Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

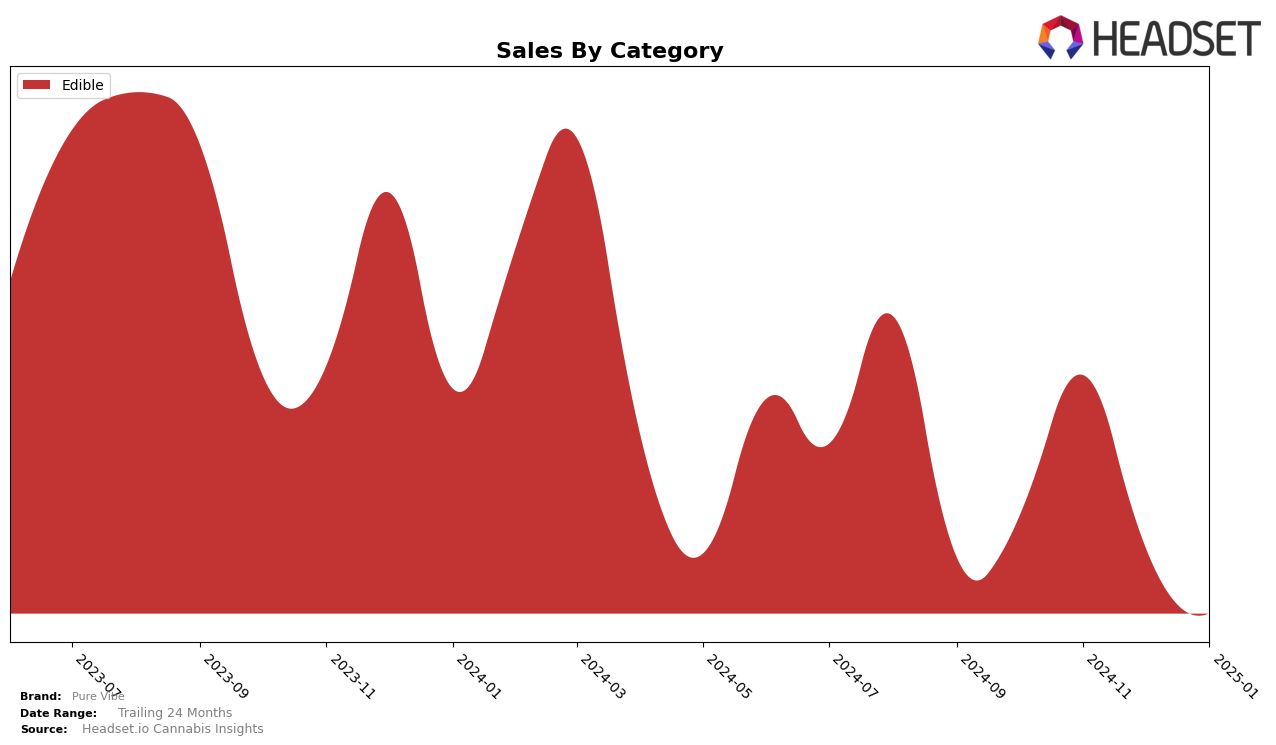

Pure Vibe has shown varied performance across different states and product categories over the past few months. In the New York market, Pure Vibe's presence in the Edible category has been relatively consistent, maintaining a rank within the top 30 brands. Specifically, from October 2024 to January 2025, the brand's rank fluctuated slightly, starting at 25th position, briefly improving to 24th in December, and then dropping to 29th by January 2025. This indicates a slight downward trend in their ranking, which may be of concern if the pattern continues. The sales figures also reflect this movement, with a significant peak in November 2024 followed by a decline through January 2025, suggesting potential challenges in sustaining consumer interest or facing increased competition.

While Pure Vibe has managed to stay within the top 30 in New York for Edibles, the absence of rankings in other states for this category suggests they may not have a strong presence or are facing stiff competition elsewhere. This could be a strategic area for Pure Vibe to explore further, potentially expanding their market reach or enhancing their product offerings to improve their standings in other key regions. The brand's ability to maintain a consistent presence in New York's Edible market, despite a slight decline, demonstrates resilience but also highlights the importance of addressing the competitive dynamics to prevent further slippage in rankings.

Competitive Landscape

In the competitive landscape of the edible category in New York, Pure Vibe has experienced fluctuating rankings, reflecting dynamic market conditions. From October 2024 to January 2025, Pure Vibe's rank shifted from 25th to 29th, indicating a slight decline in its competitive position. Despite this, Pure Vibe maintained a stronger sales performance compared to competitors like Koko Nuggz and OMO - Open Minded Organics, both of which consistently ranked lower or similarly but with less robust sales figures. Notably, The Green Lady Dispensary showed a slight improvement in rank, moving from 29th to 28th, while To The Moon experienced a decline, dropping to 31st by January 2025. These shifts suggest that while Pure Vibe faces stiff competition, its sales trajectory remains comparatively resilient, highlighting the brand's potential to capitalize on market opportunities and regain its ranking momentum.

Notable Products

In January 2025, Cherry Rush Gummies 10-Pack (100mg) maintained its position as the top-selling product in the Pure Vibe lineup, continuing its lead from December 2024 with sales of 976 units. Rainbow Pack Gummies 10-Pack (100mg) climbed to second place, despite a slight drop in sales compared to the previous month. Magic Mango Gummies 10-Pack (100mg) made a notable entry into the rankings, securing the third position with a strong debut performance. Cherry Mango Bliss Gummies 10-Pack (100mg) held steady at fourth place, showing consistent sales figures over the past few months. Chill'n Blue Raspberry Gummies 10-Pack (100mg), previously a top performer, experienced a significant drop to fifth place, indicating a sharp decline in sales from its peak in November 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.