Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

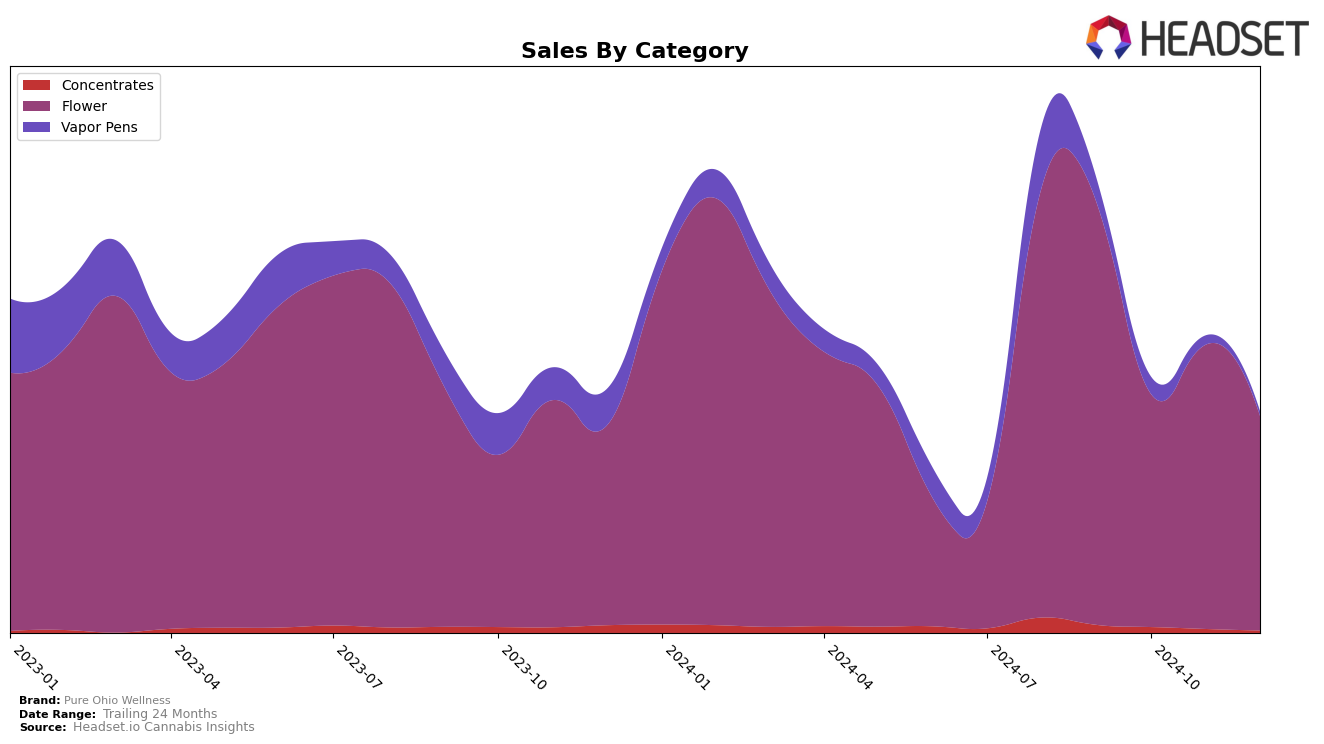

Pure Ohio Wellness has demonstrated a varied performance across different product categories in Ohio. In the Flower category, the brand maintained a consistent presence within the top 20, showing a slight improvement from 20th in October 2024 to 19th in both November and December 2024. This suggests a stable demand for their flower products, despite a noticeable dip in sales from September to December. Conversely, their performance in the Concentrates category was less remarkable, as they only appeared in the rankings in September 2024, holding the 29th position, and did not make it into the top 30 in subsequent months. This indicates potential challenges in maintaining a competitive edge in this segment.

In the Vapor Pens category, Pure Ohio Wellness faced difficulties in breaking into the top 30, with rankings of 43rd in September and slipping further to 52nd by November 2024. This downward trend highlights the competitive nature of the vapor pen market in Ohio, where the brand has yet to establish a significant foothold. The absence from the December rankings further emphasizes the need for strategic adjustments to enhance their market presence. Overall, while Pure Ohio Wellness shows promise in the Flower category, there is room for growth and improvement in both Concentrates and Vapor Pens to ensure a more balanced performance across all product lines.

Competitive Landscape

In the competitive landscape of the Ohio flower category, Pure Ohio Wellness has experienced fluctuations in its rank and sales over the last few months of 2024. Despite starting strong in September with a rank of 15, the brand saw a decline to 20 in October and maintained a position around 19 through November and December. This shift coincides with a noticeable drop in sales from September to October, followed by a modest recovery in November. Competitors such as The Standard have shown resilience, improving their rank from 22 in September to 15 in November, indicating a potential capture of market share that could have impacted Pure Ohio Wellness. Meanwhile, Farkas Farms / Bullseye Gardens maintained a steady rank of 17 throughout the period, suggesting consistent performance. The dynamic shifts in rankings and sales among these brands highlight the competitive pressures Pure Ohio Wellness faces in maintaining its market position.

Notable Products

In December 2024, Durban Poison 2.83g maintained its top position as the best-selling product for Pure Ohio Wellness, with impressive sales figures reaching 4073 units. Gelato 14.15g climbed significantly to secure the second spot, a notable rise from its fifth position in October. Animal Mints 2.83g entered the rankings for the first time, achieving the third position. Crescendo 2.83g and Lemon Drip 14.15g both debuted in the rankings at the fourth position. This month saw a dynamic shift in product popularity, with new entries disrupting the previous rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.