Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

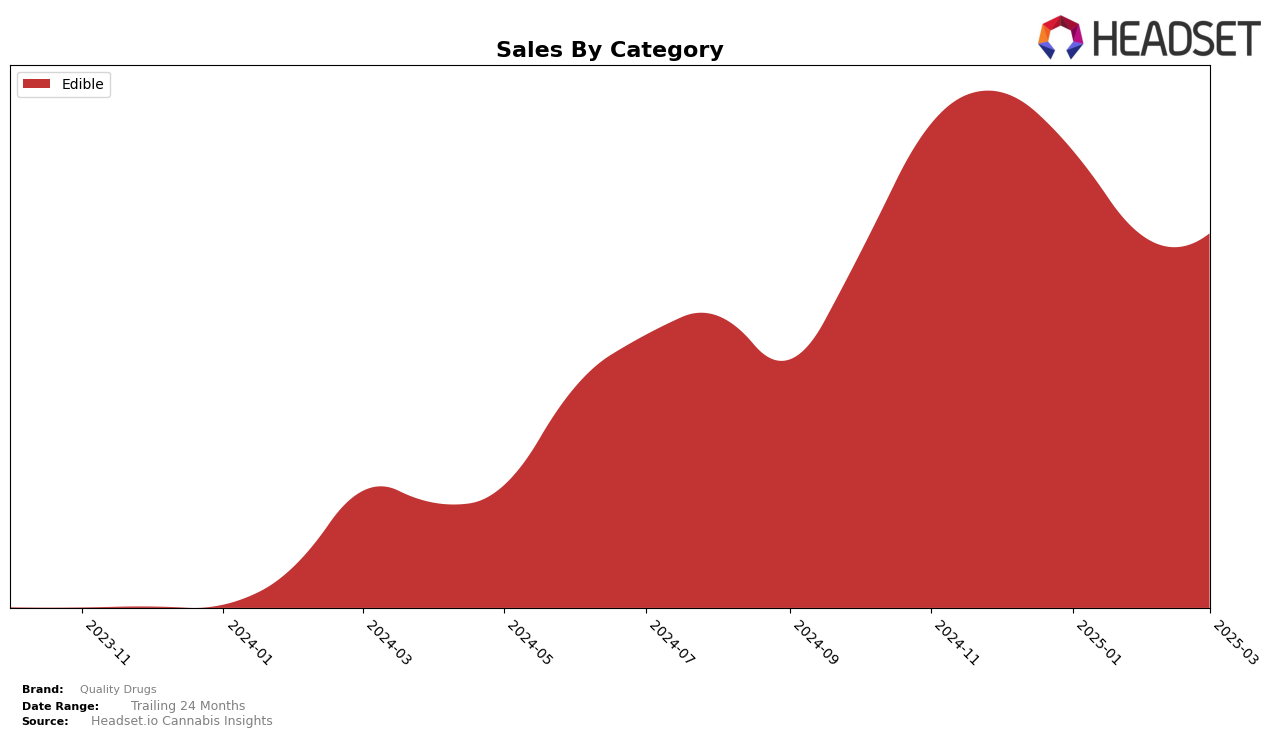

Quality Drugs has shown a consistent presence in the Oregon edible market, maintaining a position within the top 15 brands. Starting at rank 9 in December 2024, the brand experienced a slight decline to rank 11 by March 2025. This downward trend could suggest increasing competition or a shift in consumer preferences within the state. Despite this, the brand's ability to stay within the top 15 indicates a stable consumer base and brand recognition in Oregon, which is crucial for maintaining market presence.

Interestingly, Quality Drugs did not appear in the top 30 brands for any other state or category during this period, which could be interpreted as a lack of market penetration outside Oregon or a strategic focus on the edible category within the state. This absence from other rankings might be seen as a limitation in their market strategy or an opportunity for growth and expansion. The brand's performance in Oregon’s edibles category, despite a decrease in sales from December to March, highlights the importance of monitoring competitive dynamics and consumer trends to sustain or improve their market position.

Competitive Landscape

In the Oregon edible cannabis market, Quality Drugs has experienced a notable shift in its competitive standing from December 2024 to March 2025. Initially ranked 9th in December 2024, Quality Drugs saw a decline in its rank to 11th by March 2025, indicating increased competition and possibly a dip in consumer preference or market presence. This decline is contrasted by brands like Hapy Kitchen, which maintained a stable position in the top 10, and Botz, which improved its rank from 11th to 10th. Despite these changes, Quality Drugs' sales figures show a significant drop from December 2024 to February 2025, with a slight recovery in March 2025, suggesting potential challenges in maintaining market share amidst a competitive landscape. Meanwhile, Verdant Leaf Farms and Feel Goods have shown more stable rankings, indicating consistent performance. These dynamics highlight the need for Quality Drugs to reassess its strategies to regain its competitive edge in the Oregon edibles market.

Notable Products

In March 2025, the top-performing product for Quality Drugs was the CBD/CBN/THC 1:1:1 Berry Bonanza Gumdrops 10-Pack, which climbed to the number one spot from third place in February. The CBD/CBN/THC 1:1:1 Cherry Bomb Remix Gumdrops 10-Pack also showed a strong performance, securing the second position with notable sales of 2052 units. Wavy Watermelon Gummy maintained its consistent popularity, holding steady at third place. Assorted Caramels 10-Pack made a notable entry into the rankings, achieving fourth place despite not being ranked in previous months. Mellow Mango Gummy experienced a decline, dropping to fifth position from its second-place rank in January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.