March. Meanwhile, Versus showed a positive trend, climbing from 14th in December to 11th in March, indicating a potential threat to Pure Laine's market share. Lastly, LowKey remained consistently lower in rank, suggesting less competitive pressure from this brand. These dynamics highlight the competitive pressures Pure Laine faces and the need for strategic adjustments to regain its foothold in the Ontario Flower market.

Notable Products

In March 2025, Original Kush (3.5g) maintained its position as the top-performing product for Pure Laine, despite a decrease in sales to 11,071 units. Big Pleasures (28g) and Special Haze (3.5g) also held steady at the second and third ranks respectively, showing consistent performance over the past months. Little Pleasures (7g) continued to occupy the fourth spot, while Original Kush (14g) re-entered the rankings at fifth place after a brief absence in February. Notably, all top products have shown a decline in sales figures since December 2024, but their rankings remained unchanged, indicating stable consumer preference within the product lineup. This trend suggests a potential seasonal or market-wide factor affecting overall sales volume.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.